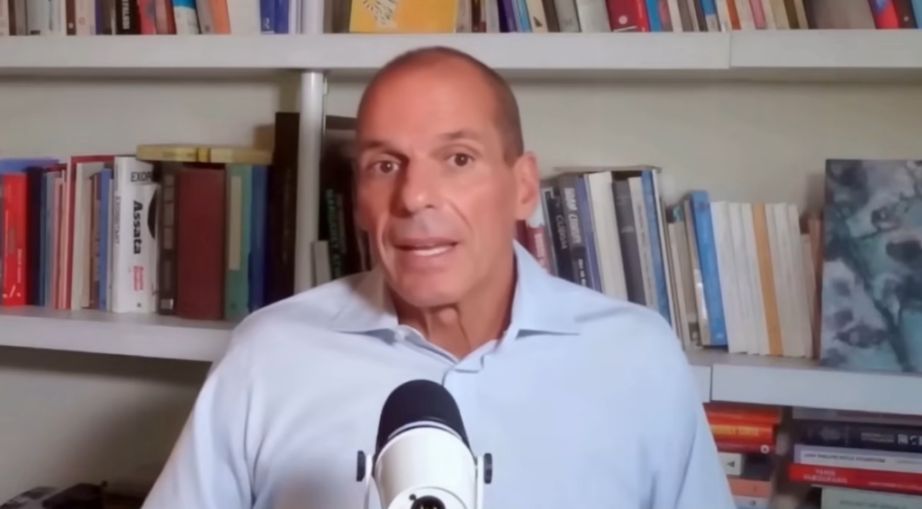

Every country is heavily in debt, so who are the creditors? Former Greek Finance Minister: "It's all of us."

Former Greek Finance Minister Varoufakis reveals that the true creditors of national debt are ourselves—pension accounts, savings, and even central banks, making everyone a "lender."

Written by: Zhang Yaqi

Source: Wallstreetcn

Currently, every major country on Earth is deeply mired in debt, raising the century-old question: "If everyone is in debt, then who is doing the lending?" Recently, former Greek Finance Minister Yanis Varoufakis delved into this complex and fragile global debt system on a podcast, warning that the system is facing an unprecedented risk of collapse.

Yanis Varoufakis stated that the lenders of government debt are far from outsiders, but rather an internal closed-loop system within each country. Taking the United States as an example, the largest creditors of the government are the Federal Reserve and internal government trust funds such as Social Security. The deeper secret is that ordinary citizens, through their pensions and savings, hold a large amount of government bonds, making them the largest lenders.

For foreign countries like Japan, purchasing U.S. Treasuries is a tool for recycling trade surpluses and maintaining the stability of their own currency. Therefore, in wealthy countries, government bonds are actually the safest assets that creditors compete to hold.

Yanis Varoufakis warns that the system will fall into crisis when confidence collapses, and there are historical precedents. Although conventional wisdom holds that major economies will not default, the accumulation of high global debt, high interest rates, political polarization, and risks such as climate change may lead to a loss of confidence in the system, triggering disaster.

Yanis Varoufakis summarized the puzzle of "who is the creditor": the answer is all of us. Through pensions, banks, central banks, and trade surpluses, countries collectively lend to each other, forming a vast and interconnected global debt system. This system brings prosperity and stability, but is also extremely unstable as debt levels reach unprecedented heights.

The question is not whether it can continue indefinitely, but whether the adjustment will be gradual or erupt suddenly in the form of a crisis. He warns that the margin for error is narrowing. Although no one can predict the future, structural issues such as the disproportionate benefit to the wealthy and high interest payments by poor countries cannot last forever, and no one truly controls this complex system with its own logic.

Below is a summary of the podcast highlights:

- In wealthy countries, citizens are both borrowers (benefiting from government spending) and lenders, as their savings, pensions, and insurance policies are all invested in government bonds.

- U.S. government debt is not a burden imposed on unwilling creditors, but an asset they want to own.

