Those strings of astonishing profit figures once put them on a pedestal, but in the end, it was only a fleeting celebration before liquidation.

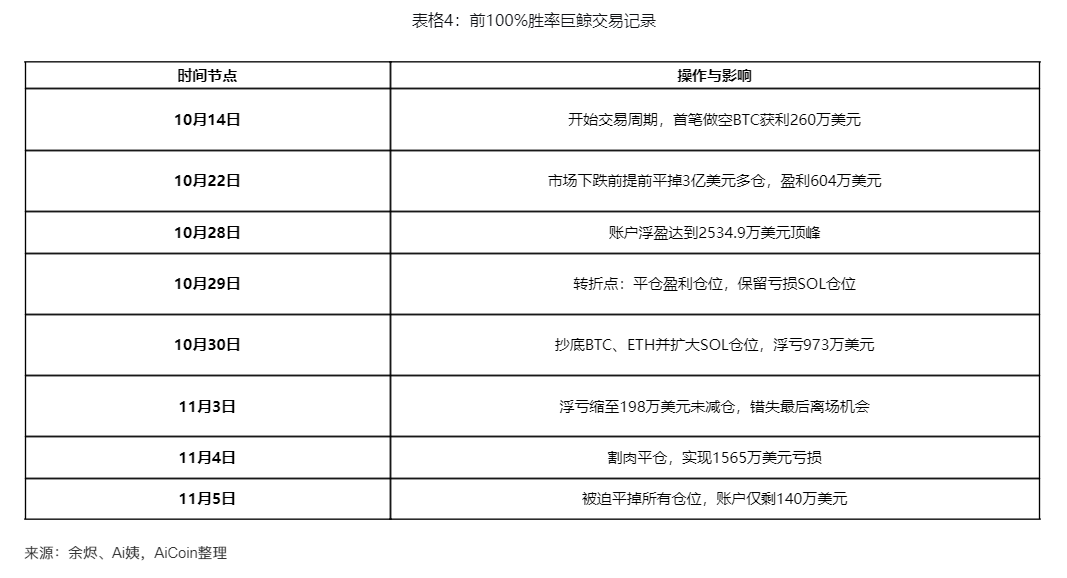

An anonymous whale who once maintained a 100% win rate reached his profit peak on October 28: $25.349 million. In just one week, in the early morning of November 5, he was forced to close all positions, with only $1.4 million margin left in his account. More than $44 million evaporated in the market.

