Bitcoin ( BTC ) experienced a sharp pullback in early Asian trading on Monday, dropping to $85,500 amid increasing expectations of a December rate hike by the Bank of Japan (BOJ).

Key takeaways:

Bitcoin dropped 5% to almost $85,000 in a marketwide correction, liquidating $656 million in longs.

Mounting expectations for a BOJ rate hike at its Dec. 18-19 meeting weighed on the BTC price.

Bitcoin’s bear flag projects a potential drop to $67,700.

BTC/USD hourly chart. Source: Cointelegraph/ TradingView

BTC/USD hourly chart. Source: Cointelegraph/ TradingView Bitcoin wipes out liquidity in tumble

BTC price fell as low as $85,616 on Monday, down 5.5% in the past 24 hours , amid a broader market retreat.

This extended the drawdown from the Oct. 6 all-time high of $126,000 to 32% and was accompanied by massive liquidations across the derivatives market.

Related: Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?

More than $564.3 million in long positions was liquidated, with Bitcoin accounting for $188.5 million of that. Ether ( ETH ) followed with $139.6 million in long liquidations.

Across the board, a total of $641 million was wiped out of the market in short and long positions, as shown in the figure below.

Crypto liquidations (screenshot). Source: CoinGlass

Crypto liquidations (screenshot). Source: CoinGlass Several analysts attribute the downside to surging expectations for a BOJ rate hike at its Dec. 18-19 meeting. This potential tightening — Japan’s first since January — has amplified concerns about unwinding the massive yen carry trade , pressuring risk assets such as cryptocurrencies.

“$BTC dumped cause BOJ put Dec rate hike in play,” said BitMEX co-founder Arthur Hayes in an X post on Monday, adding that a USD/JPY rate of between 155 and 160 “makes BOJ hawkish.”

BTC/JPY chart. Source: Arthur Hayes

BTC/JPY chart. Source: Arthur Hayes Japanese yields are spiking with the two-year at its highest level since 2008. The yen is also surging, said co-founder and CEO of Coinbureau Nic in his latest post on X.

As a result, “bond investors place a 76% chance of a BoJ rate hike on Dec. 19,” Nic wrote, adding:

“An increase in Japanese base rates and strengthening of Yen leads to an unwind of the carry trade (borrowing in Yen, buying risk assets). ”

Japanese two-year yields. Source: Nick

Japanese two-year yields. Source: Nick A Reuters poll showed that 53% of economists expect a hike , up from prior months, driven by risks of imported inflation and fading political pressure for easing. Polymarket bettors now project a 52% chance of a 25 bps increase at the Dec. 19 meeting.

A stronger yen from higher rates makes carry trades costlier, prompting investors to unwind positions en masse. This forces the sale of risk assets, as seen in August 2024, when a surprise BOJ hike triggered a 20% BTC price crash to $49,000 and $1.7 billion in liquidations.

How low can Bitcoin price go?

