Bitcoin STH Loss Transfers Fall 80% From Peak – What Comes Next?

Bitcoin has managed to reclaim the $90,000 level after days of intense volatility, but upward momentum remains limited as the market continues to battle uncertainty and fear. While bulls have regained some ground, selling pressure is still dominating sentiment, and speculation about the start of a new bear market continues to grow. Many analysts warn that the recent bounce may not be enough to shift the broader trend unless stronger demand returns.

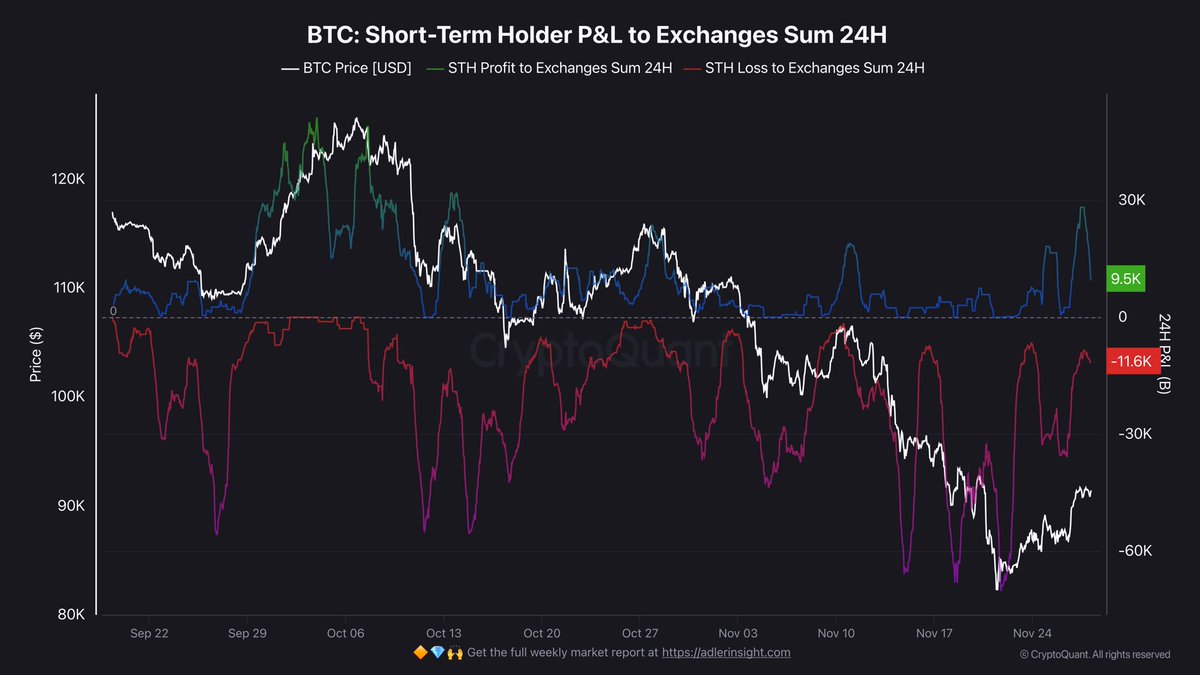

According to fresh data from Darkfost, short-term stress among investors has eased slightly. The amount of BTC sent to exchanges at a loss has dropped sharply, now sitting around 11,600 BTC—significantly lower than the extreme 67,000 BTC capitulation spike recorded on November 22nd. This decline suggests that panic-driven selling may be cooling off, giving the market a temporary moment of stabilization.

However, despite this improvement, Bitcoin still faces strong headwinds. Investors remain cautious, liquidity conditions are tight, and macro uncertainty continues to weigh on risk assets. For now, BTC must hold above the $90K region and show sustained strength to avoid renewed downside pressure. The coming sessions may determine whether this rebound marks the start of recovery—or just a pause before another leg lower.

Short-Term Holders Face a Critical Decision Point

Darkfost adds that the amount of BTC in profit being sent to exchanges by short-term holders remains relatively low at around 9,500 BTC. However, a slight increase has appeared as Bitcoin climbed back above $90K, showing that some STHs have begun testing the market to secure small gains or reduce their exposure.

This subtle shift highlights a growing tension among recent buyers, who must choose between waiting for a full return to break even or selling now to minimize further losses.

This situation creates a delicate environment. Even though selling pressure has eased, STHs remain highly sensitive to small price movements, and their behavior often dictates short-term market direction. The past few days have been unusually calm compared to the violent capitulation seen earlier in the month, and that calmness is actually constructive. It suggests that panic has temporarily subsided and the market is trying to find balance.

What becomes critical now is monitoring how STHs react as Bitcoin approaches their realized price. If they hold and confidence increases, BTC could gain enough stability to push higher. If they sell aggressively, renewed downside pressure could quickly return. The next move from this cohort will likely set the tone for the coming weeks.

Bitcoin Attempts Recovery But Faces Heavy Overhead Resistance

Bitcoin’s daily chart shows the asset attempting a recovery after reaching a capitulation low near $80K, but the structure remains fragile. Price has reclaimed the $90K area, yet momentum is limited as BTC trades below the 50-day and 100-day moving averages—both of which continue sloping downward, signaling sustained bearish pressure.

The 200-day moving average sits higher, reinforcing the broader downtrend that has formed since early October’s $126K peak.

Recent candles reflect a hesitant rebound: upward wicks show sellers defending every push toward $92K–$94K, while the tight body ranges highlight indecision. Volume has cooled significantly compared with the panic-driven sell-off earlier in November, suggesting that forced selling has eased but strong buy-side conviction is still missing.

Structurally, BTC remains below key resistance clusters formed during its previous consolidation. Reclaiming these zones will be essential for invalidating the bearish trend. Until then, every bounce risks becoming a lower high within a broader corrective structure.

On the downside, the $85K–$87K region remains the most important support. A breakdown below it could reopen the path toward deeper corrective targets. For now, Bitcoin is attempting to stabilize, but bulls must reclaim higher levels soon to shift market sentiment and avoid renewed downside pressure.

Featured image from ChatGPT, chart from TradingView.com