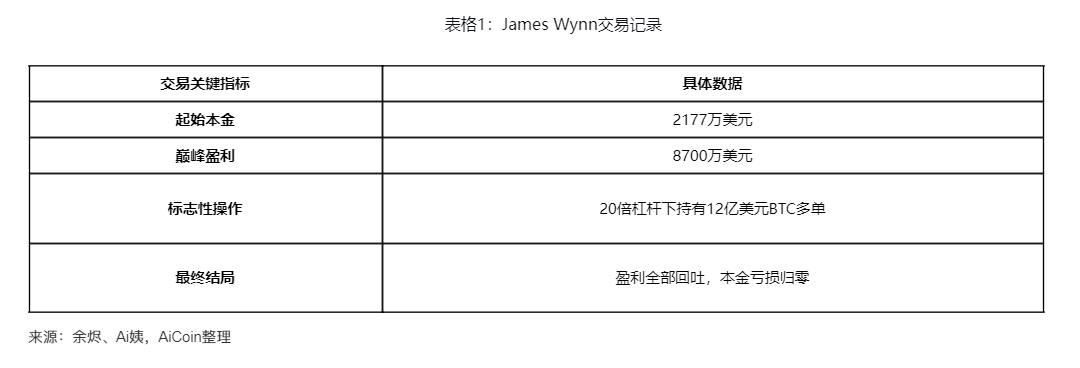

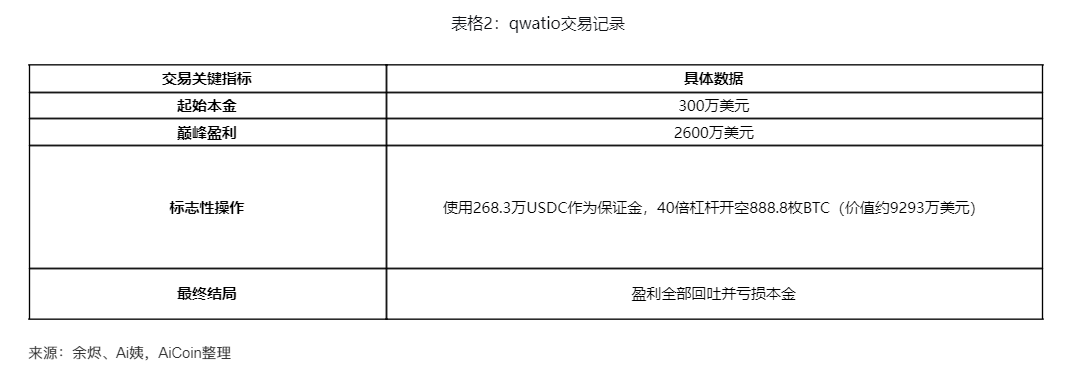

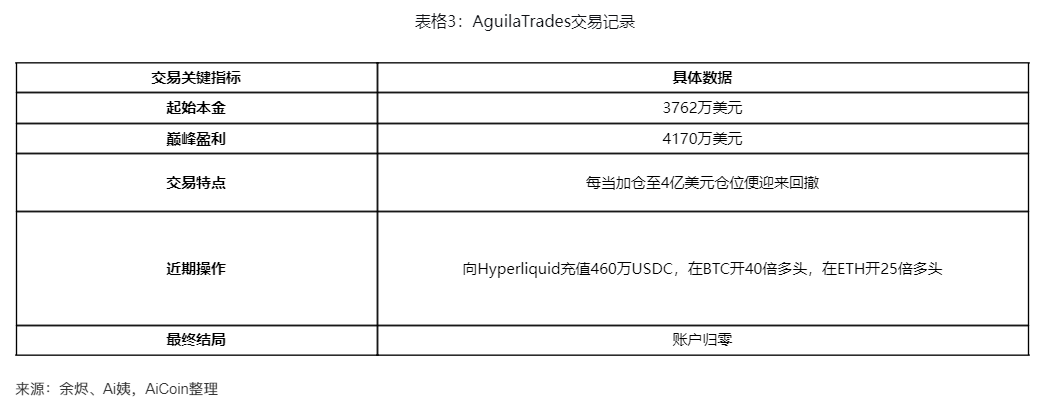

He was not the only victim. On the Hyperliquid platform, several whales such as James Wynn, qwatio, and AguilaTrades experienced similar trajectories: massive profits, increased leverage, market reversal, and then liquidation to zero.

These stories collectively reveal a harsh truth: in the world of high-leverage trading, no matter how glorious the past, the ultimate outcome of lacking risk management is usually the same—failure and exit.

I. Complete Trading Records of Four Major Whales

On the fervent soil of high-leverage trading at Hyperliquid, four traders from different backgrounds once stood out with astonishing results, jokingly called “insider traders” by the community. They seemed to possess a Midas touch, yet little did they know that fate had already set a price in secret.

II. The Fall of the [100% Win Rate] Whale

Among all these whales, the most eye-catching was the “former 100% win rate whale.” His story fully demonstrates how a trader can go from glory to ruin, serving as a living lesson in the risks of high-leverage trading.

● October 14, he began his 14-win streak legend with a precise short operation. He bought 5,255 ETH, sold them all the next day for 22 million USDC, and shorted BTC with about 5x leverage, earning $2.6 million overnight.

● October 22, he closed about $300 million in long positions ahead of a market drop, profiting $6.04 million, earning praise from the community as “quick to react.”

● October 28, 6:12 AM, his account’s unrealized profit reached a peak of $25.349 million, the last unilateral rise in his P&L curve. However, after the peak, crisis crept in.

● October 29 became the turning point. He chose to close profitable positions first, while holding on to the losing ones. This “cutting profits and letting losses run” approach set the stage for his later disaster.

● October 30, a speech by Federal Reserve Chairman Powell triggered a brief market drop. He chose to bottom-fish BTC and ETH, and simultaneously increased his SOL position. By that evening, all three major positions were underwater, with an unrealized loss of $9.73 million.

● November 3, 8:00 AM, the unrealized loss shrank to $1.98 million, just one step away from breaking even, but he did not reduce his positions. In just three hours, the market turned bearish again, and all four of his long positions went back into the red.

