YFI Value Increases by 1.18% During Market Fluctuations

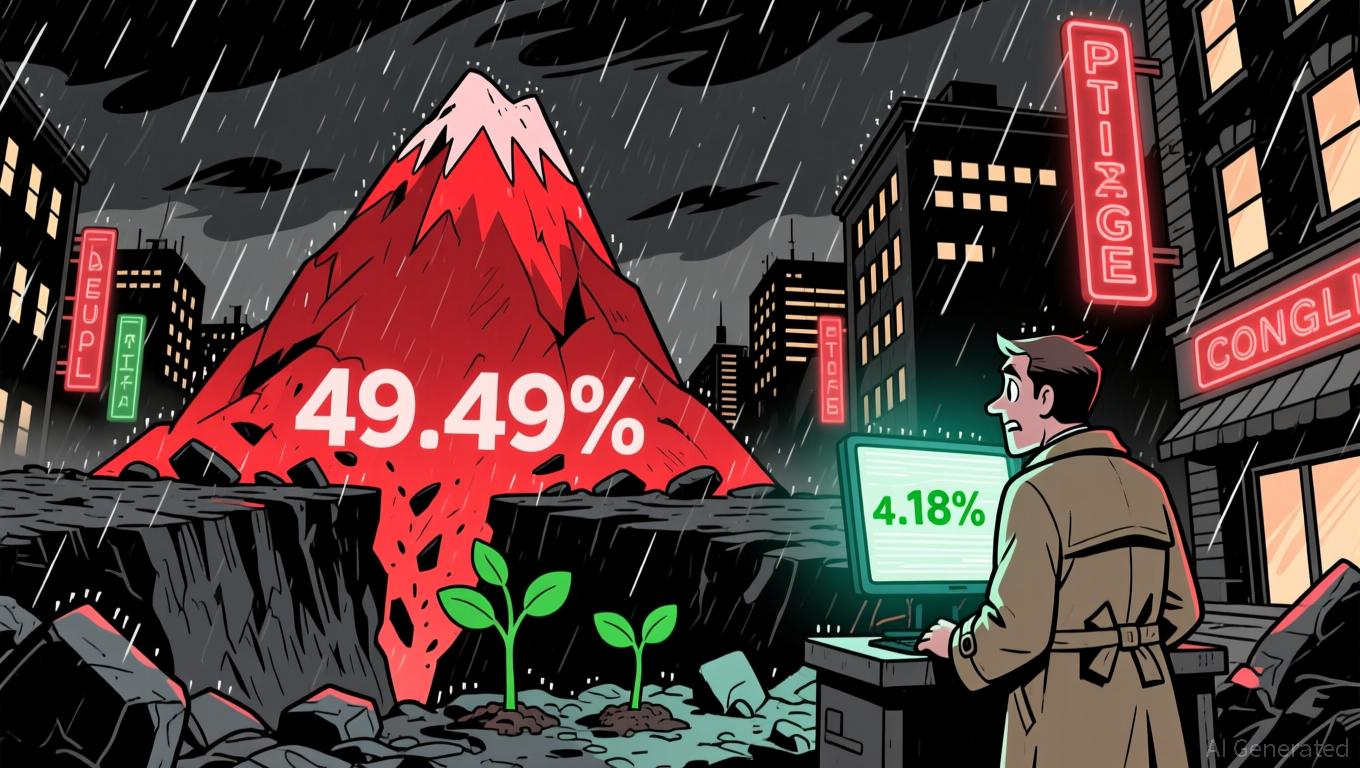

On November 24, 2025, YFI (yearly interest factor) saw its value climb by 1.18% in the past 24 hours, bringing its price to $4,036. Despite this brief upward movement, the overall trend remains negative: in the last seven days, YFI has fallen by 9.16%, and over the previous 30 days, it has lost 14.24%. Most notably, the asset has suffered a 49.49% decrease over the past year, highlighting a persistent bearish pattern even with the recent short-term rise.

This activity highlights the continued instability within the

The recent changes in YFI’s price mirror the broader sense of unpredictability in the market. Short-lived gains can often be attributed to shifts in liquidity, economic indicators, or speculative trades. However, since there have been no notable news or events linked to YFI, this movement likely stems from general market forces. Traders are watching closely for any signs of stabilization, but the prevailing downward trend continues to dominate.

Given the asset’s performance over the past year, investors should approach with caution, as it remains highly responsive to economic shifts and changing market sentiment. While the latest increase is encouraging, it does not necessarily signal a reversal of the broader trend. Uncertainty is still being factored into the market, and only a sustained period of growth could indicate a potential change in direction.