Need Funding, Need Users, Need Retention: A Growth Guide for Crypto Projects in 2026

Original Title: Crypto Marketing Trends & Predictions: 2026 and Beyond

Original Author: @emilyxlai

Translated by: Peggy, BlockBeats

Editor's Note: Marketing in the crypto industry is undergoing a profound transformation: trend lifecycles are getting shorter, competition is fiercer, and traditional tactics are gradually losing effectiveness. For entrepreneurs, growth leads, and marketing teams, understanding these changes is not just a matter of survival, but the key to gaining a competitive edge.

This article, based on a speech by Emily Lai, CMO of Hype Partners, systematically outlines the 7 core trends in crypto marketing for 2026, covering performance marketing, content creation, channel diversification, event experiences, incentive mechanisms, and AI-driven operations. It also shares industry predictions and a framework for staying ahead.

The industry is evolving rapidly—how can you seize opportunities and avoid falling behind? This article gives you the answer.

The following is the original text:

The crypto industry changes in the blink of an eye, with extremely short attention cycles; trends emerge quickly and disappear even faster, with lifecycles becoming increasingly compressed.

At the g(t)m con1 conference held last Sunday (November 16), I shared my observations and experiences from the past year and offered forward-looking insights for 2026.

The core of this talk was to share with entrepreneurs, growth leads, and marketing experts our team's outlook on the industry's future, discuss what this means for your marketing strategy, and how to stay ahead in the competition.

Ten Months Can Change a Lot

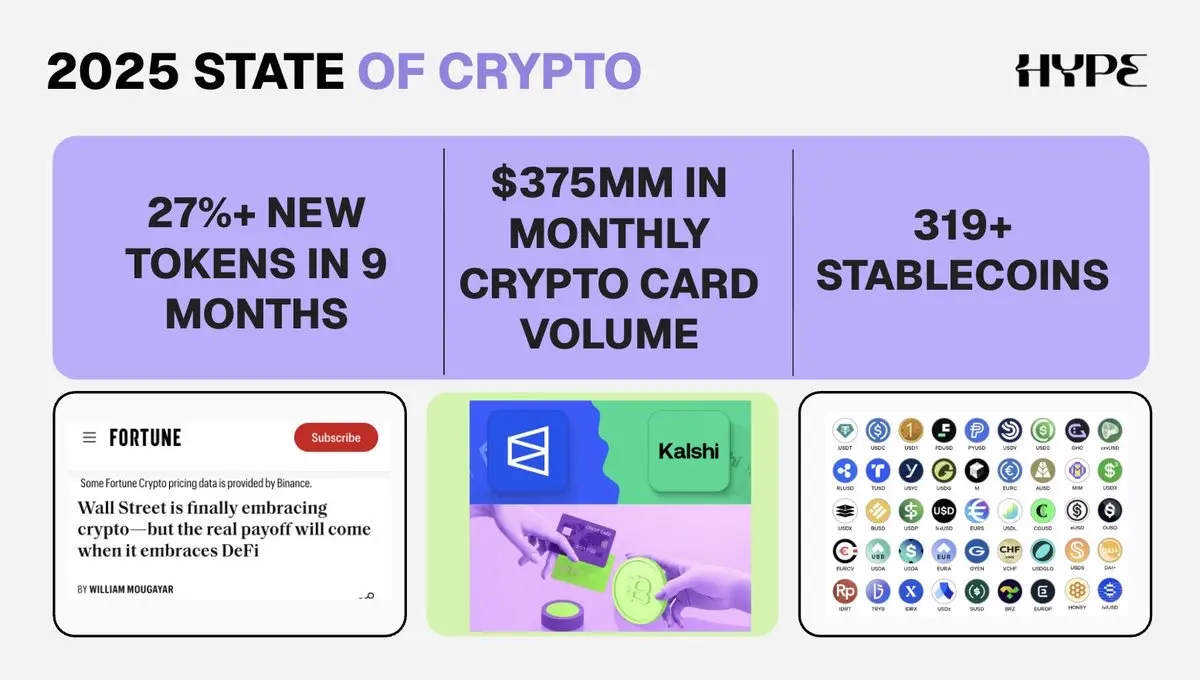

Since my keynote at the EthDenver conference in February 2025, we have witnessed: over 319 new stablecoins launched; institutions and Wall Street entering the space, including enterprise blockchains, DAT, ETF, and fintech giants adopting stablecoins; a relaxed regulatory environment, the introduction of the GENIUS Act, and the US welcoming a "crypto-friendly" president; new token issuance up over 27%, reaching 567 million tokens at the time of writing; a surge in crypto payment card options, with card transaction volume on traceable blockchains hitting $375 million in October 2025 alone; an explosion in prediction markets, with @Kalshi and @Polymarket setting new trading volume records and new players entering; and new banks and mobile-first financial apps launching on crypto rails.

Crypto in 2024 vs. Today

Last November, the first g(t)m con was held in Bangkok. The main trends at the time included: team-led marketing, founder personal branding, AI agents, interactive "reply masters," brand mascots, airdrops, intern accounts, and the mysterious concept of "mindshare" (brand awareness) proposed by the InfoFi platform.

One year later, the industry landscape has clearly shifted: from the APAC liquidity focus, to the return of ICOs, to the rise of "CT Leads," the pace of change in crypto is astonishing.

User Mindshare ≠ Growth

RIP Mindshare

Over the past year, many highly anticipated TGEs (Token Generation Events) saw weak buying pressure and price performance far below crypto Twitter (CT) sentiment expectations, even under high attention. From a KPI perspective, the industry has refocused on user acquisition (covering both B2B and B2C) and retention.

At the narrative and industry meta-trend level, ecosystems and applications are emphasizing "revenue and buybacks." Internal discussions are also centered on token strategies, tokenomics, and incentive design to alleviate sell pressure.