- The U.S. is expected to pay $1 trillion in interest in the 2025 fiscal year.

- This is one of the great ironies of modern monetary policy: we create money to save the economy, but this money disproportionately benefits those who are already wealthy. The system works, but it exacerbates inequality.

- Paradoxically, the world needs government debt.

- Historically, crises often erupt when confidence evaporates; when lenders suddenly decide not to trust borrowers, a crisis occurs.

- Every country has debt, so who is the creditor? The answer is all of us. Through our pension funds, banks, insurance policies, and savings accounts, through our governments' central banks, and through the money created and recycled via trade surpluses to buy bonds, we collectively lend to ourselves.

- The question is not whether this system can continue indefinitely—it cannot, nothing in history lasts forever. The question is how it will adjust.

Below is the podcast transcript:

Global Debt Crisis: The "Mysterious" Lenders Are Ourselves

Yanis Varoufakis:

I want to talk to you about something that sounds like a riddle, or even a magic trick. Every major country on Earth is deeply mired in debt. The U.S. owes $38 trillion, Japan's debt is equivalent to 230% of its entire economy. The UK, France, Germany—they're all running deficits. Yet somehow, the world keeps turning, money keeps flowing, and markets keep functioning.

This is the riddle that keeps people up at night: If everyone is in debt, who is doing the lending? Where does all this money come from? When you borrow money from a bank, the bank owns that money—it's a perfectly reasonable question. It comes from somewhere: depositors, investors, bank capital, funding pools, and borrowers. Simple. But when we scale this up to the national level, something very strange happens—the math no longer makes intuitive sense. Let me explain what actually happens, because the answer is far more interesting than most people realize. I must warn you, once you understand how this system really works, you'll never look at money the same way again.

Let's start with the United States, because it's the easiest case to examine. As of October 2, 2025, U.S. federal debt reached $38 trillion. That's not a typo—$38 trillion. To give you a sense of scale, if you spent $1 million every day, it would take you over 100,000 years to spend that much money.

Now, who holds this debt? Who are these mysterious lenders? The first answer may surprise you: Americans themselves. The single largest holder of U.S. government debt is actually the U.S. central bank—the Federal Reserve. They hold about $6.7 trillion in U.S. Treasuries. Think about that for a moment: the U.S. government owes money to the U.S. government bank. But that's just the beginning.

Another $7 trillion exists in what we call "intragovernmental holdings," which is money the government owes itself. The Social Security Trust Fund holds $2.8 trillion in U.S. Treasuries, the Military Retirement Fund holds $1.6 trillion, and Medicare holds a large portion as well. So, the government borrows from the Social Security fund to finance other projects, promising to pay it back later. It's like taking money from your left pocket to pay your right pocket's debt. So far, the U.S. actually owes itself about $13 trillion, which is already more than a third of the total debt.

The question of "who is the lender" gets weird, doesn't it? But let's continue. The next major category is private domestic investors—ordinary Americans participating through various channels. Mutual funds hold about $3.7 trillion, state and local governments own $1.7 trillion, and there are also banks, insurance companies, pension funds, etc. U.S. private investors collectively hold about $24 trillion in U.S. Treasuries.

Now, here's where it gets really interesting. These pension funds and mutual funds are funded by American workers, retirement accounts, and ordinary people saving for the future. So, in a very real sense, the U.S. government is borrowing from its own citizens.

Let me tell you a story about how this works in practice. Imagine a schoolteacher in California, 55 years old, who has taught for 30 years. Every month, a portion of her salary goes into her pension fund. That pension fund needs to invest the money somewhere safe, somewhere that reliably generates returns so she can enjoy a secure retirement. What could be safer than lending to the U.S. government? So her pension fund buys government bonds. That teacher might also be worried about the national debt. She watches the news, sees those scary numbers, and is right to be concerned. But here's the twist: she's one of the lenders. Her retirement depends on the government continuing to borrow and pay interest on those bonds. If the U.S. suddenly paid off all its debt tomorrow, her pension fund would lose one of its safest and most reliable investments.

