Bloomberg: $1.3 Billion Paper Loss - Is Tom Lee's Ethereum Bet on the Verge of Collapse?

Original Article Title: Tom Lee's Big Crypto Bet Buckles Under Mounting Market Strain

Original Article Author: Sidhartha Shukla, Bloomberg

Original Article Translation: Chopper, Foresight News

Ethereum's corporate treasury experiment is now unraveling in real time.

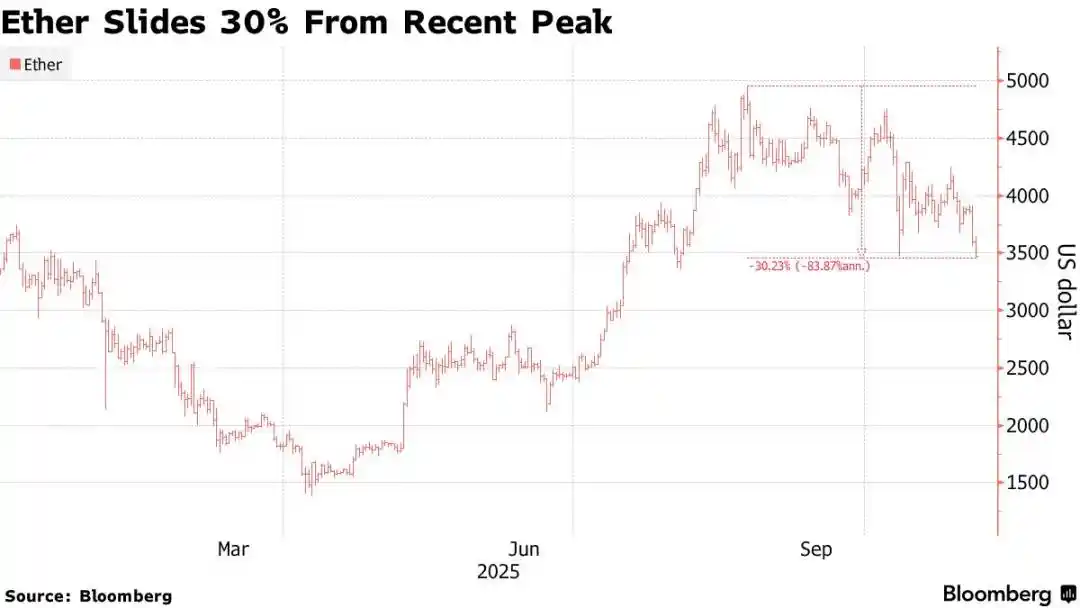

The world's second-largest cryptocurrency tumbled below $3,300 on Tuesday, mirroring the broader market sell-off seen in Bitcoin and tech stocks. This drop has pushed Ethereum's price down by 30% from its August peak, returning it to levels before large-scale corporate purchases, further solidifying its entry into a bear market.

According to research firm 10x Research, this reversal has left Ethereum's most aggressive corporate supporter, Bitmine Immersion Technologies Inc., facing over $1.3 billion in paper losses. This publicly traded company, backed by billionaire Peter Thiel and led by Wall Street analyst Tom Lee, adopted a strategy mirroring Michael Saylor's Bitcoin treasury model by acquiring 3.4 million Ethereum at an average price of $3,909. Now, Bitmine's treasury is fully deployed and facing increasing pressure.

10x stated in its report, "For months, Bitmine has been dictating market narratives and fund flows. Now with its treasury fully deployed, facing over $1.3 billion in paper losses, and no spare capital available."

The report highlights that retail investors who bought Bitmine shares at a premium to net asset value (NAV) have suffered even greater losses, and the market's willingness to catch a falling knife is limited.

Lee did not immediately respond to requests for comment, and representatives from Bitmine did not respond promptly either.

Bitmine's bet is far from a simple balance sheet trade. Behind the company's accumulation lies a grander vision: the digital asset's evolution from a speculative tool to corporate financial infrastructure, thereby solidifying Ethereum's position in the mainstream financial arena. Supporters believe that by integrating Ethereum into a publicly traded company's asset treasury, enterprises will help build an entirely new decentralized economy. In this economic system, code replaces contracts, and tokens serve as assets.