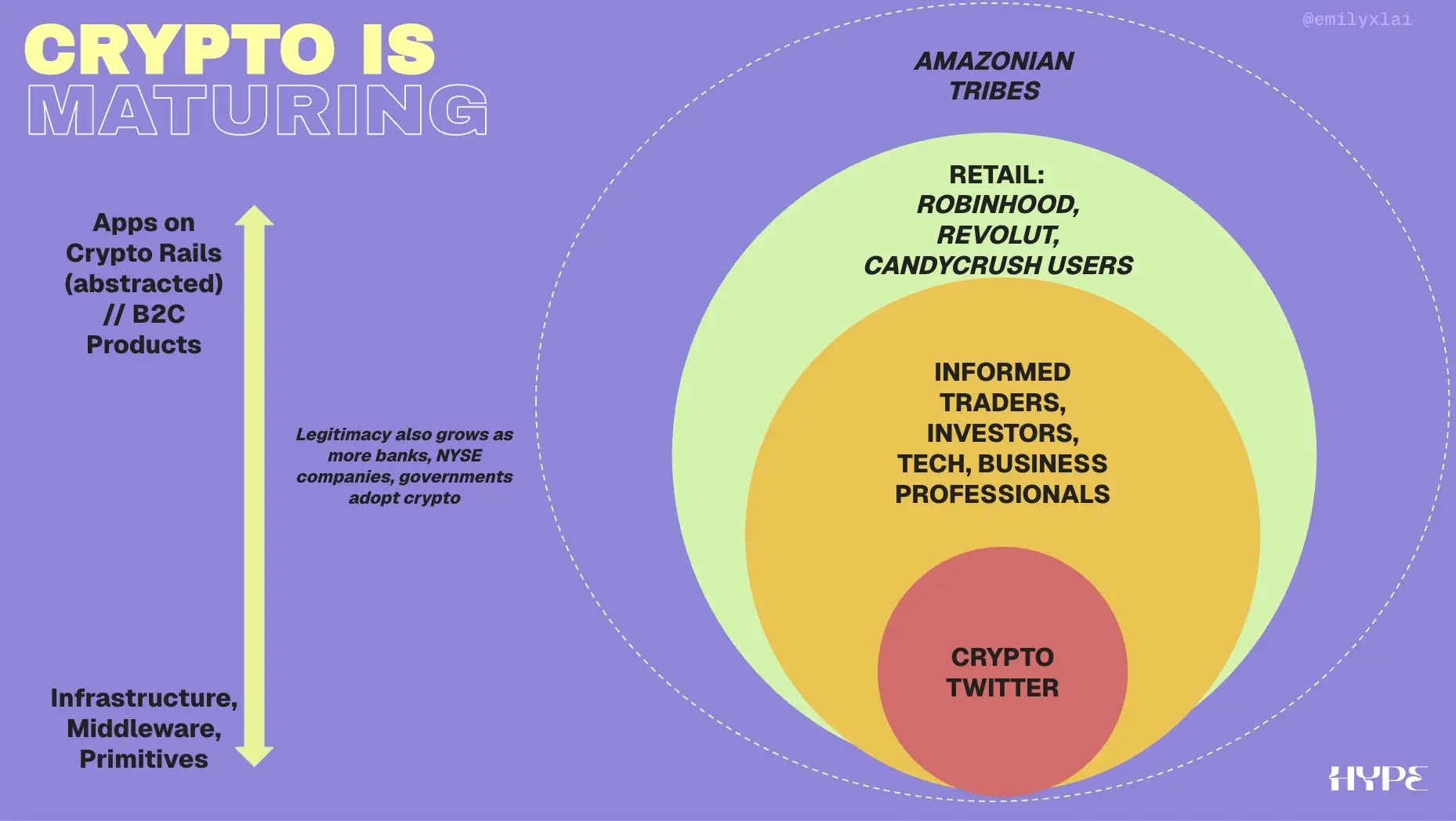

As infrastructure, base protocols, and middleware mature, the industry's focus is shifting from chains and ecosystems to applications. When traditional financial institutions start deploying capital and fintech apps with millions of users integrate blockchain rails, this not only brings legitimacy to the entire industry, but more importantly, allows us to reach new users beyond CT.

As user experience improves, new applications emerge, and trust is built, the addressable market and audience continue to expand. This also means that Web2 user acquisition strategies, previously considered negative ROI/ROAS, are becoming reasonable again.

