Cryptocurrency Whale Manipulation Highlights: Insider Trader Faces $40 Million Loss, Follower Gets Rekt

Original Article Title: "Cryptocurrency Whale Operation Highlights: Insider Incurs $40 Million Floating Loss, Follower Faces Bloodbath"

Original Article Author: Wenser, Odaily Planet Daily

The cryptocurrency market has once again entered a period of price volatility, and the well-known "market indicator" cryptocurrency whales have once again begun their performance as scheduled. However, for the whales with substantial funds, the recent trading operations have been far from satisfactory. Among them, some chose to continue increasing their positions after experiencing a market rebound, only to incur a floating loss of tens of millions of dollars; some harvested gains from a token's surge but are still far from breaking even; while others chose to directly sell BTC on exchanges and cash out. Odaily Planet Daily will summarize the recent cryptocurrency whale operations in this article for readers' reference.

Whale with 100% Win Rate Incurs Nearly $40 Million Floating Loss in Past Week, Position Value Exceeds $380 Million

As the cryptocurrency whale with the highest win rate since the "October 11 Flash Crash," revered by the community as the "Whale with 100% Win Rate," the current status of its positions is also not optimistic.

At the end of October, it successively opened long positions for BTC and ETH, realizing over $10 million in floating profits in three days;

On October 27, its position saw a floating profit of over $20 million at one point;

On October 28, it opened a long position for SOL and quickly raised the position to over $21 million on the same day;

On October 29, it closed the BTC long position with a profit of $1.4 million; at that time, it still held ETH (5x leverage) and SOL (10x leverage) long positions worth $263 million, with a floating loss of $1.3 million; in the afternoon, it started to reduce the ETH long position, first by selling 3400 ETH and profiting $186,000; then selling 11,000 ETH and profiting $618,000. Finally, in the afternoon, it closed the ETH long position, accumulating a total profit of $1.637 million; holding only the SOL long position, with a position value of $74.21 million and a floating loss of $1.68 million.

On October 30, it once again opened a long position for BTC, quickly realizing a total floating loss of $3.33 million in combination with the SOL long position; then, after Powell's speech led to a market downturn, it opened an ETH long position again. By midday, its floating loss soared to around $6.5 million.

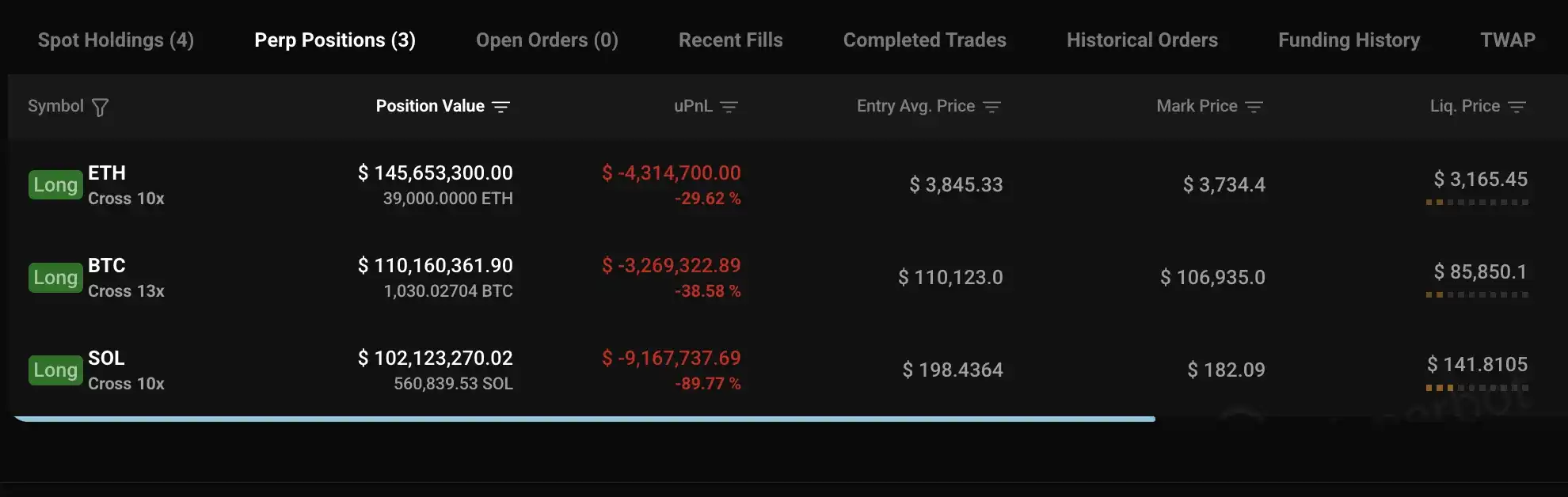

On October 31, their long position's unrealized loss once increased to over $16 million, including:

