Solana Faces More Pain as Two Bearish Crossovers Loom — But the Worst May Be Over

Solana (SOL) has dropped by 5.3% in the past 24 hours, extending its 30-day losses to over 27%. It’s one of the biggest large-cap losers this week, showing how bearish pressure has intensified.

But while Solana’s structure remains weak, a few on-chain and derivatives signals hint that the downside could now be limited.

Crossovers Confirm the Bearish Setup

Solana’s breakdown from the rising wedge pattern confirmed the bearish turn. But the problem deepens as two bearish crossovers are forming on the daily chart.

A bearish crossover happens when a short-term Exponential Moving Average (EMA), a trend indicator that gives more weight to recent prices, crosses below a longer-term one, signaling that sellers have taken control.

In Solana’s case, the 50-day EMA is about to cross under the 100-day, and the 20-day is nearing a cross below the 200-day EMA. These combined crossovers usually trigger further downside before a new base forms.

Bearish Crossovers Loom: TradingView

Bearish Crossovers Loom: TradingView Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, the broader picture suggests that while sellers dominate, signs indicate that the worst for the Solana price may be behind us.

Derivative Data Suggests a Long Squeeze-Led Drop

Solana’s latest 5.3% daily drop appears more closely linked to derivatives than to heavy holder selling.

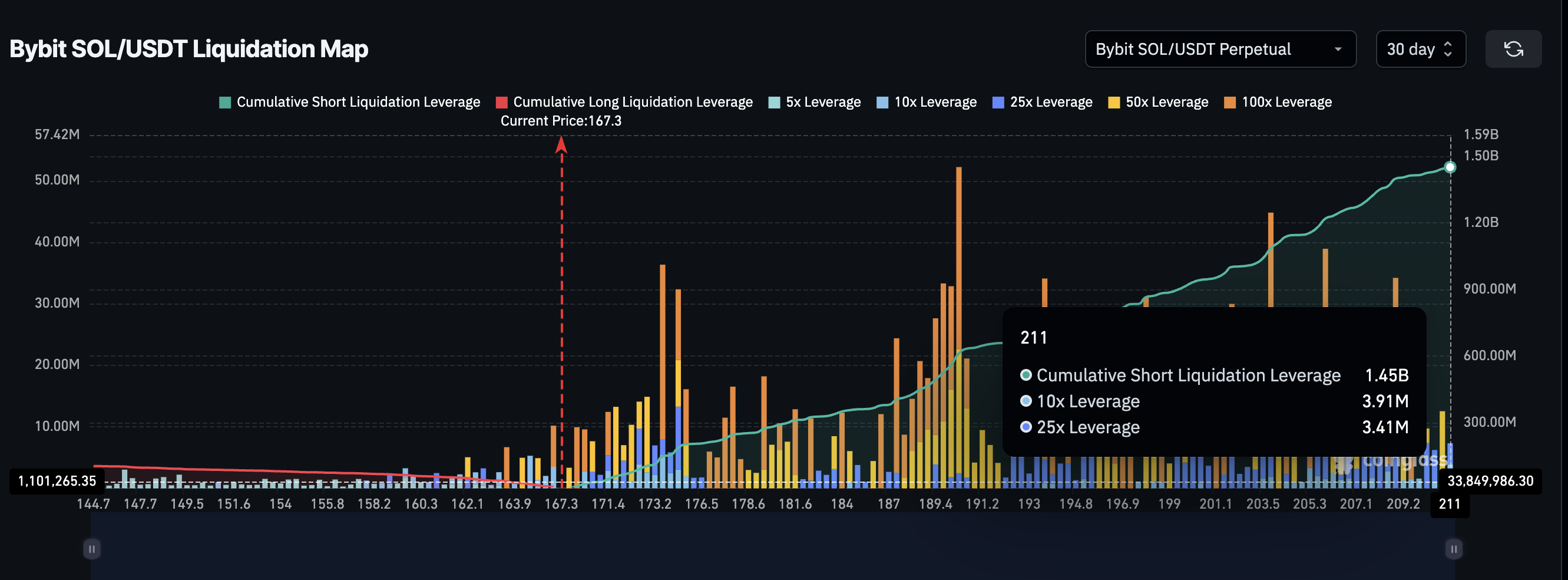

The 30-day data from Bybit alone shows that most long positions and leverage are out of play. Only $103.9 million in long leverage remains, compared to $1.45 billion in shorts. The massive imbalance confirms that the correction was driven mainly by a long squeeze, rather than new bearish bets.

One hope for the longs remains, though. As the perpetual space is now short-specific, even the smallest of Solana price rebounds can trigger a short-squeeze. That could lead to a relief bounce, if not a relief rally.

