In the past month, long-term bitcoin holders have unprecedentedly sold about 400,000 BTC, worth over $40 billions, becoming the core driving force behind this round of deep market correction.

Under the dual pressure of continued tightening of macro liquidity and concentrated selling by whales at the micro level, the crypto market is undergoing a severe test. This article will deeply analyze the truth behind this wave of selling, interpret its macro and micro motivations, and draw on historical cycle patterns in an attempt to explore bottom signals for this market downturn.

I. Whale Exposure: The Truth Behind the Sale of 400,000 BTC

While the market was still speculating about the reasons for the decline, on-chain data had already pointed the way: This time, it is not retail panic selling, but a collective action by long-term holders.

1. The Scale of Selling Revealed by Data

According to data released by CryptoQuant analyst Maartunn,

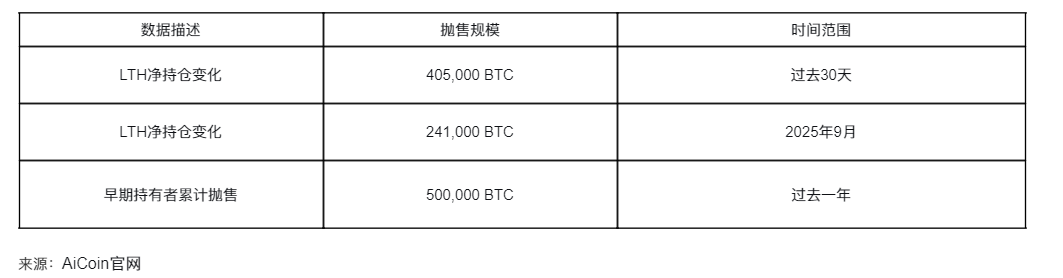

● In the past 30 days, the net position of long-term holders (LTH) in bitcoin has decreased by 405,000 BTC. Calculated at the average price during the period, the total value of these sold bitcoins is over $40 billions.

● This is not an isolated incident. As early as the beginning of September 2025, this group had already started reducing their positions, with a single-week net reduction of up to 241,000 BTC at that time.

● Research institution 10x Research further pointed out that over the past year, early holders have cumulatively sold about 500,000 BTC.

2. Who Are the "Long-Term Holders"?

In the field of on-chain analysis, "long-term holders" are clearly defined as addresses holding bitcoin for more than 155 days. They are the most steadfast group in the market and are usually regarded as the "ballast stone" of the market. When this group begins large-scale collective action, it often signals a major turning point in market trends.

3. The Rotation of Capital: Old vs. New

Blockchain analyst @EmberCN pointed out on X: "This is more like a rotation of capital rather than a panic exit." Early low-cost holders, after experiencing huge gains, chose to take profits and lock in returns. The chips they sold are being absorbed by new institutional funds (mainly through bitcoin spot ETFs) entering the market.

4. Specific Whale Cases Come to Light

In addition to the collective action of long-term holders, the moves of individual "ancient whales" have had a huge impact on market sentiment.

● The most typical case is that a whale who had held bitcoin for over 14 years, with the assistance of Galaxy Digital, sold 80,000 BTC in one go at the end of July 2025. This transaction was completed partly through exchanges and partly via OTC deals.

According to insiders, this sale was part of the client's "inheritance strategy", aimed at avoiding the high inheritance tax in the United States. The disclosure of this news sparked concerns in the market about a comprehensive exit by old holders.

II. Reasons for the Decline: Dual Pressure from Macro and Micro Factors

This round of market decline is the result of the combined effect of the macro environment and internal market structure, forming a typical "Davis double kill".

1. Macro Background: The Tide of Liquidity Is Receding

● The shift in Federal Reserve monetary policy is the core factor. To cope with persistent high inflation, the Fed has shifted from "pausing rate hikes" at the beginning of 2025 to "discussing rate hikes" and has continued quantitative tightening. This has directly drained liquidity from global capital markets, with risk assets bearing the brunt.

● "Only when the tide goes out do you discover who's been swimming naked." Warren Buffett's famous quote aptly describes the current market environment. The US dollar index has strengthened due to robust US economic data, causing capital to flow back to the US from risk assets such as cryptocurrencies.

● Geopolitical risks cannot be ignored either. Uncertainties such as the escalation of US-China trade tensions have increased risk aversion in the market, with investors preferring to hold cash and other safe assets.

2. Micro Reasons: Whale Selling and Leverage Liquidations

Within the market, the demonstration effect of whales and the chain reaction of high-leverage positions have formed a vicious cycle.

