Date: Wed, Nov 26, 2025 | 06:15 AM GMT

The cryptocurrency market continues its steady recovery following last week’s sharp volatility, which dragged Ethereum (ETH) to a low of $2622 before rebounding toward $2950. This recovery is now helping several altcoins regain strength, including Pi Network (PI) , which is beginning to flash an interesting technical pattern on its daily chart.

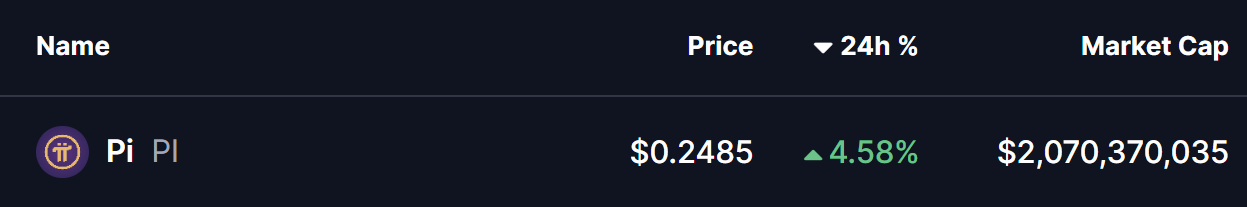

PI is currently trading with a modest 4% intraday gain, but beyond the price jump, the structure forming on the chart is what truly stands out — suggesting that a larger move may be developing soon.

Source: Coinmarketcap

Source: Coinmarketcap Symmetrical Triangle in Play

On the daily chart, PI has been moving inside a symmetrical triangle, a pattern known for tightening price action and eventually leading to a forceful breakout in either direction. Unlike descending or ascending triangles, this formation is neutral, but its breakout signals often come with significant volatility.

During the recent pullback, PI dipped toward the triangle’s lower support near $0.2160. This trendline has been a reliable buffer throughout the consolidation phase, and once again, buyers defended it strongly. The rebound from this zone has pushed PI back toward $0.2485, placing the price directly beneath the triangle’s upper resistance trendline.

Pi Network (PI) Daily Chart/Coinsprobe (Source: Tradingview)

Pi Network (PI) Daily Chart/Coinsprobe (Source: Tradingview) The closer PI moves toward this resistance while maintaining higher lows, the more momentum builds for a potential breakout. This tightening structure suggests rising pressure that could soon resolve with a decisive move.

What’s Next for PI?

If bulls manage to push PI above the triangle’s upper resistance line and reclaim the 100-day Moving Average near $0.2755, it would confirm a bullish breakout from the pattern. Once this confirmation occurs, the next key target sits around $0.3169, offering more than 27% potential upside from current levels based on the pattern’s measured projection.

However, if PI struggles to break through resistance, the price may continue to consolidate inside the triangle. In that case, the $0.2280 zone becomes the important short-term support area to watch for any renewed buying pressure.