Post-peak CD returns threatened by Fed reductions—investors hurry to lock in rates

In late November 2025, Certificate of Deposit (CD) rates peaked at an annual percentage yield (APY) of 4.20%, highlighting a market still adapting to changes in Federal Reserve policy. Recent figures from financial monitoring services indicate a modest drop in CD rates across most durations, a trend linked to the central bank’s ongoing rate reductions this year. Nevertheless, investors can still find attractive yields, especially with short-term options such as 12-month CDs

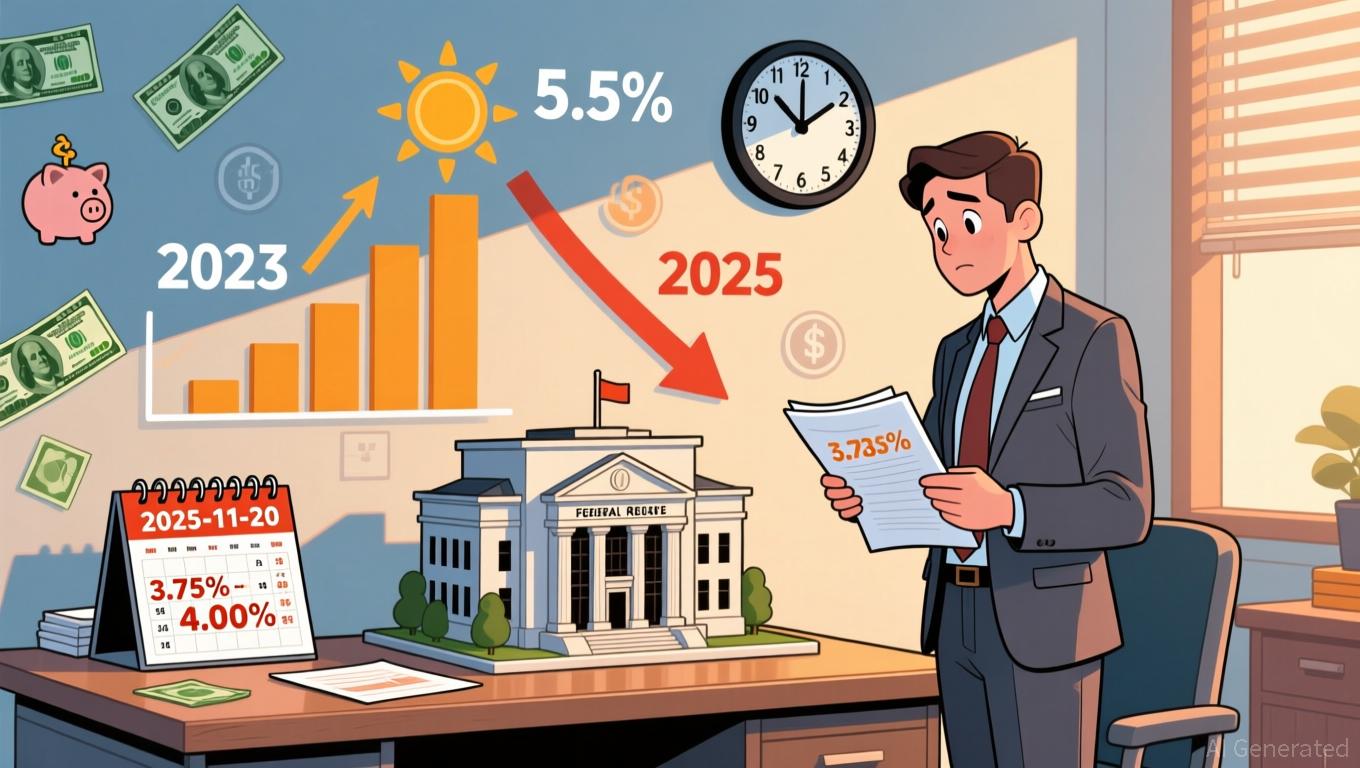

In October 2025, the Federal Open Market Committee (FOMC) lowered the federal funds rate to a 3.75%-4.00% range, following two rate cuts in 2025 and three in 2024. These moves, designed to curb inflation while supporting economic expansion, have caused CD rates to fall from their mid-2023 highs of 5.25%-5.50%. Even with this decline, today’s rates are still near historic highs, with the leading 10% of 12-month CDs yielding 3.92% APY

Experts in the market recommend that investors act soon to secure current rates before they decrease further. The FOMC is scheduled to convene again in December 2025, and another rate cut is widely expected. Data from CD Valet reveals that median rates for 24-month CDs have leveled off, while 36- and 48-month CDs have experienced slight drops. For those saving, short- and medium-term CDs—especially 12- or 24-month terms—continue to be the most appealing choices. A 12-month CD with a 3.92% APY could yield better returns than longer-term CDs, which have seen rates fall to 3.60%

More investors are adopting strategic deposit approaches. Financial professionals suggest putting larger amounts into CDs with higher APYs to maximize earnings. For example, investing $100,000 in a 12-month CD at 3.92% APY would earn $3,920 in interest, compared to $3,600 from a 24-month CD at 3.60%. This strategy takes advantage of the current market to boost returns before any further rate reductions occur.

Looking at history, timing is crucial. In the early 1980s, CD rates soared into double digits due to high inflation and aggressive Fed rate hikes. Today’s rates, though lower, reflect a more stable economic setting. Investors should keep an eye on FOMC announcements and adjust their CD investments as needed. With another rate cut likely in December, the opportunity to lock in favorable rates may soon narrow before rates settle at a new, lower level.