Crypto News: What to Expect in Crypto Market Next Few Days?

The crypto news is sitting at a crossroads again. After weeks of steady decline, the total crypto market capitalization has found a temporary footing around $3.05 trillion, with signs of a mild rebound. But with key events like the Fed’s end to Quantitative Tightening on Dec 1, Ethereum’s Fusaka upgrade, and the FOMC rate decision looming, traders are watching the charts with extra caution. The question now is simple—can this recovery hold, or will macro pressure drag the crypto market back below $3 trillion?

Crypto News: Crypto Market Pauses Near a Critical Zone

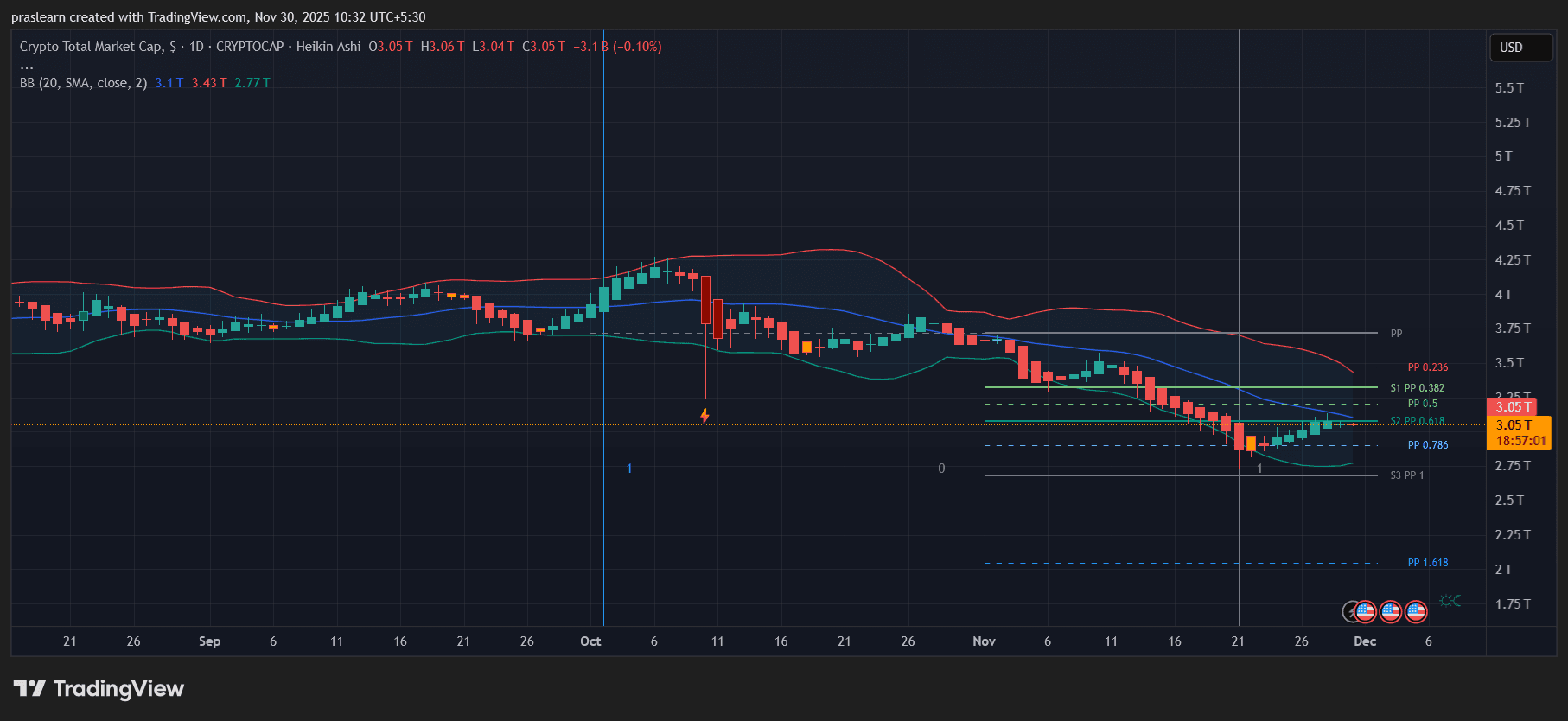

Total Crypto Market Cap: TradingView

Total Crypto Market Cap: TradingView The daily chart of the total crypto market cap shows a clear downtrend since mid-October, with price hugging the lower Bollinger Band before flattening near the $3.0T support level. The recent Heikin Ashi candles have turned lighter in color, suggesting reduced bearish momentum.