Short-Leverage Remains: Coinglass

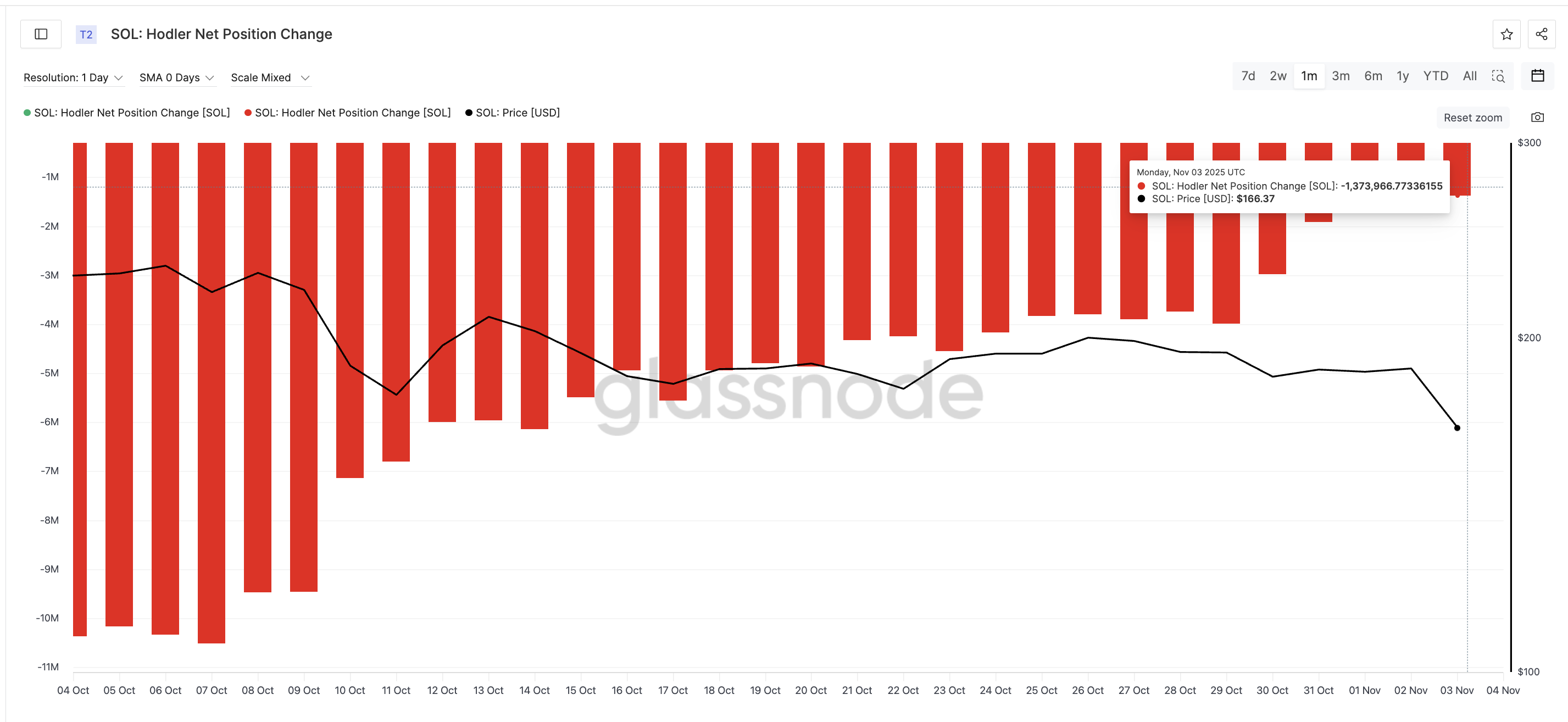

Short-Leverage Remains: Coinglass Meanwhile, the Holder Net Position Change, which tracks how much Solana is moving into or out of long-term wallets, still signals caution but not panic.

On October 7, the value stood at –10.52 million SOL, and by November 3, it had improved to –1.37 million SOL, a drop of nearly 87% in net outflows.

Solana Hodlers Not Selling At A Clip: Glassnode

Solana Hodlers Not Selling At A Clip: Glassnode This suggests that while short-term traders are active, long-term holders aren’t cashing out heavily. This reinforces the idea that the worst of the selling may be over. More so when the long squeeze setup has nearly played out.

Key Solana Price Levels To Watch

Solana’s current price sits around $166, holding just above its strong support zone at $163. If that level fails, the next key zone lies near $155. But that’s where the downside may slow because there are fewer long positions left to liquidate.

Yet, a dip under $155 could prime the Solana price for new lows. That would also invalidate the limited-downside hypothesis. On the upside, the first resistance sits at $180, followed by $191 — both coincide with major short-liquidation clusters.

Solana Price Analysis: TradingView

Solana Price Analysis: TradingView Crossing $191 could trigger a sharp short squeeze toward $200. And a stronger breakout could even push prices near $222, the 0.786 Fibonacci level.

For now, the path of least resistance remains downward. Yet, with short positions piled up and most longs already wiped out, Solana’s next rebound might start sooner than traders expect.

Read the article at BeInCrypto