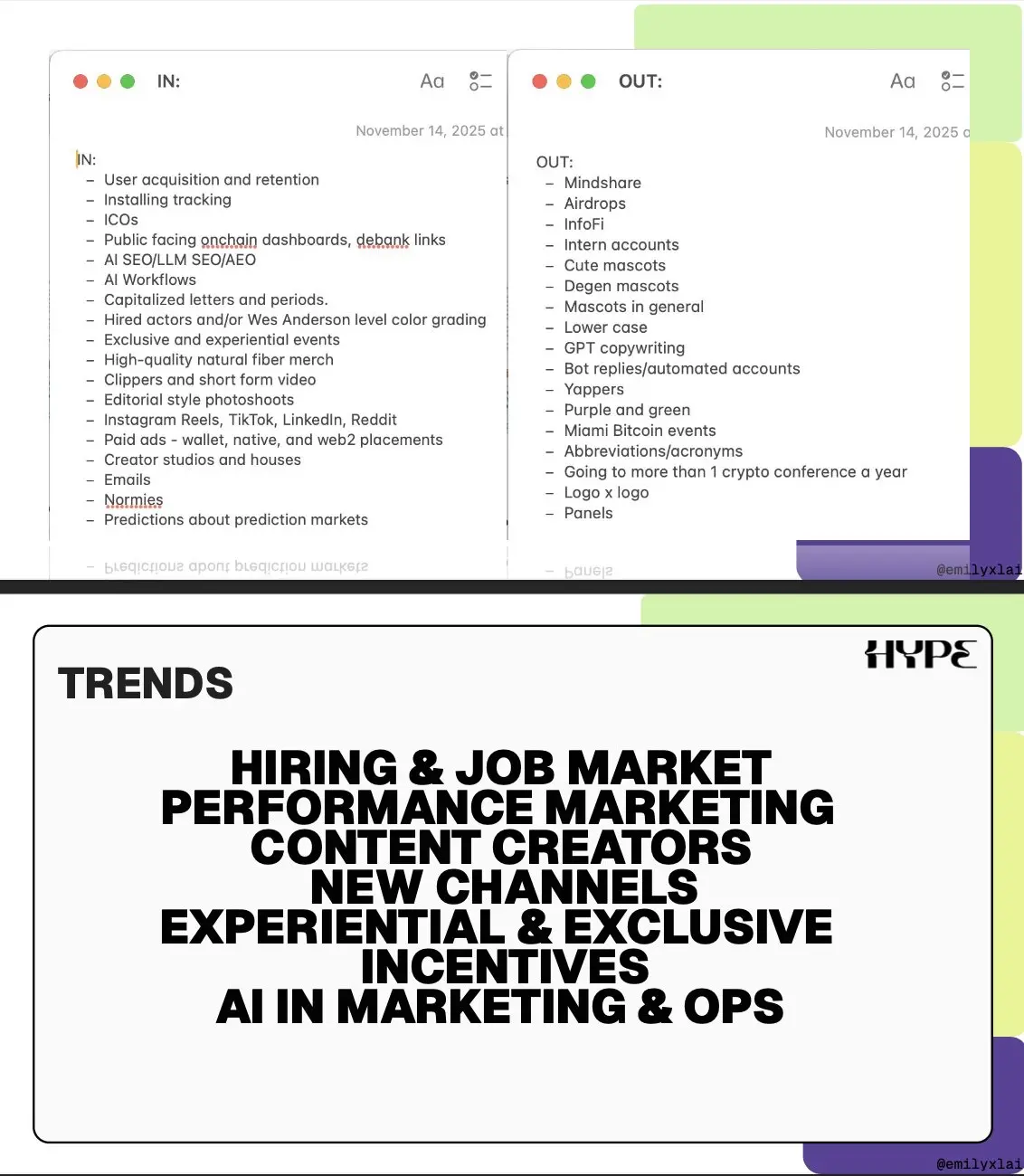

Hot and Not: Trend Review

Below is a subjective and incomplete "in and out" list. I first compiled my own views, then gathered opinions from a crypto VC friend, as well as from crypto marketing group chats and CT.

Afterwards, I broke down these trends and observations into 7 themes, providing a high-level overview and synthesis, summarizing my learnings and observations from 2025.

The original talk was only supposed to be 25 minutes, but thanks to @clairekart's flexibility, I was able to share in a "stream of consciousness" style for 45 minutes on stage.

Performance Marketing

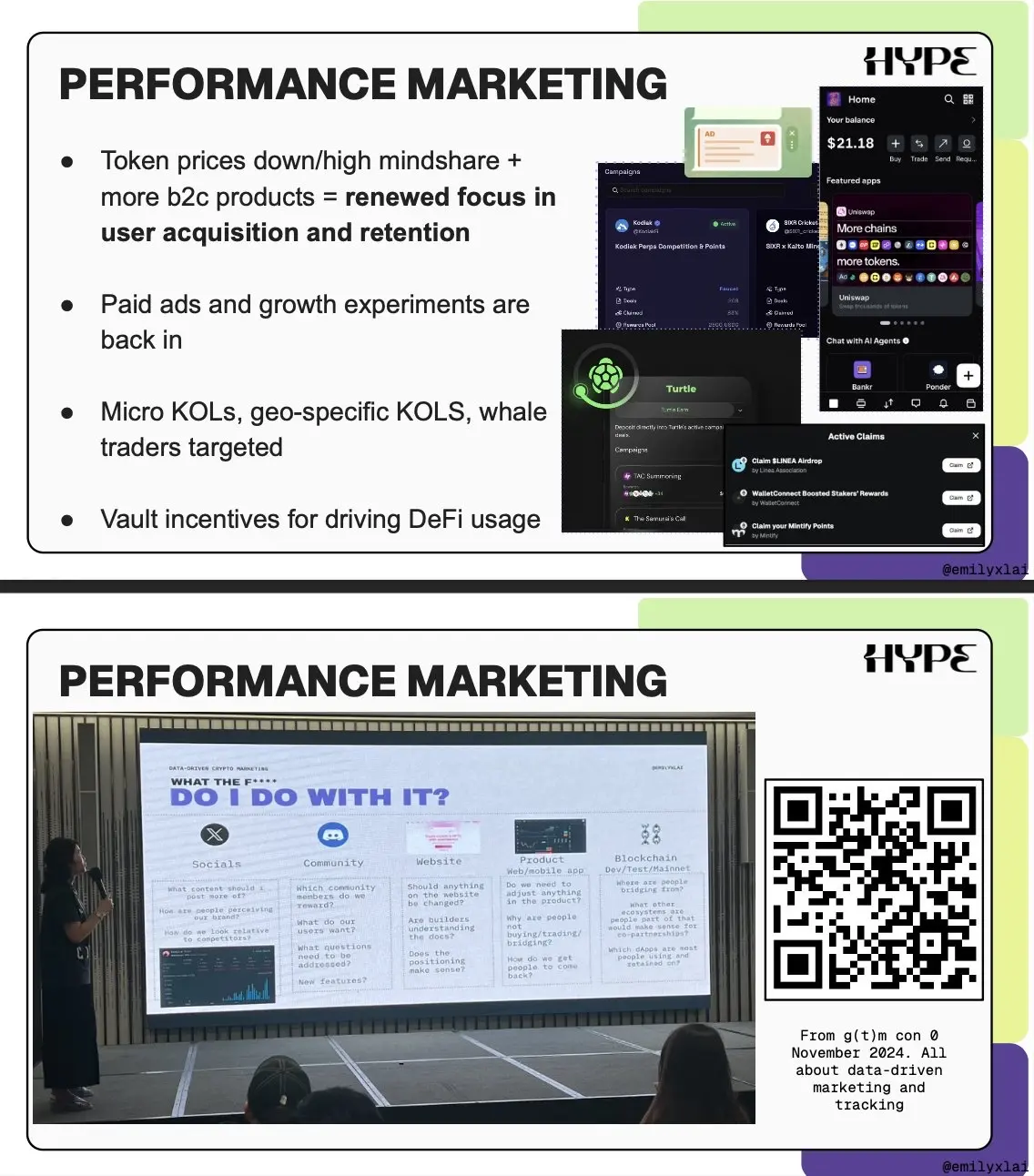

At last November's g(t)m con in Bangkok, I shared about data-driven marketing, focusing on funnel models and key metrics. What seemed important then is even more relevant now.

