"Black Tuesday" for US Stock Retail Investors: Meme Stocks and Crypto Plunge Amid Earnings Reports and Short-Selling Pressure

Original Title: "Retail Investors' 'Black Tuesday' in the US Stock Market: Meme Stocks and Crypto Plunge Amid Earnings Reports and Short Sellers' Onslaught"

Original Author: Bao Yilong, Wallstreetcn

For retail investors keen on chasing hot stocks, the overnight US stock market became the worst trading day since April.

On Tuesday, a combination of Palantir's earnings report, bearish bets from well-known short sellers, and turmoil in the cryptocurrency market triggered a fierce sell-off in previously popular retail stocks and assets. All three major US stock indices fell, with the Nasdaq plunging over 2%.

According to Goldman Sachs' index tracking retail investors' heavy holdings, the index plummeted 3.6% that day—about three times the decline of the S&P 500—marking the largest single-day drop since April 10.

At the opening of the US stock market on Tuesday, retail investors' trading enthusiasm did not immediately subside. According to data compiled by JPMorgan, as of 11 a.m. New York time on Tuesday, retail investors were still net buyers of stocks and ETFs worth $560 million.

This may be one of the reasons why the market rebounded briefly in the morning and the S&P 500 narrowed its losses, but the rally did not last, and the market soon turned downward again. Melissa Armo, CEO of trader education platform Stock Swoosh, described Tuesday's US stock market performance as follows:

When people start to panic and sell, this is what happens.

Poor Earnings and the Entry of 'Big Short' Sellers

Specifically, two major events directly triggered the sell-off of retail favorites. First, Palantir's earnings report raised concerns about its growth prospects.

Wallstreetcn mentioned that while Palantir's earnings report showed strong performance in the third quarter, the market doubted the sustainability of its high valuation. This retail "darling," which had soared over 150% this year, suffered a sharp decline yesterday, closing down nearly 8% and remaining weak in after-hours trading.

Palantir stock price plunges

Secondly, legendary investor Michael Burry's regulatory filing became the last straw that broke the camel's back.

According to a 13F regulatory filing, Michael Burry, the hedge fund manager made famous by the movie "The Big Short," established bearish positions on Palantir and chip giant Nvidia in the previous quarter.

Just a few days ago, Burry had issued a warning to retail investors about excessive market exuberance. The disclosure of his short positions undoubtedly confirmed his bearish stance and quickly intensified market panic.

Crypto Market Turmoil Intensifies Sell-Off

In addition to the direct impact on the stock market, turmoil in the cryptocurrency sector also increased pressure on retail investors and dragged down crypto-related stocks.

Wallstreetcn mentioned that bitcoin prices accelerated their decline, falling below the $100,000 mark for the first time since June, briefly dipping to around $99,932 and breaking below the 200-day moving average, marking the second-largest single-day drop of the year. Ethereum, the second-largest by market cap, also plunged over 10%, dropping to around $3,225.

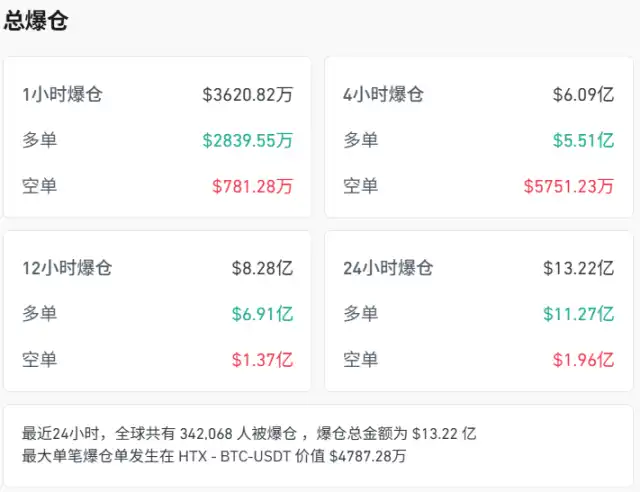

According to coinglass statistics, in the past 24 hours, 342,000 traders were liquidated across the network, with total liquidations exceeding $1.3 billion, of which long positions accounted for 85% of the losses.

This crypto market decline is not far removed from the historic liquidity crisis three weeks ago, when violent market swings forced the liquidation of billions of dollars in leveraged crypto positions.

Looking ahead, market sentiment remains tense. Melissa Armo said she is preparing for another possible round of declines on Wednesday. She advised:

If traders can withstand some pain, they can start preparing a potential stock buy list. If not, then I suggest selling.