The "Invisible Tax" of On-Chain Gold: Trading Premiums and Structural Flaws

When "Tokenization" Loses Its Meaning: Why Are We Paying a Premium for On-Chain Gold?

Written by: @ballsyalchemist

Translated by: AididiaoJP, Foresight News

On-chain gold (such as PAXG and XAUT) has introduced the concept of real-world assets, but it comes with a major pitfall: persistent trading premiums and structural flaws. These factors together hinder efficient arbitrage by market makers, allowing token prices to deviate significantly and for extended periods from their fair value. Ultimately, these flaws act as an "indirect tax," harming investors' interests.

Tokenized gold has successfully attracted many crypto users into the real-world asset sector, but at what cost?

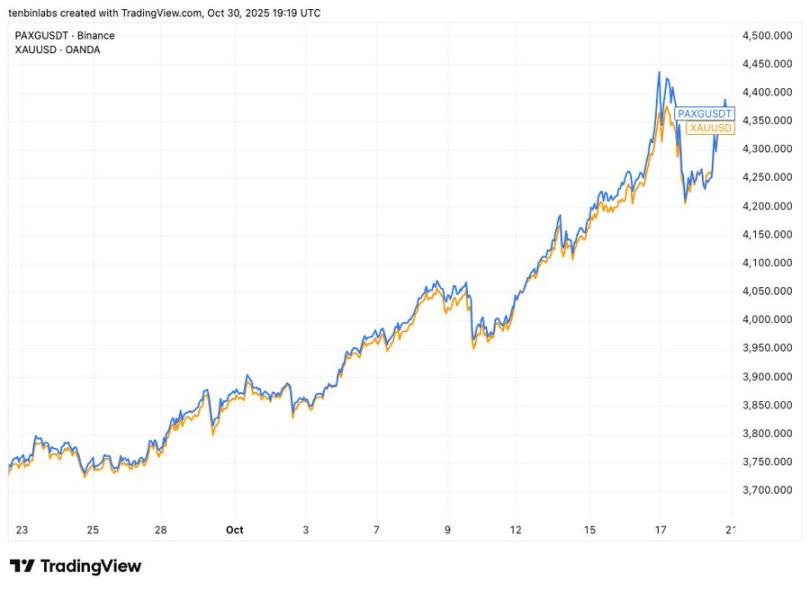

Binance PAXG Price vs. Spot Gold Price

This simple price comparison chart shows: the blue line is the mainstream tokenized gold PAXG, and the yellow line is spot gold. Each PAXG token corresponds to one ounce of spot gold. But during the period shown, almost every PAXG buyer purchased at a price higher than the spot price.

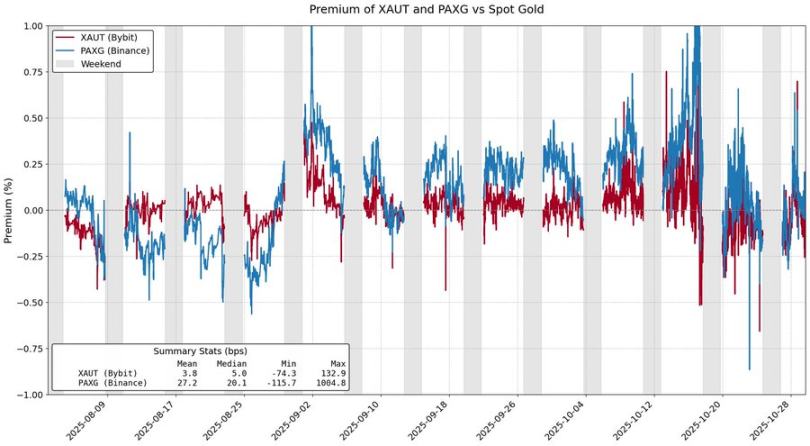

Premiums of PAXG and XAUT Relative to Spot Gold

Tokenized assets are supposed to make real asset investment more cost-effective, but gold, which accounts for 84% of the total market cap of tokenized commodities, has failed to achieve this goal. These premiums may seem to stem from market demand, but in reality, they originate from inherent structural frictions in the token issuance model.

Minting and Redemption Fees

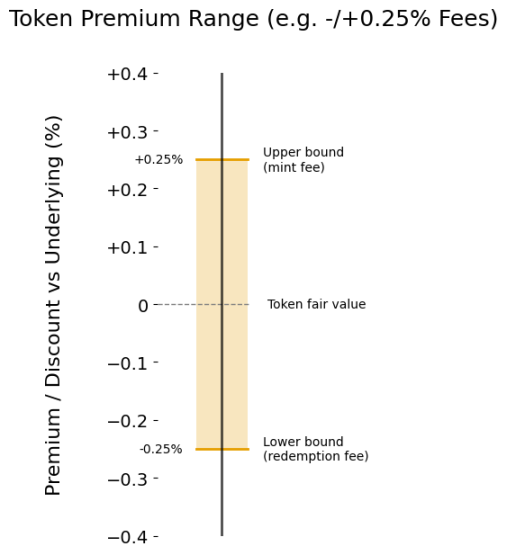

The main source of premiums in tokenized products is minting and redemption fees. These fees essentially define the "premium range" for token prices, allowing them to float reasonably relative to the value of the underlying asset.

Suppose you are a market maker for XAUt and PAXG. Gold surges, and capital flows into tokenized gold. At what price would you be willing to sell? At the very least, not below your inventory cost, which is determined by the minting fee, effectively setting a soft upper limit for the price.

Similarly, tokenized gold can also trade at a discount. When capital flows out, you would only buy XAUt or PAXG at a price lower than what you would get by redeeming the tokens from Tether or Paxos. Just as the minting fee limits the upside, the redemption fee limits the downside.

Premium Range Determined by Fees

The higher the fees, the larger the premium range, and the greater the deviation of token prices from their true value. Currently, Tether charges a 0.25% minting and redemption fee for XAUt, while Paxos uses a tiered fee structure: 1% for 2-25 PAXG, and 0.125% for over 800 PAXG.

Given the operational costs of tokenizing physical gold, these fees may be reasonable. But clearly, lowering these fees would reduce price deviations and ultimately benefit investors.

Structural Frictions

Minting and redemption fees only set the "soft" boundaries for prices; other frictions in the token issuance model also push up premiums.

For example, Tether Gold requires a minimum minting of 50 XAUt (about $200,000) and redemption of 430 (about $1.7 million). Such thresholds make it difficult for market makers to operate flexibly, tying up capital for long periods and incurring high opportunity costs.

Another issue is settlement delays. Paxos explicitly states that PAXG redemptions may take several business days. Funds are locked up for a long time, and the opportunity cost is considerable.

These frictions deter market makers unless the profits are substantial enough. As a result, the price of tokenized gold can deviate significantly from its true value, even breaking through the boundaries set by fees.

Tokenized gold demonstrates the appeal of RWA, but also exposes the limitations of the current model. On-chain gold not only trades at a premium, but redemption is also slow. These obstacles act like invisible taxes. If tokenized assets are to develop, users choosing on-chain options should not have to suffer losses.

Liquidity, redemption efficiency, and price stability must complement each other, not come at the expense of one another. This must change.