● November 4, he cut his losses and closed BTC, ETH, and SOL long positions worth $258 million, realizing a loss of $15.65 million. This figure was almost equal to the $15.83 million profit he had made in 14 consecutive wins over the previous 20 days.

● November 5, around 5:00 AM, it was all over. He was forced to close all positions, with only $1.4 million margin left in his account. The $15.83 million profit from 14 consecutive wins, plus $28.76 million in principal, totaling $44.67 million, was wiped out in a single loss.

III. The Fatal Temptation of High Leverage

Although the trading stories of these whales differ, they all share one fatal factor—high leverage. Leverage is like a sharp double-edged sword: it can instantly amplify returns, but can also quickly destroy wealth.

● The essence of leverage is borrowed trading, allowing traders to control positions far larger than their own capital with a small amount of principal. On derivative trading platforms like Hyperliquid, leverage ratios often reach 20x, 50x, or even higher.

● High leverage greatly reduces survival probability. Even the whale with 14 consecutive wins lost everything in the end simply because he was “4% away” from liquidation. Market volatility itself does not kill traders, but volatility magnified by leverage can.

● AguilaTrades chose to use 40x leverage on BTC, which meant he faced liquidation risk if the price dropped more than 2.5%. His 25x long on ETH carried similar risk, as he was betting or gambling on a short-term rebound. In the highly volatile crypto market, a 2.5% intraday swing is almost the norm, making high-leverage positions like walking on a cliff’s edge.

IV. The Common Fatal Flaws of Whales

Analyzing the trading behaviors of these whales reveals several key fatal weaknesses they share, which are infinitely magnified in a high-leverage environment.

● Overconfidence and arrogance. Consecutive profits give traders an illusion of invincibility, making them believe their judgment is always correct. After reaching his peak, the 14-win whale did not choose to take profits, but instead increased his positions, ultimately leading to collapse.

● Refusal to admit mistakes and cut losses. Several whales, when facing losses, chose to add to losing positions in hopes of “holding out for a rebound,” rather than cutting losses in time. The 14-win whale, when his unrealized loss had shrunk to $1.98 million, did not reduce his positions, missing his last chance to exit.

● Risk concentration instead of diversification. These whales often held high-leverage positions in multiple trades simultaneously, so when the market turned as a whole, they suffered a chain reaction. The 14-win whale held long positions in BTC, ETH, and SOL at the same time, with no hedging protection during a market-wide decline.

● Emotion-driven decisions. At critical moments, these traders were all driven by greed or fear, rather than rational analysis. When the 14-win whale’s liquidation price was approached, “any rational trader would have stopped, but he instead increased his positions at ETH $3,497 and SOL $159,” further raising his liquidation threshold.

V. Survival Rules for High-Leverage Trading

These bloody cases provide us with valuable lessons. To survive in high-leverage trading, a few iron rules must be followed.

● Strictly control leverage ratio. Leverage is a double-edged sword; using leverage beyond your risk tolerance is doomed to lead to destruction. Even the 14-win whale kept his leverage below 8x during his successful phase, but in the later out-of-control phase, his leverage ratio increased significantly.

● Firmly implement stop-loss strategies. “Stop-loss is the cost of trading, not a loss.” Setting clear stop-loss points and strictly executing them is key to long-term survival. If these whales had decisively cut losses early instead of adding to losing positions, their outcomes might have been completely different.

● Take profits in time. Unrealized profits are just numbers on paper; only profits after closing positions are real wealth. James Wynn’s $87 million peak profit and the 14-win whale’s $25.349 million unrealized gain both ultimately vanished into thin air.

● Maintain humility and respect. The market is always right; past success does not guarantee future performance. The 14-win whale’s failure was largely due to overconfidence in his own judgment and neglecting market uncertainty.

The market never lacks stars, only survivors. When the 14-win whale closed his last position in the early morning of November 5, looking at the mere $1.4 million margin left, he may have finally understood this truth.

Leverage can amplify returns, but not wisdom; it can accelerate wealth accumulation, but also hasten destruction. After the tragedies of these whales, a new legend is being written on Hyperliquid—whether it will repeat the past or break the cycle of fate remains to be seen.