Performance marketing is making a comeback because the industry is refocusing on user acquisition and retention. This means: installing tracking tools (on-chain, product/web, distribution channels); growth experiments; combining paid and organic traffic; evolving from social tasks to liquidity tasks; precise KOL marketing campaigns, etc.

We're seeing more projects using or inquiring about tools such as:

@spindl_xyz, @gohypelab, @themiracle_io: for native wallet placements

@tunnl_io, @yapdotmarket: targeted bounty campaigns for small KOLs

@turtledotxyz, @liquidity_land: for liquidity marketing campaigns

There are also more precise strategies: I've spoken with some perpetual DEXs that use "white glove" user onboarding, even DMing whale users one-on-one, or leveraging APAC trading KOLs for initial traffic (with incentives, of course).

Meanwhile, Web2 paid ad channels are back in focus, including paid social, search ads, and out-of-home (OOH) advertising. Telegram ads remain an underrated channel. In the future, as LLM and OpenAI build ad product suites, we'll see new ad placement scenarios emerge.

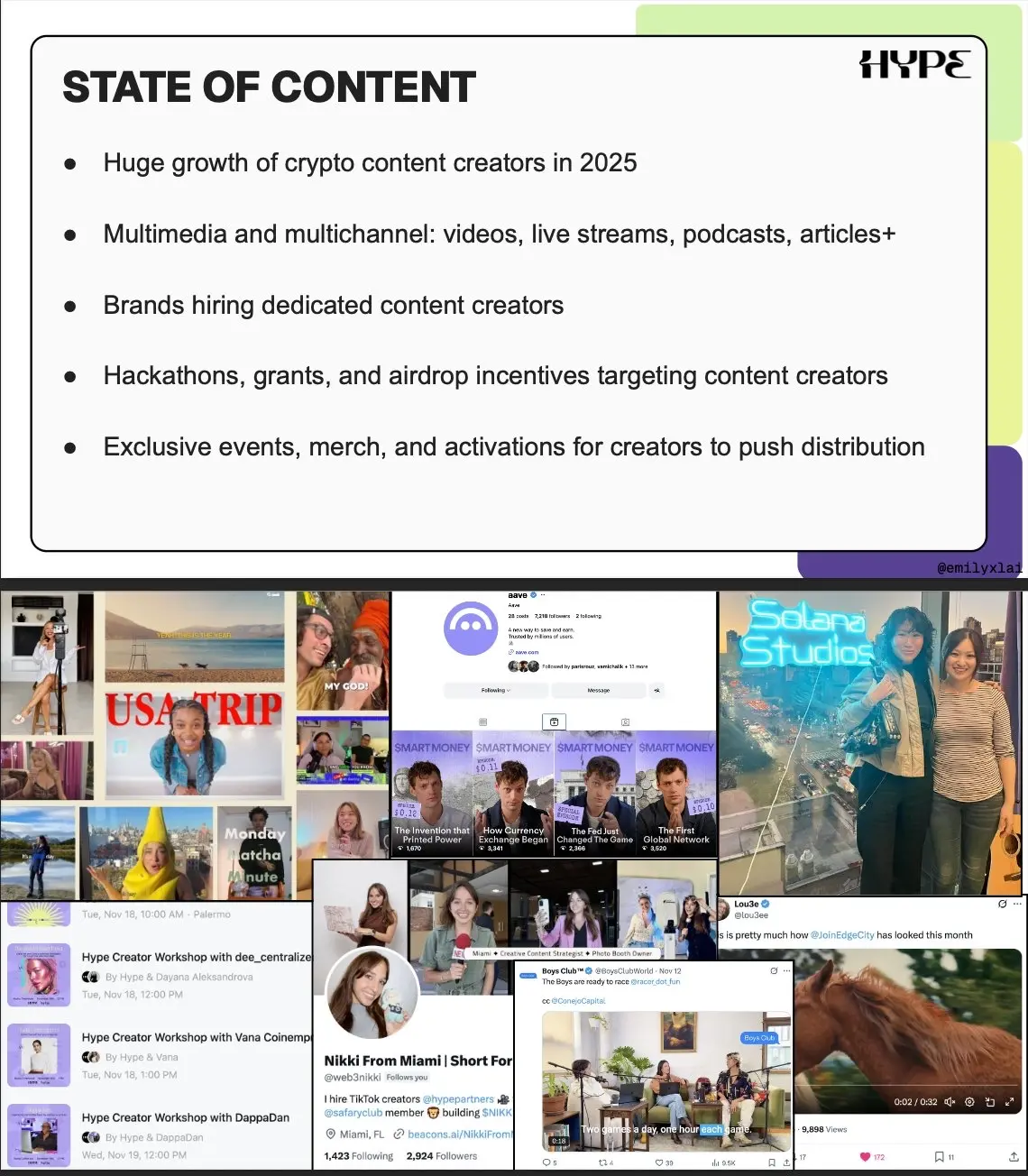

Content, Content, and More Content

This year, we've seen an explosive growth of content creators and video on social platforms, with timelines flooded by all kinds of content: from vloggers and short video creators to technical explainers, livestreams, and even cinematic storytelling...

Meanwhile, the InfoFi platform has driven the rise of "brand ambassador" roles, people who actively post ("yap") to promote projects in hopes of earning rewards. However, I believe this trend won't last—"yappers" are already on my OUT list.

Leaving the DevConnect venue last week, I joked that DJI's revenue must be soaring, as microphones and cameras were everywhere. We're in the season of content creators.

Some creators are freelancers making content for brands they love, like @coinempress and @DAppaDanDev. Brands are also hiring full-time content creators to make videos, vlogs, host Spaces, and even leverage creators' personal brands (like CT Leads @alexonchain). @dee_centralized is one of the leaders of the short video crypto wave.