● In addition to the aforementioned collective action by long-term holders, high-leverage trading has acted as an "accelerator" during the downturn. According to on-chain monitoring platforms such as Lookonchain, several whale addresses known for their "high win rates" have suffered huge unrealized losses in recent trades.

● For example, the whale at address "0xc2a3..." was liquidated due to a 40x leveraged long position, losing $6.3 million. Such cascading liquidations have intensified selling pressure, forming a "decline-liquidation-further decline" death spiral.

III. Historical Patterns: Is the Cycle Being Rewritten?

The crypto market has long been said to follow a "four-year cycle," but this cycle is particularly complex due to its structural changes.

Source: AiCoin compilation

1. Lessons from Historical Cycles

Looking back at history, each cycle has its unique driving factors and reasons for ending.

● The 2013-2016 cycle was brought to attention by the Cyprus crisis and later collapsed due to the bankruptcy of Mt.Gox exchange;

● The 2016-2019 cycle peaked due to ICO mania and then entered a bear market after regulatory crackdowns;

● The 2019-2022 cycle hit all-time highs amid global central bank "money printing," then crashed due to aggressive Fed rate hikes and the LUNA/FTX blowups.

2. The Fundamental Difference in This Cycle

The core difference in this cycle is that institutions have become one of the dominant forces through ETFs. The entry of traditional financial giants such as BlackRock and Fidelity has changed the previous model driven by retail investors and halving narratives.

● Jacob Smyth, managing partner of crypto fund APE Capital, said: "We are witnessing a fundamental shift in market structure. The traditional 'four-year cycle' script may have been rewritten, and bitcoin is transitioning from a fringe asset to a mainstream allocation asset."

IV. Searching for the Bottom: Four Major Signals of Market Bottoming

Although it is impossible to predict the absolute bottom, we can judge whether the market has entered a bottom area from the following dimensions.

1. Macro Liquidity Shows a "Policy Bottom"

● Closely monitor the Fed's monetary policy moves. Key signals include: the Fed officially ending quantitative tightening (QT), and the US government resuming fiscal spending after the government shutdown ends. These will be the most direct catalysts for a market rebound. Currently, the Fed's QT has slowed significantly, and the balance sheet has dropped to the edge of the target range. Any dovish shift could become an opportunity for a market rebound.

2. On-Chain Fundamentals: Stablecoin Supply as a Leading Indicator

● History shows that when the supply of major stablecoins (such as USDT, USDC) resumes steady growth, it means the market has sufficient "ammunition" ready to enter. According to on-chain analytics firm CryptoQuant, despite the market downturn, stablecoin supply remains on an upward trend. This is a sign of hope for market resilience.

3. Market Sentiment Reaches "Extreme Fear"

● When the "Fear and Greed Index" remains in the "extreme fear" zone for a prolonged period, and discussions about the "end of the bull market" become mainstream in the media and communities, it often means market sentiment has become overly pessimistic and a bottom is brewing.

4. Selling Pressure from Long-Term Holders Eases

● When on-chain data shows that the selling speed of LTHs has significantly slowed or even stopped, and they start accumulating again, it will be a strong positive signal. At present, selling continues but at a slower pace, and further observation is needed.

V. Market Views and Future Outlook

● Li Ming, Chief Strategist at Quantum Capital believes: "This is not the end of the cycle, but a switch of cycles. The transfer of chips from LTHs to ETFs is a process of consolidating the market foundation. Once macro pressures ease, a new round of gains driven by compliant funds will be healthier."

● Sarah Chen, analyst at on-chain research institution ByteTree said: "Data shows that despite the price drop, stablecoin supply is still slowly increasing, indicating that off-market funds have not completely exited but are waiting for the right opportunity. The real risk lies in unexpected tightening at the macro level."

● Anonymous whale observer WhaleWatcher warned: "The whale who sold 80,000 BTC is just the beginning. I have detected several 'ancient addresses' making tentative moves recently. If they act collectively, the market bottom could be deeper than expected."

● The overall market sentiment is shifting from wait-and-see to panic. Investors are generally worried about macro uncertainties and the potential for more whale sell-offs, and FOMO (fear of missing out) sentiment has completely disappeared.

● For investors, at this stage, it is more important to closely monitor the evolution of the above key signals and manage risk, rather than predicting prices. History tells us that every large-scale chip rotation often lays a solid foundation for the next bull market—only this time, it is not retail investors who are taking over, but BlackRock and Fidelity.