This logic drove the summer rally. Ethereum's price once approached $5000, with over $90 billion flowing into Ethereum ETFs in just July and August. However, after the crypto market crash on October 10, the situation reversed: according to Coinglass and Bloomberg compiled data, Ethereum ETFs saw outflows of $8.5 billion, and Ethereum futures open interest decreased by $16 billion.

Lee had previously predicted that Ethereum would reach $16,000 by the end of this year.

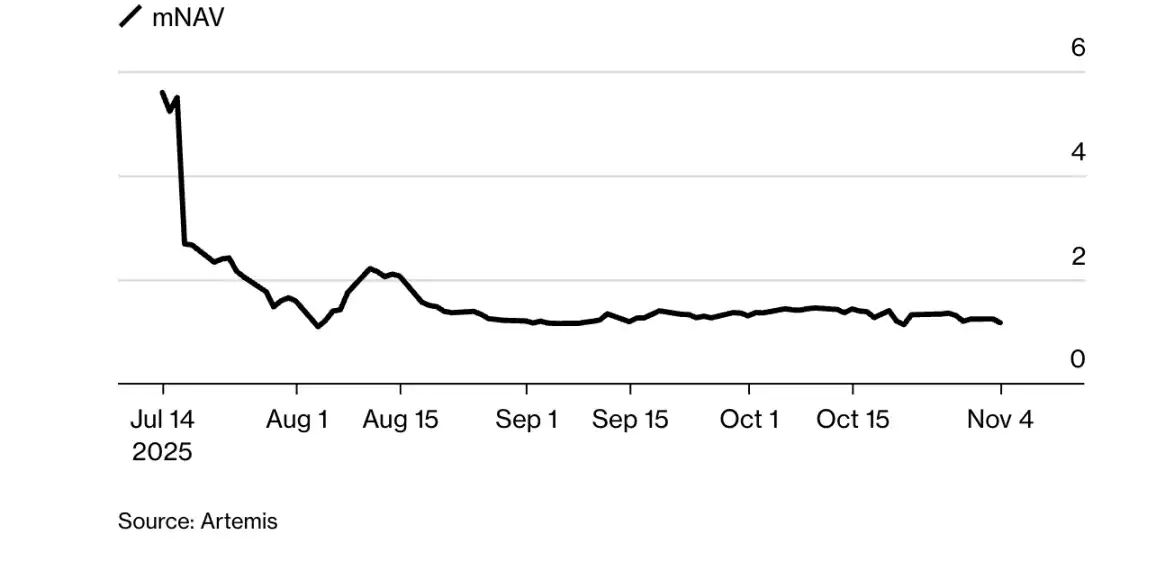

Bitmine's Net Asset Value (mNAV) Premium Declines

According to Artemis data, Bitmine's market cap-to-NAV multiple has plummeted from 5.6 in July to 1.2, with its stock price dropping 70% from its peak. Similar to other Bitcoin-related companies, Bitmine's stock price is now closer to its underlying holdings' value, as the market reassesses the once overvalued positions on crypto assets' balance sheets.

Last week, another publicly traded Ethereum treasury company, ETHZilla, sold $40 million worth of Ethereum holdings to buy back shares, aiming to bring its modified Net Asset Value (mNAV) ratio back to normal. In a press release, the company stated, "ETHZilla plans to use the proceeds from the remaining Ethereum sales to further repurchase shares and intends to continue selling Ethereum to buy back shares until the discount relative to the Net Asset Value normalizes."

Despite the price decline, Ethereum's long-term fundamentals seem to remain strong: its on-chain value processed still surpasses all competitors in the smart contract space, and its staking mechanism gives the token both yield and deflationary characteristics. However, with rising competitors like Solana, a reversal in ETF fund flows, and waning retail interest, the narrative of "institutions stabilizing cryptocurrency prices" is gradually losing its effectiveness.