Six weeks ago, I visited @solana's New York office and toured Solana Studio—a content space designed for founders and creators, where people like @bangerz and @jakeclaychain produce content.

We're also seeing brands hire actors, Hollywood-level studios, and photographers to produce high-quality content and ads. @aave has started ramping up content on Instagram (to warm up its retail mobile app—a smart strategy), while @ethereumfnd has brought in storytelling creators like @lou3ee.

Content formats are diversifying: beyond text and video, there are livestream series (like @boysclubworld), static series, podcasts, short video clips, 3D or AI announcement videos, etc. @OctantApp provides grants for creators, and I recently hosted a workshop on the psychological factors brands value in content creation.

At Hype (@hypepartners), we held 4 content creator workshops during DevConnect week and brought in @web3nikki in January to lead a new short video department. Content will continue to saturate; quality, depth, and production value will become more important, and reaching new users beyond CT is equally crucial.

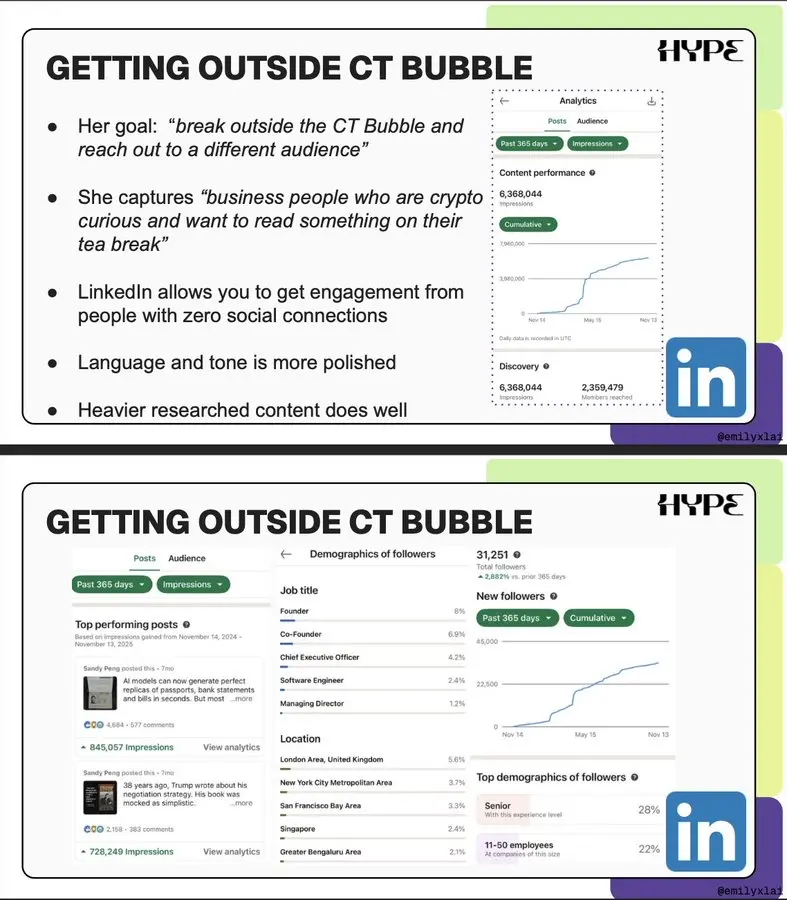

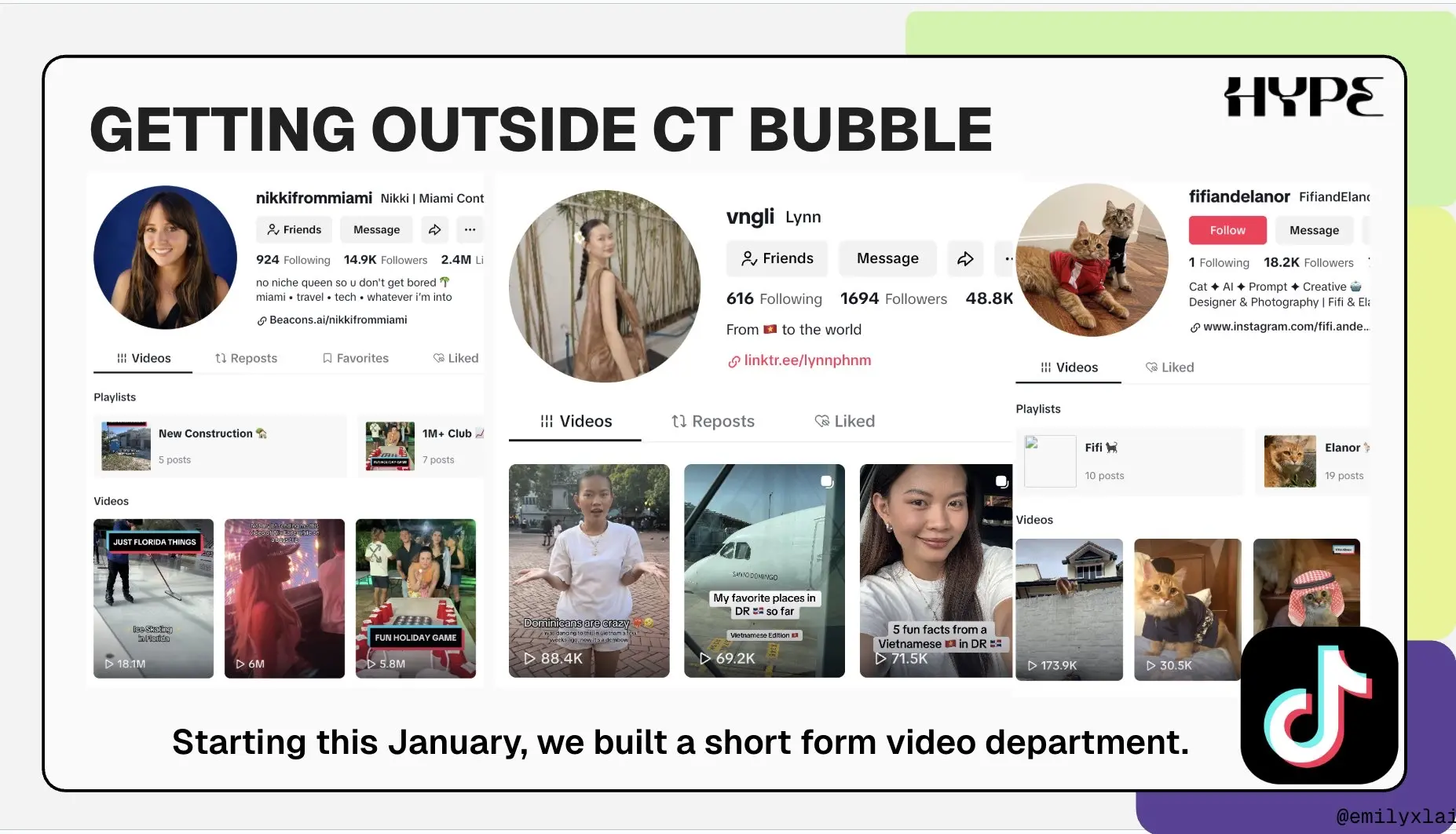

The World Beyond X

This year at Hype, we've explored (and re-explored) new channels, including YouTube, Reddit, AI SEO (like Perplexity, GPT), Instagram, and Whop. In my talk, I focused on LinkedIn and TikTok.