This is the first major secret of government debt. In wealthy countries, citizens are both borrowers (benefiting from government spending) and lenders, because their savings, pensions, and insurance policies are all invested in government bonds.

Now, let's talk about the next category: foreign investors. This is what most people imagine when they think about who holds U.S. debt. Japan owns $1.13 trillion, the UK owns $723 billion. Foreign investors, including governments and private entities, collectively hold about $8.5 trillion in U.S. Treasuries, about 30% of the publicly held portion.

But what's interesting about foreign holdings is: why do other countries buy U.S. Treasuries? Let's take Japan as an example. Japan is the world's third-largest economy. They export cars, electronics, and machinery to the U.S., and Americans buy these products with dollars, so Japanese companies earn a lot of dollars. Now what? These companies need to convert dollars into yen to pay domestic employees and suppliers. But if they all try to convert dollars at once, the yen will appreciate sharply, making Japanese exports more expensive and less competitive.

So what does Japan do? The Bank of Japan buys these dollars and invests them in U.S. Treasuries. This is a way to recycle trade surpluses. Think of it this way: the U.S. buys physical goods from Japan, like Sony TVs and Toyota cars; Japan uses those dollars to buy U.S. financial assets, namely U.S. Treasuries. The money circulates, and the debt is just an accounting record of this circulation.

This leads to a crucial point for much of the world: U.S. government debt is not a burden imposed on unwilling creditors, but an asset they want to own. U.S. Treasuries are considered the world's safest financial asset. When uncertainty strikes—war, pandemics, financial crises—money floods into U.S. Treasuries. This is called a "flight to safety."

But I've been focusing on the U.S. What about the rest of the world? Because this is a global phenomenon. Global public debt currently stands at $111 trillion, accounting for 95% of global GDP. In just one year, debt grew by $8 trillion. Japan may be the most extreme example. Japanese government debt is 230% of GDP. If Japan were a person, that would be like earning £50,000 a year but owing £115,000—a state of bankruptcy. Yet Japan keeps functioning. Japanese government bond yields are close to zero, sometimes even negative. Why? Because Japan's debt is almost entirely held domestically. Japanese banks, pension funds, insurance companies, and households hold 90% of Japanese government debt.

There's a psychological factor here. Japanese people are known for their high savings rate; they diligently save money. These savings are invested in government bonds because they are seen as the safest store of wealth. The government uses these borrowed funds for schools, hospitals, infrastructure, and pensions, benefiting the very citizens whose savings fund the debt, creating a closed loop.

Mechanisms and Inequality: QE, Trillion-Dollar Interest, and the Global Debt Predicament

Now let's explore how it works: Quantitative Easing (QE).

Quantitative Easing essentially means that central banks create money out of thin air by typing numbers into a computer, then use this newly created money to buy government bonds. The Federal Reserve, Bank of England, European Central Bank, and Bank of Japan don't need to raise funds elsewhere to lend to their governments—they create money by increasing the numbers in accounts. This money didn't exist before; now it does. During the 2008 and 2009 financial crisis, the Federal Reserve created about $3.5 trillion this way. During the COVID-19 pandemic, they created another massive sum.

Before you think this is some elaborate scam, let me explain why central banks do this and how it's supposed to work. In times of crisis, like financial crashes or pandemics, the economy grinds to a halt. People stop spending out of fear, businesses stop investing due to lack of demand, and banks stop lending out of fear of defaults, creating a vicious cycle. Less spending means less income, which leads to even less spending. At this point, the government needs to step in—building hospitals, issuing stimulus checks, bailing out failing banks, whatever it takes. But the government also needs to borrow massively to do this. In abnormal times, there may not be enough willing lenders at reasonable interest rates. So, the central bank steps in, creates money, and buys government bonds to keep interest rates low and ensure the government can borrow what it needs.

In theory, this newly created money flows into the economy, encouraging borrowing and spending, and helps end the recession. Once the economy recovers, the central bank can reverse the process, selling those bonds back to the market and withdrawing the money, returning everything to normal.

