Crypto "No Man's Land": Cycle Signals Have Emerged, But Most People Remain Unaware

Author: Christina Comben

Source: The Coin Republic

Original Title: The Forgotten Phase: Why the Crypto Market Might Be Stuck Between Cycles

Compiled and organized by: BitpushNews

Key Points:

-

The crypto market may be neither in a bull market nor a bear market, but rather in a "forgotten mid-phase," similar to the calm period after the end of quantitative tightening in 2019, which often signals the beginning of a new rally.

-

The Federal Reserve's end of quantitative tightening policy, along with similar market risk score levels, both indicate that the crypto market is in a consolidation phase rather than a pre-crash warning.

-

Despite short-term volatility, pro-crypto regulatory policies, the launch of ETFs, and large-scale institutional adoption have made the market foundation in 2025 much more solid than in 2019.

Market Status: An Indefinable State

"Is it a bull market or a bear market now?"—this is the most hotly debated question in the crypto market, but by the end of 2025, it may no longer be relevant. As traders and analysts try to label the current market, they find that this market refuses to be simply defined.

Crypto prices have failed to replicate the parabolic surge of 2021, but are also far from the true despair of a bear market. So, what exactly is happening?

Crypto trader Dan Gambardello offers his interpretation: we may be in the "forgotten chapter" of the cycle.

This calm phase is almost identical to the period from July to September 2019: at that time, the market was consolidating, the Federal Reserve ended quantitative tightening, and the crypto market seemed to enter a strange stagnation before brewing its next big move.

The Ghost of 2019

Looking back at crypto news from July 2019: the Federal Reserve officially announced the end of quantitative tightening, a policy shift that marked a subtle but significant change in global liquidity.

In September, a few months later, policy tightening officially stopped. This paved the way for a subsequent moderate rally, which eventually triggered the market explosion of 2020-2021.

Now, history seems to be repeating itself. The Federal Reserve has once again announced that it will end quantitative tightening in December 2025. In both periods, macro liquidity had already begun to shift, but market confidence in crypto prices had yet to catch up.

"The news that quantitative tightening is ending has just been released," Gambardello said in a video. "This is neither the peak of a bull market nor the bottom of a bear market, but rather a blurry zone in between."

This "intermediate state" is often overlooked in crypto news, yet it is precisely the key stage of cycle reset. In 2019, Bitcoin's risk score hovered around 42, almost identical to the current score of 43. Despite different prices, market sentiment shows similar uncertainty.

Crypto Market Risk Indicators and the Value of Patience

"If you believe that ending QT will bring a liquidity boost, consider gradually building positions on any pullbacks before December 2025," Gambardello suggests.

He developed an AI-driven system called "Zero" that recommends rational capital deployment, identifying risk zones rather than chasing market momentum.

He points out that in 2019, Ethereum's risk model score was 11, while now it is 44. Cardano's score is 29. These numbers, derived from volatility and sentiment data, help macro investors plan accumulation zones rather than trade emotionally on volatility.

If the score falls back to the 30 or 20 range, it may present the accumulation opportunity that long-term holders dream of.