The market is attempting to break above the mid-Bollinger Band (around $3.1T), which also aligns with the Fibonacci 0.382 retracement zone—a typical reaction point during bear market rallies. If bulls manage to push beyond $3.2T, the next target would be around $3.4T, where heavy resistance and the 50-day moving average intersect.

On the downside, failure to hold above $3.0T could expose the market to another leg lower toward $2.77T (Fib 0.786) or even the psychological $2.5T area. In short, the current structure signals early recovery, but confirmation requires stronger volume and a clear daily close above $3.15T.

Crypto Market: Fed Ends Quantitative Tightening (Dec 1)

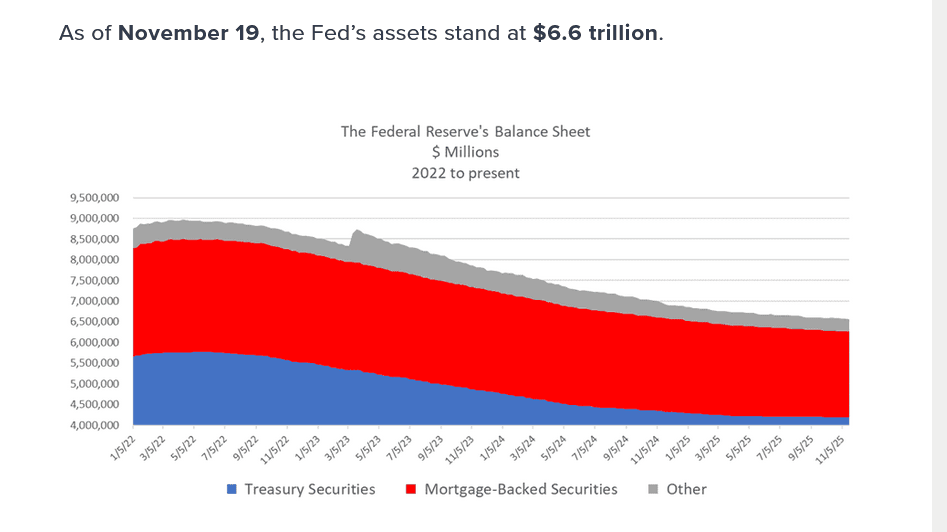

Image Source: The American Action Forum

Image Source: The American Action Forum The first big macro trigger comes on December 1, when the Federal Reserve is expected to end its quantitative tightening phase . Historically, such liquidity injections have acted as a tailwind for Bitcoin and the broader crypto sector.

If the Fed indeed pauses balance sheet reductions, bond yields may ease, reducing the appeal of traditional assets and potentially reviving risk appetite. A clear confirmation of easing could lift total crypto market cap by 5–8% within days, possibly pushing it toward the $3.25T–$3.4T band. However, any ambiguity from the Fed could lead to short-term volatility spikes.

Ethereum Fusaka Upgrade (Dec 3): Catalyst for Layer-2 Momentum

Ethereum’s Fusaka upgrade , scheduled for December 3, introduces PeerDAS, a major leap for data availability and cost reduction for validators. This technical advancement could attract more developers to Ethereum, boosting confidence in Layer-2 ecosystems like Arbitrum and Optimism.

Historically, ETH upgrades tend to trigger short bursts of volatility, followed by a sustained price adjustment period. Expect heightened movement in ETH pairs around the event—if ETH strengthens , the total crypto market cap could benefit from broader sector rotation into smart-contract tokens.