However, reality is more complicated. The first round of QE after the financial crisis seemed to work well, preventing a total systemic collapse. But at the same time, asset prices soared, including stocks and real estate. That's because all the new money ended up in the hands of banks and financial institutions. They didn't necessarily lend it to small businesses or homebuyers, but used it to buy stocks, bonds, and property. As a result, the wealthy, who own most financial assets, became even wealthier.

Research by the Bank of England estimates that QE increased stock and bond prices by about 20%. But behind this, the wealthiest 5% of UK households saw their average wealth increase by about £128,000, while households with few financial assets benefited little. This is one of the great ironies of modern monetary policy: we create money to save the economy, but this money disproportionately benefits those who are already wealthy. The system works, but it exacerbates inequality.

Now, let's talk about the cost of all this debt, because it's not free—it accrues interest. The U.S. is expected to pay $1 trillion in interest in the 2025 fiscal year. That's right, just the interest payments amount to $1 trillion, more than the country's entire military spending. It's the second-largest item in the federal budget after Social Security, and the number is rising rapidly. Interest payments have nearly doubled in three years, from $497 billion in 2022 to $909 billion in 2024. By 2035, interest payments are expected to reach $1.8 trillion per year. Over the next decade, the U.S. government will spend $13.8 trillion on interest alone—money not spent on schools, roads, healthcare, or defense, just interest.

Think about what this means: every dollar spent on interest is a dollar not spent elsewhere. It's not used to build infrastructure, fund research, or help the poor—it's just paid to bondholders as interest. This is the current math: as debt increases, interest payments increase; as interest payments increase, deficits increase; as deficits increase, more borrowing is needed. It's a feedback loop. The Congressional Budget Office projects that by 2034, interest costs will consume about 4% of U.S. GDP and 22% of total federal revenue, meaning that more than one out of every five tax dollars will go purely to interest payments.

But the U.S. is not the only country in this predicament. Across the OECD, the club of wealthy nations, interest payments now average 3.3% of GDP, more than these governments spend on defense. More than 3.4 billion people live in countries where government debt interest payments exceed spending on education or healthcare. In some countries, governments pay more to bondholders than they spend educating children or treating patients.

For developing countries, the situation is even more severe. Poor countries paid a record $96 billion to service external debt. In 2023, their interest costs reached $34.6 billion, four times what they were a decade ago. In some countries, interest payments alone account for 38% of export income. This money could have been used to modernize their armies, build infrastructure, or educate their people, but instead it flows to foreign creditors as interest. Sixty-one developing countries now spend 10% or more of government revenue on interest payments, and many are in distress, spending more on servicing existing debt than they receive from new loans. It's like drowning—paying off your mortgage while watching your house sink into the sea.

So why don't countries just default and refuse to pay? Of course, defaults do happen. Argentina has defaulted nine times in its history, Russia defaulted in 1998, and Greece nearly defaulted in 2010. But the consequences of default are disastrous: being shut out of global credit markets, currency collapse, imports becoming unaffordable, pensioners losing their savings. No government chooses to default unless it has no other choice.

For major economies like the U.S., UK, Japan, and the European powers, default is unthinkable. These countries borrow in their own currency and can always print more money to repay. The problem is not the ability to pay, but inflation—printing too much money devalues the currency, which is another kind of disaster.

The Four Pillars Sustaining the Global Debt System and Collapse Risks

This raises a question: what exactly keeps this system running?

The first reason is demographics and savings. Populations in wealthy countries are aging, people are living longer, and need a safe place to store retirement wealth. Government bonds meet this need. As long as people need safe assets, there will be demand for government debt.

The second reason is the structure of the global economy. We live in a world of massive trade imbalances. Some countries have huge trade surpluses, exporting far more than they import; others run huge deficits. Those with surpluses often accumulate financial claims on deficit countries in the form of government bonds. As long as these imbalances persist, so will the debt.