Take @Scroll_ZKP co-founder @sandypeng as an example: for those not active on LinkedIn, she posted consistently throughout 2025, growing from zero to 6.3 million impressions and 31,000 followers, and shared her strategy and data (first time publicly, thanks Sandy).

Sandy Peng (co-founder of Scroll)'s LinkedIn

In January, we noticed a clear increase in brand demand for channels like Instagram, YouTube, and TikTok, so we brought in @web3nikki to establish a short video department focused on brand growth and user acquisition, with a special focus on TikTok. The team is made up entirely of TikTok natives, familiar with the algorithm, skilled at creating viral content, and able to adapt content strategies to a crypto perspective.

Since the department was established, we've worked with 12 clients, accumulating a wealth of experience and insights.

Events Are Becoming More Immersive and Exclusive

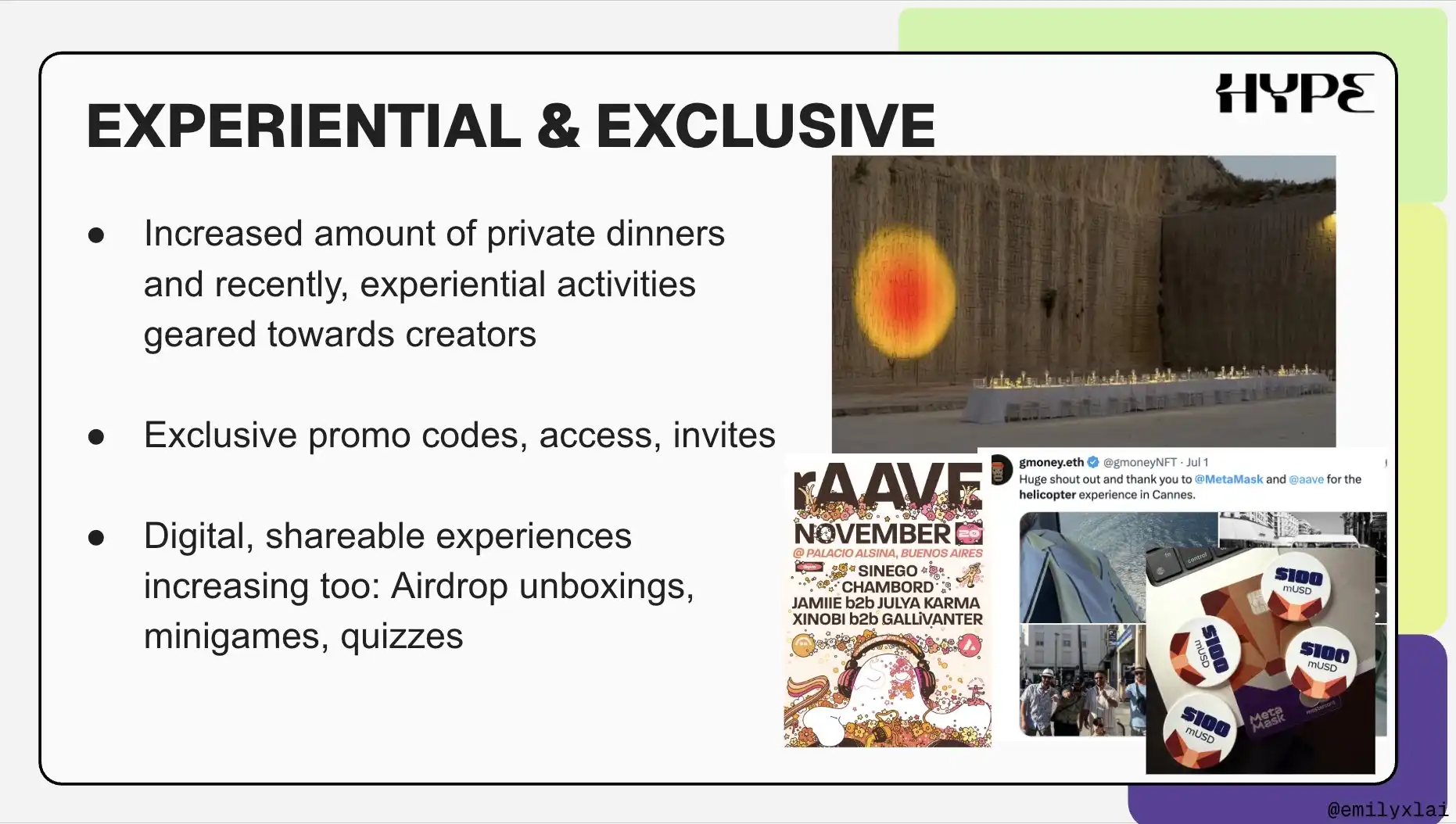

As crypto conference side events become heavily saturated (often over 500 in a single week), organizers are competing fiercely to attract participants. This trend extends to swag: higher quality, better design, and exclusive giveaways. This year, we've seen a significant increase in private dinners.