· ETH long position's unrealized loss of $4.31 million;

· BTC long position's unrealized loss of $3.27 million;

· SOL long position's unrealized loss of $9.16 million.

The subsequent story is well known to all—

On November 1, the unrealized loss narrowed to around $7 million;

On November 2, they once again increased their SOL long position, adding 23,871.83 SOL, spending approximately $4.39 million, and the unrealized loss narrowed again to $6.3 million.

As of the time of writing, the insider whale had returned the previous contract opening profit at this address; their unrealized loss over the past week has increased to nearly $40 million.

Following the insider whale also suffered a heavy market blow, 2 whales lost over $1.2 million

Ridiculously, perhaps the insider whale with a 100% win rate had a too dazzling past performance, attracting many followers in the market. However, as the market continued to decline, these followers quickly learned their lesson.

The address 0x955...396A8 opened a long position on BTC during the morning rebound on October 30, then panic-sold during a rapid midday pullback, suffering a loss of about $217,000 in just 4 hours;

The address 0x960...0e2Ee, when BTC price hit a high of $115,372.8 on October 27, went long on BTC and ETH, with a total position reaching $36.87 million at one point, but ultimately liquidated during the downturn, suffering a loss of about $1.061 million in 24 hours.

It is worth mentioning that the whale who went long on BTC and suffered heavy losses is far from just the above 3 individuals.

Whale Goes Long on BTC with 40x Leverage, Gets Liquidated Losing $6.3 Million in One Day

On October 30, a whale went long on BTC with 40x leverage, with a position worth $107 million. During the night's sharp drop, the entire long position worth $143 million was liquidated, resulting in a loss of $6.3 million.

Subsequently, the whale continued to go long on BTC with the remaining $470,000 from the liquidation, with a position value of $19 million. The liquidation price was only $1200 away from the current price.

Currently, the whale's address has chosen to go long with 5x leverage on ASTER, VIRTUAL, ZEC, all of which are in a loss-making state.

Two Whales Long ZEC, One Profits Over $4 Million While One Loses Over $6 Million

On November 1, according to OnchainLens monitoring, as ZEC's market cap surpassed XMR, two whales holding positions on HyperLiquid profited significantly from their long positions, including:

The address 0x519c with a ZEC 5x long position, had an unrealized profit of about $2.2 million; the address has since closed the position, accumulating profits exceeding $1.58 million.

The address 0x549e also held a ZEC 5x long position, with an unrealized profit of about $1.8 million at the time; the current profit has since retraced to around $1.14 million;

While the HYPE 10x long position, which once had an unrealized profit of about $2.3 million, is now in a loss-making state.

Currently, the whale's overall account is still in a floating loss of over $6 million.

Insider Whale Quietly Takes Profit, Long-term Player Profits Over $14.4 Million

While some choose to stay and fight, others naturally choose to take their gains and leave.

Long-term Whale Sells 5,000 ETH, Profits $14.43 Million

On October 29, according to The Data Nerd monitoring, a whale address (0x742...ede) deposited 5,000 ETH into Kraken, worth approximately $19.91 million.

It is reported that this whale had accumulated 8,240 ETH three years ago at an average price of $1,195 and sold them last year at an average price of $2,954. The recent transaction of 5,000 ETH was purchased six months ago at an average price of $1,582, realizing a profit of around $14.43 million with an ROI of 152%.

Insider Whale Dumps 1,200 BTC, Worth $132 Million

On November 2, according to on-chain analyst Ai Yi's monitoring, the whale address (1E2...ZRpQ) that had previously made a huge profit by shorting before the 1011 flash crash has transferred a total of 1,200 BTC to Kraken over the past week, worth $132 million.

The latest transfer involved 500 BTC, and the address has now emptied its holdings.