The third reason is monetary policy itself. Central banks use government bonds as policy tools—buying bonds to inject money into the economy, selling bonds to withdraw money. Government debt is the lubricant of monetary policy; central banks need a large supply of government bonds to function properly.

The fourth reason is that in modern economies, safe assets are valuable precisely because they are scarce. In a world full of risk, safety commands a premium. Government bonds from stable countries provide that safety. If governments actually paid off all their debt, there would be a shortage of safe assets. Pension funds, insurance companies, and banks would all struggle to find safe investments. Paradoxically, the world needs government debt.

However, there's one thing that keeps me up at night and should concern us all: this system is stable right up until it collapses. Throughout history, crises often erupt when confidence evaporates—when lenders suddenly decide not to trust borrowers, a crisis occurs. This happened to Greece in 2010, during the 1997 Asian financial crisis, and in many Latin American countries in the 1980s. The pattern is always the same: everything seems normal for years, then suddenly some event or loss of confidence triggers panic, investors demand higher interest rates, governments can't pay, and a crisis erupts.

Could this happen to a major economy? Could it happen to the U.S. or Japan? Conventional wisdom says no, because these countries control their own currencies, have deep financial markets, and are "too big to fail" on a global scale. But conventional wisdom has been wrong before. In 2007, experts said nationwide house prices would never fall—but they did. In 2010, experts said the euro was unbreakable—but it nearly collapsed. In 2019, no one predicted a global pandemic would shut down the world economy for two years.

Risks are accumulating. Global debt is at unprecedented peacetime levels. After years of near-zero interest rates, rates have risen sharply, making debt servicing more expensive. Political polarization is intensifying in many countries, making coherent fiscal policy harder to achieve. Climate change will require massive investment, which must be raised at already historically high debt levels. Aging populations mean fewer workers supporting more retirees, putting pressure on government budgets.

Finally, there's the issue of trust. The entire system depends on confidence in three things: that governments will honor their payment promises, that money will retain its value, and that inflation will remain moderate. If that confidence collapses, the whole system falls apart.

Who Is the Creditor? We All Are

Back to our original question: every country has debt, so who is the creditor? The answer is all of us. Through our pension funds, banks, insurance policies, and savings accounts, through our governments' central banks, and through the money created and recycled via trade surpluses to buy bonds, we collectively lend to ourselves. Debt is the claim of one part of the global economy on another—a vast and interconnected web of obligations.

This system has brought enormous prosperity, funding infrastructure, research, education, and healthcare; it allows governments to respond to crises without being constrained by tax revenues; it creates financial assets that support retirement and provide stability. But it is also extremely unstable, especially as debt levels reach unprecedented heights. We are in uncharted territory—never before in peacetime have governments borrowed so much, nor have interest payments consumed such a large share of budgets.

The question is not whether this system can continue indefinitely—it cannot, nothing in history lasts forever. The question is how it will adjust. Will the adjustment be gradual? Will governments slowly control deficits, and will economic growth outpace debt accumulation? Or will it erupt suddenly in a crisis, forcing all painful changes to happen at once?

I don't have a crystal ball—no one does. But I can tell you: the longer this goes on, the narrower the path between these two possibilities becomes, and the margin for error is shrinking. We've built a global debt system where everyone owes everyone else, central banks create money to buy government bonds, and today's spending is paid for by tomorrow's taxpayers. In such a place, the rich disproportionately benefit from policies meant to help everyone, while poor countries pay heavy interest to creditors in wealthy countries. This cannot go on forever—we will have to make choices. The only question is what to do, when to do it, and whether we can manage the transition wisely or let it spiral out of control.

When everyone is in debt, the riddle of "who is lending" is not really a riddle at all—it's a mirror. When we ask who the lender is, we're really asking: who is involved? Where is this system headed? Where will it take us? And the unsettling truth is that no one is truly in control. The system has its own logic and momentum. We've built something complex, powerful, and fragile—and we're all trying to steer it.