@metamask set a new standard at July's EthCC Cannes event: invite-only guests, taking KOLs and content creators on speedboats, helicopters, and planes.

@raave continues to set the standard for crypto music events, inviting world-class DJs and creating top-tier stage effects. Ticket access is tiered, exclusive, and released through a series of marketing campaigns.

This experience isn't limited to the real world—it extends to digital: airdrop unboxings, mini-games, Buzzfeed-style personality quizzes, and other shareable interactive experiences are on the rise. We're seeing more inspiration drawn from Web2 brand events, pop-up concepts, and influencer happenings brought into crypto.

Last week, we co-hosted a candlelight concert with @octantapp; you can see clips from the event here. Attendance was invite-only, as the venue couldn't accommodate all 20,000 people. If you'd like to join the next experience, contact @cryptokwueen or me.

Reshaping and Redesigning Incentive Mechanisms

This year, we've seen incentive campaigns shift from airdrops back to some new forms of privilege. Some incentives are positioned as perks:

"Being able to buy this token is a privilege in itself" (similar to NFT whitelists in 2021)

"Buy now and you'll get the privilege of a discounted purchase"

"Stake now to earn higher yields and/or points from multiple protocols"

"To get the most airdrops, discounts, or points, you must reach top-tier membership" (like airline and hotel loyalty tiers)

All of this reminds me of banks and Web2 fintech companies, which package product usage and access as a privilege. My Chase emails often say: "Congratulations! You are pre-qualified for mortgage refinancing."

In the future, we'll continue to see incentive programs evolve, increasingly resembling loyalty and status tier programs.

AI in Marketing and Operations

These are the AI trends I've seen in marketing, as well as our experience building an internal "context engine" at Hype.

In September, we established the Hype AI department, led by @antefex_moon (our VP of AI). For more details, see CEO @0xDannyHype's introduction.

We're testing AI extensively at every stage to improve work quality, research, operations, data measurement, and project management. This requires ongoing testing and iteration.

We've also launched a new service line: AI SEO / LLM SEO, which ensures your company appears in AI prompts, depending on whether you're in the right place in the training data. Web2 tools like Ahrefs and SEMrush have started offering AI visibility measurement. Meanwhile, OpenAI has officially announced it is exploring an ad platform, which will bring new ad placement scenarios and marketing strategies.

Other Predictions

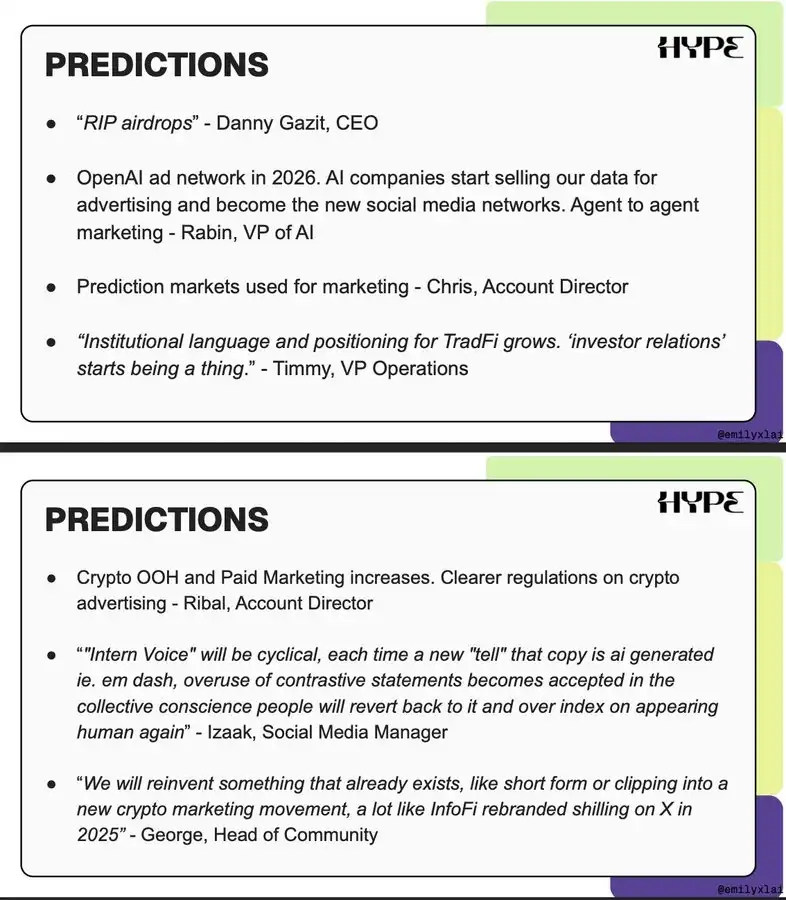

The above trends and observations have directly influenced some of the business and marketing decisions we've made at Hype. Before sharing my "stay ahead" framework, I collected predictions on crypto marketing from the Hype team. You can read perspectives from @0xdannyhype, @ChrisRuzArc, @groverGPT, @izaakonx, @Timmbo_Slice, and others:

How to Stay Ahead

Trend lifecycles are getting shorter and shorter, due to:

Weaker moats (for example, with AI, the internet, and tools, it's easier than ever to create content)