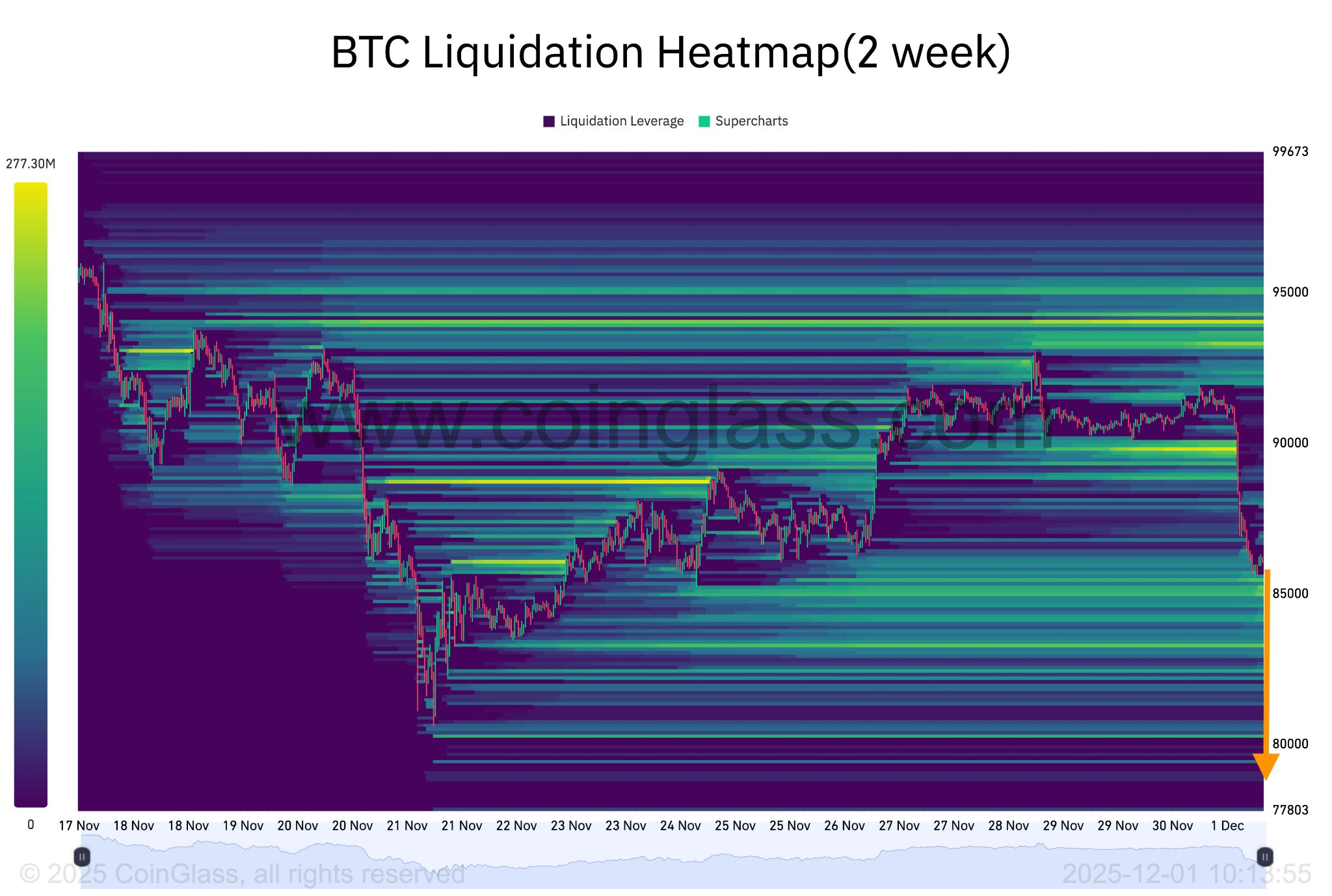

The Bitcoin liquidation heatmap showed the price eating away liquidity around $86,000, with millions in bid orders still sitting between the spot price and $79,600

BTC/USDT liquidation heatmap. Source: CoinGlass

BTC/USDT liquidation heatmap. Source: CoinGlass This suggests that Bitcoin’s price might drop further to sweep this liquidity before staging any recovery.

From a technical perspective, the price has validated a bear flag on the daily chart after dropping below the lower boundary of the flag at $90,300 on Monday.

A daily candlestick close below this level would confirm the continuation of the downtrend toward the measured target of the flag at $67,700 (near 2021 all-time highs). Such a move would bring the total losses to $21%.

BTC/USD daily chart. Source: Cointelegraph/ TradingView

BTC/USD daily chart. Source: Cointelegraph/ TradingView Veteran trader Peter Brandit shared a chart showing that Bitcoin’s macro downtrend could find support within the lower green zone, which lies between $45,000 and $70,000.

Not to bust anyone's banana, but the upper boundary of the lower green zone starts at sub $70s with lower boundary support in the mid $40s.

— Peter Brandt (@PeterLBrandt) December 1, 2025

How soon before Saylor's Shipmates ask about the life-boats? $BTC pic.twitter.com/YLfjSDdw9H

As Cointelegraph reported , Bitcoin is following the 2022 bear market trajectory so far, with a near 100% correlation in 2025. The true BTC price rebound may not occur until well into the first quarter of next year if this trend continues.