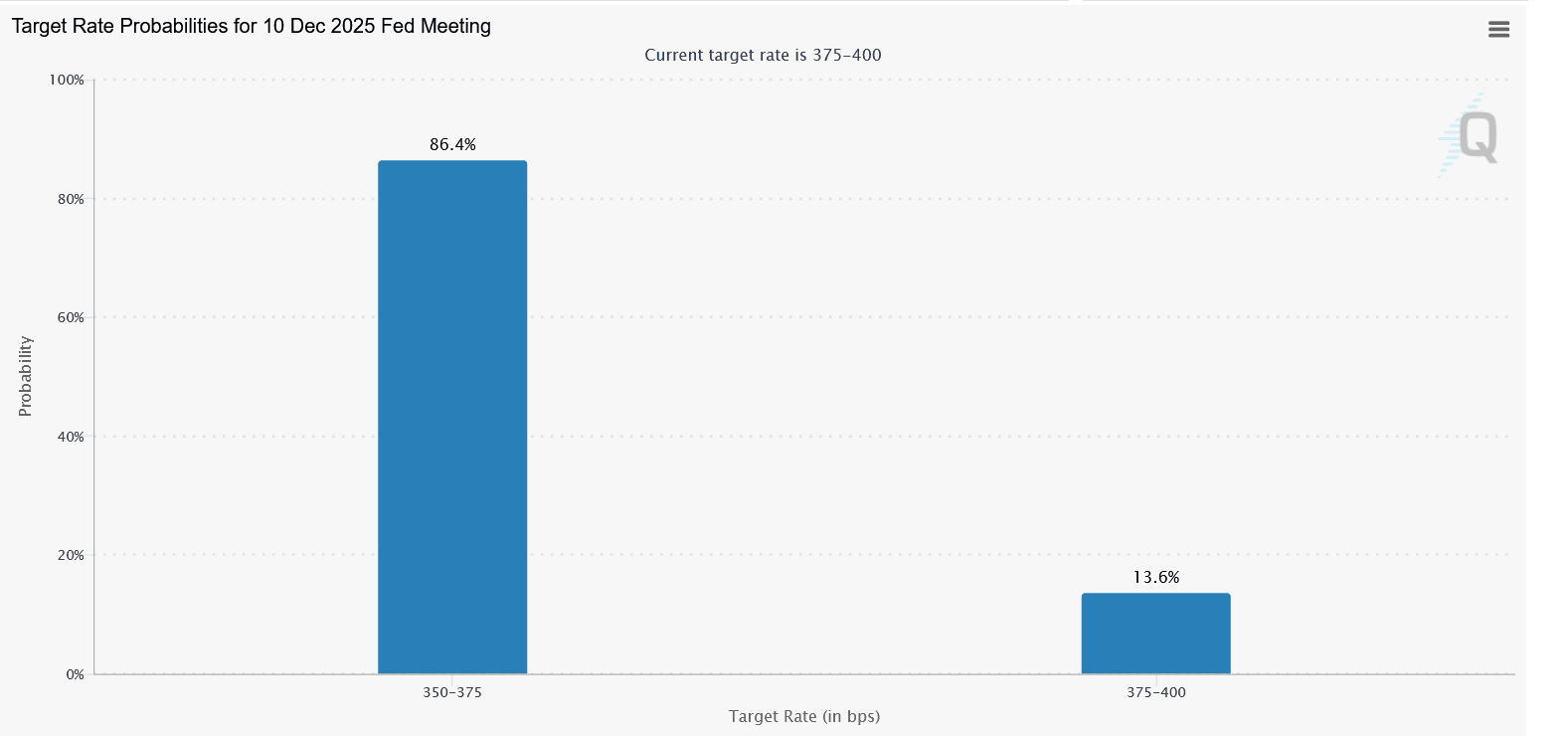

FOMC Rate Decision (Dec 10): The Real Market Shaker

The December 10 FOMC meeting is the pivotal event that could decide crypto’s December trend. Markets currently price in an 86% chance of a rate cut , which, if confirmed, may ignite a sharp rally across Bitcoin, Ethereum, and large-cap altcoins.

However, if the Fed maintains a hawkish tone or delays easing due to inflation persistence, expect renewed selling pressure. Crypto’s current 0.81 correlation with the Nasdaq implies that tech and crypto will likely move in tandem. A dovish pivot could see the market regain the $3.5T mark swiftly, while a hawkish surprise might drag it back under $2.9T.

Year-End Regulation Crypto News Watch: MiCA and Institutional Risk

The EU’s MiCA transitional regime expiry on December 31 marks the beginning of a stricter regulatory era. Exchanges and custodians failing to comply may exit key European markets, tightening short-term liquidity but improving long-term investor trust.

Meanwhile, the MSCI Crypto Treasuries ruling (January 15) could create tremors among institutional holders. If firms like MicroStrategy are reclassified as “funds,” forced index fund sell-offs could dampen Bitcoin’s price temporarily, though such dips may become strong accumulation opportunities for retail investors.

Crypto Market Outlook: Short-Term Bounce, Medium-Term Uncertainty

The total crypto market cap appears to be forming a temporary bottom near the $3T zone. Technical oscillators show oversold readings, while macro liquidity signals are improving. The near-term outlook favors a relief rally toward $3.3T–$3.4T, especially if the Fed confirms policy easing.

However, macro uncertainty and upcoming regulations mean this rebound could face resistance in mid-December. Traders should watch the $3.15T breakout zone closely—above it, sentiment may flip bullish again; below it, the market risks sliding into another consolidation phase through early January.

Conclusion

Crypto market is entering a decisive stretch where both monetary policy and blockchain upgrades will dictate sentiment. If liquidity flows return and Ethereum’s upgrade goes smoothly, the overall market could regain its momentum heading into 2026. But for now, the trend remains fragile—one hawkish sentence from Powell could undo weeks of buildup.

In short, the next two weeks are about patience and positioning. The charts hint at recovery, but confirmation still depends on how global monetary and regulatory winds blow in December.