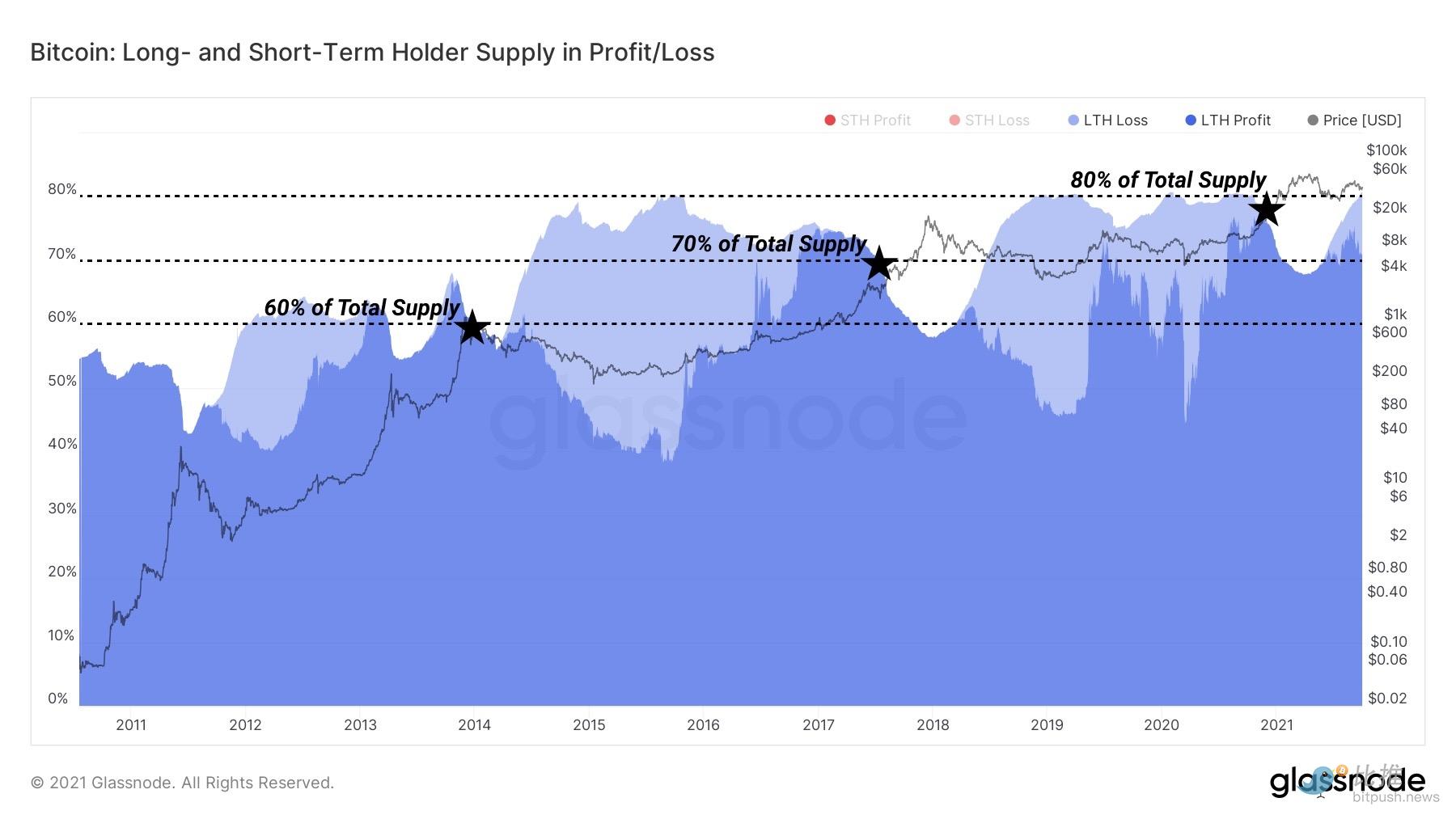

Glassnode data supports this pattern. During mid-term consolidation, the supply held by long-term holders usually increases as speculative traders exit.

In 2019, long-term Bitcoin holders accounted for more than 644% of circulating supply; in 2025, this figure is once again approaching the same level. Patience seems to be the secret weapon of calm investors.

(Chart source: studio.glassnode.com)

What the Charts Are Revealing

On Ethereum's weekly chart, the trend shows a striking similarity. In July 2019, shortly after QT ended, Ethereum tested its 20-week moving average, rebounded, then retested it, and only truly recovered months later.

This summer, the same 20-50 week moving average crossover is happening again; this reminds us once again that cycles always tug between hope and exhaustion.

Gambardello explains that the signal to watch for is whether Ethereum can break above the 20-week moving average. This is a short-term confirmation signal to judge whether the market will repeat the 2019 trend.

Otherwise, a temporary drop in total market cap to the $3 trillion range (compared to the current $3.6 trillion shown on CoinMarketCap) may replay the script of that year: a drop enough to scare off retail investors, but not enough to end the upward trend.

A Different Decade, the Same Market Psychology

Of course, 2025 is not a simple repeat of 2019. The headlines in crypto news are already different, and the macro stage has undergone dramatic changes.

A pro-crypto US government is now in power. The "Clarity Act" and "GENIUS Act" have basically ended the regulatory uncertainty that once kept investors up at night. Ethereum ETFs are now trading live.

Stablecoin issuers are regulated. BlackRock now firmly holds the throne with $25 billion in crypto ETF assets.

This institutional power will not disappear overnight. On the contrary, it has changed the rhythm of the market, turning what once ran on adrenaline into a field managed by spreadsheets and stress tests.

What we are witnessing may not be another bull or bear market, but rather a more subtle change: a transitional phase within a larger monetary climate system.

The Federal Reserve's liquidity shift, the new chairman taking office before May, and regulatory normalization may together make 2025 a quiet preparation period before the next rally.

Gambardello does not believe we are entering a bear market, but rather are in an "annoying consolidation phase."

Yes, it's annoying. But perhaps it's necessary. If the 2019 crypto market taught us anything, it's that boredom is often the prelude to a breakout.