Date: Wed, Nov 05, 2025 | 08:30 AM GMT

The cryptocurrency market is showing minor signs of relief after the sharp sell-off witnessed over the last two days, which pushed Bitcoin (BTC) down to the $98K region before rebounding to around $102K.

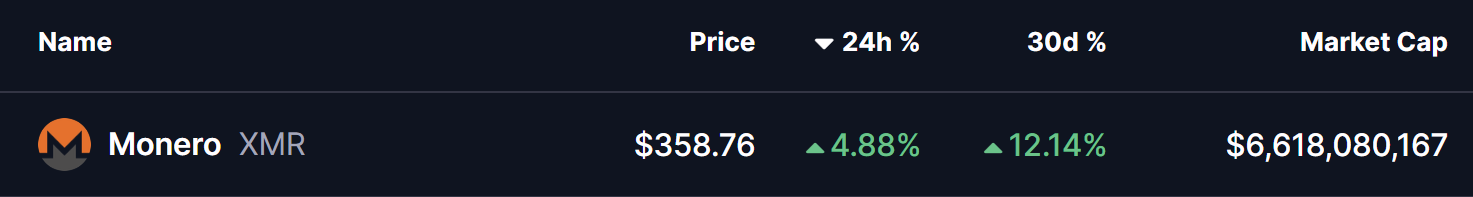

Following this, several altcoins have started turning green again — including the privacy-focused token Monero (XMR), which is up by over 4% today. More importantly, XMR’s daily chart is flashing a potentially bullish signal, hinting that a major breakout could be on the horizon.

Source: Coinmarketcap

Source: Coinmarketcap Rounding Bottom in Play

On the daily timeframe, XMR appears to be forming a rounding bottom pattern, a bullish reversal structure that often signals the transition from accumulation to a new uptrend.

The formation started earlier this year after XMR faced strong rejection from the $371 zone in May 2025, triggering a correction to as low as $232.74, where buyers stepped in aggressively. Since then, the token has maintained a steady recovery, forming a smooth, curved base typical of a rounding bottom.

Monero (XMR) Daily Chart/Coinsprobe (Source: Tradingview)

Monero (XMR) Daily Chart/Coinsprobe (Source: Tradingview) Currently, XMR is trading near $358, sitting right in its neckline resistance zone between $347 and $371. This area has been a historical supply region, and a clean breakout above it could confirm the end of the accumulation phase and the start of a new bullish cycle.

What’s Next for XMR?

If bulls successfully push XMR above the $371 neckline, the breakout would validate the rounding bottom structure. From a technical perspective, this could open doors for an initial move toward $425, followed by a potential run-up to around $500, representing nearly a 38% upside from current levels.

On the flip side, short-term pullbacks remain possible. A temporary rejection from the neckline could send XMR back into rounding bottom — before any decisive move higher.

For now, XMR’s price behavior suggests that momentum is shifting back in favor of the bulls. A confirmed breakout from the rounding bottom could mark the beginning of a sustained uptrend, reinforcing Monero’s strength among top-performing privacy coins in this recovery phase.