Cryptocurrencies continue to "crash" on Monday, with some tokens falling back to the flash crash lows of October

Institutional demand for bitcoin has, for the first time in seven months, fallen below the rate of new coin mining, a shift that suggests large buyers may be pulling back.

Written by: Ye Zhen

Source: Wallstreetcn

In the shadow of October’s historic deleveraging event, the cryptocurrency market is facing a new wave of selling pressure. A key indicator shows that demand from large institutional investors is weakening, intensifying the market’s cautious sentiment.

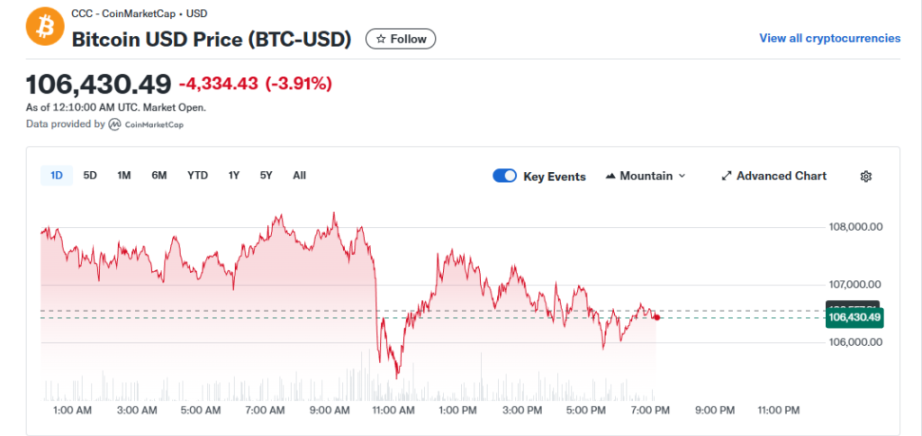

On Monday, the cryptocurrency market remained under pressure, with bitcoin prices falling below $107,000 (UTC+8). The broader altcoin market performed even more weakly, with some token prices dropping back to the lows seen during October’s flash crash, when tens of billions of dollars in leveraged positions were liquidated.

A signal worth noting is that, according to Capriole Investments founder Charles Edwards, institutional demand for bitcoin has, for the first time in seven months, fallen below the rate of new coin mining. This shift suggests that large buyers may be retreating, and together with other market activity, points to a risk-off tone across the entire cryptocurrency market.

Market Sentiment Cautious, Institutional Demand Cools

On Monday, bitcoin once fell 4.3% to around $105,300 (UTC+8). Although it is still up about 14% since December last year, its recent performance has been noticeably weak. Meanwhile, the MarketVector index, which tracks the performance of the latter 50 of the top 100 digital assets, fell for the third consecutive trading day, dropping as much as 8.8% (UTC+8). The index has fallen about 60% so far this year.

Market participants say that although three weeks have passed since the violent shock in October that wiped out about $1.9 billion in long positions, its “after-effects” are still lingering. Jordi Alexander, CEO of crypto trading and market-making firm Selini Capital, said the crypto market is in a “hangover phase” after the October liquidation shock. He believes it will take time to rebuild the destroyed capital base, and investor sentiment remains cautious.

Alexander added, “The market must first prove that a convincing price bottom is about to form before it can attempt to break upward again.” In his view, investors will not easily enter the market until there is a clear signal that prices have found support.

In addition to fragile market sentiment, a key technical indicator has also flashed red. Charles Edwards of Capriole Investments pointed out that institutional demand for bitcoin has slowed, falling below the rate of new coin production for the first time in seven months. This data suggests that one of the key forces that previously drove the market higher may be weakening.

Other Sources of Selling Pressure? Profit-Taking and “Dormant” Bitcoins Activated

Not everyone attributes this round of decline entirely to the market shock in October.

Matthew Kimmell, digital asset analyst at CoinShares, described this pullback as “somewhat puzzling.” He believes that although the market “is still experiencing some aftershocks from the liquidation event,” other factors are also worth watching.

Kimmell pointed out that, through bitcoin’s public transaction records, it can be seen that some wallets that had been dormant for a long time have been activated. “These tokens have started to move and are likely re-entering the market, providing some selling pressure as investors take profits,” he said. “This is something I am continuously monitoring.”

Jake Hanley, Managing Director at Teucrium ETFs, also believes that the reason for the price decline is that “people are taking profits.” He noted that the current technical picture shows a divided market. “Since the summer, prices led by bitcoin have been trending lower, and XRP has also clearly been on a downward trend since midsummer,” Hanley said. “In this process, the price itself is telling you that people are cashing in profits.”