The crypto industry has a limited audience size

New companies emerge constantly, competing for attention every day

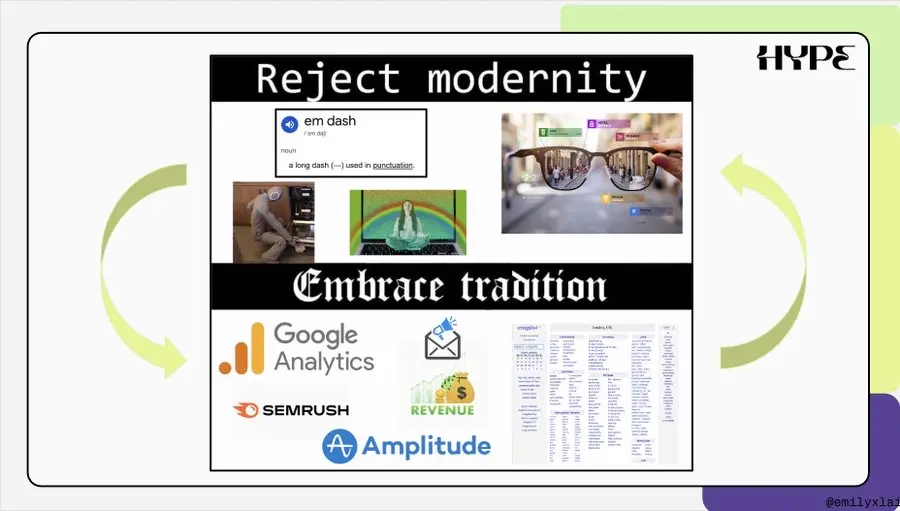

Marketing requires continuous innovation, testing, and experimentation. Teams that adopt new strategies first can leverage the "novelty effect" to capture brand awareness—until the strategy becomes saturated in the market. You can also retest old strategies and aesthetics to rekindle a sense of "freshness." It's a never-ending cycle.

When others turn left, you turn right; when everyone is turning left and right, you sit under a tree, enter a higher dimension, and explore untouched territory. Then repeat the process.

To stay ahead, you must: keep up with industry trends; draw inspiration from outside crypto; think from first principles (which requires brainstorming, deep thinking, and evaluation—not just copying others).

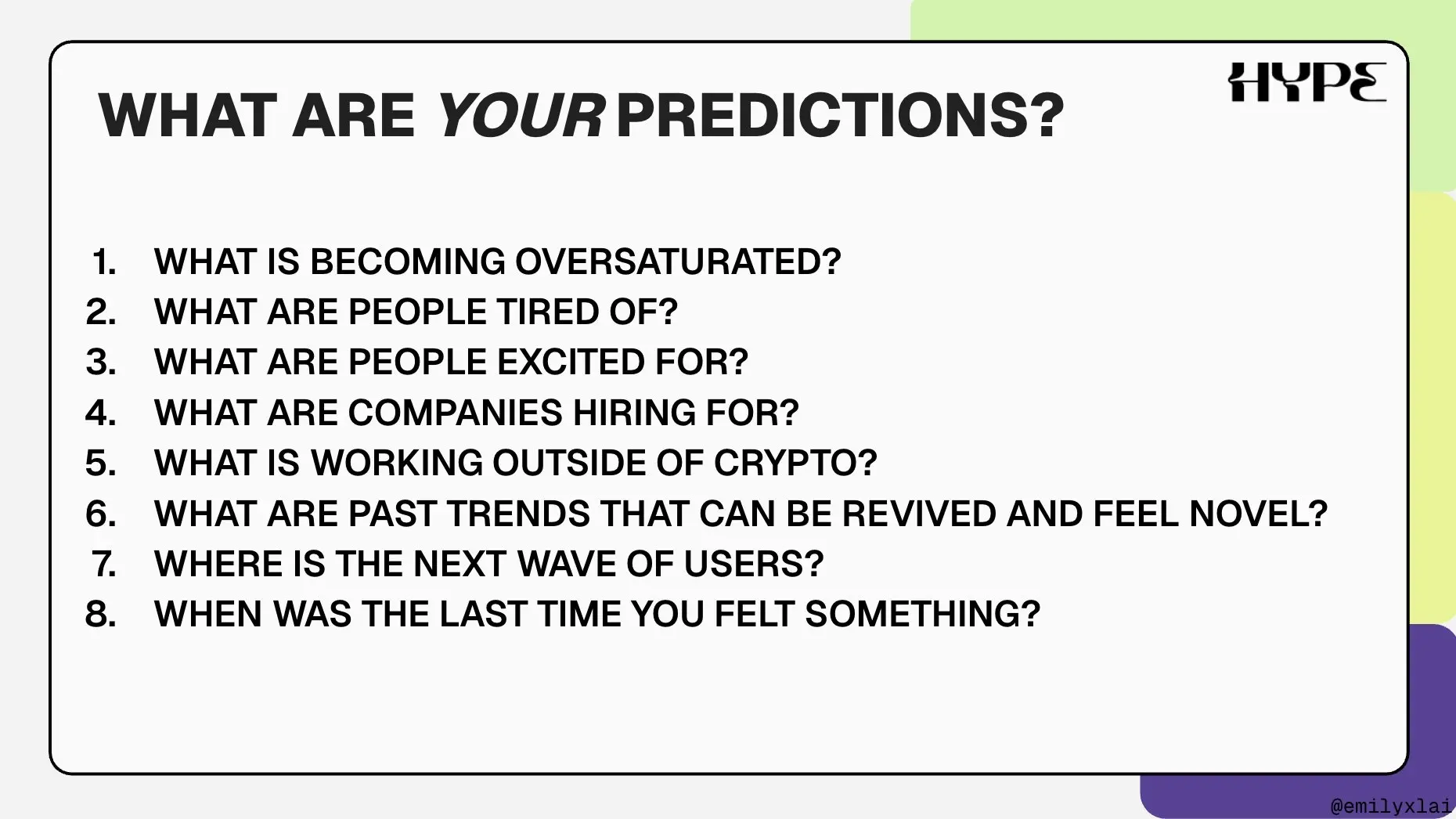

Some questions to help you define predictions and marketing bets include: Which trends will become obsolete in the next 6-12 months? Which strategies work in Web2 or other industries but haven't been applied in crypto? Which user behaviors or technological changes will reshape marketing?

Ultimately, you're betting on the future. And betting on the future means seeing the patterns and then imagining better possibilities.

Recommended Reading:

Rewriting the 2018 Playbook: Will the End of the US Government Shutdown = Bitcoin Price Surge?

1.1 billions USD in Stablecoins Evaporate: The Truth Behind the DeFi Domino Crash?

MMT Short Squeeze Review: A Carefully Designed Money Grab Game