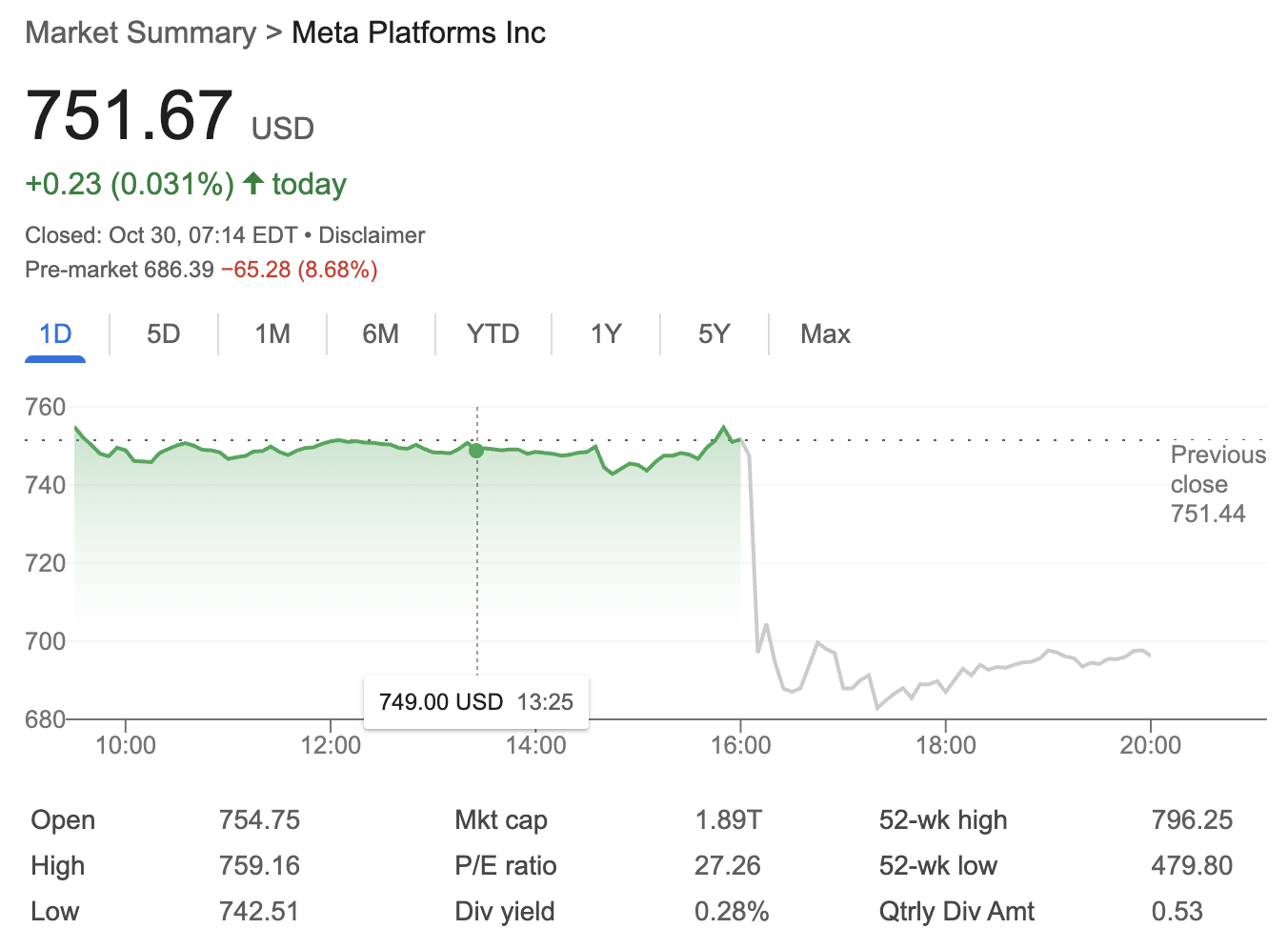

Meta’s Quarterly Profit Plummets 83% on One-Off Tax Charge, Signals Major Capital Spending Hike for 2026

Meta Platforms Inc. (NASDAQ: META) delivered its much-anticipated Meta Q3 earnings report for 2025, and the results revealed both impressive topline growth and some profit-sapping headwinds. Investors in Meta stock have much to digest, as the company’s focus on artificial intelligence (AI) and long-term infrastructure is driving up spending—even as immediate profits take a hit.

Source: Google Finance

Meta Q3 Earnings at a Glance: Revenue Growth Outshines Net Income Drop

The headline from the Meta Q3 earnings report was clear: revenue for the quarter soared to $34.15 billion, up 23% from a year ago and handily topping analyst expectations. Much of this momentum was powered by robust digital advertising demand, reflecting Meta’s ongoing leadership in the global ad market.

However, a significant one-time tax expense caused net profit to plummet by 83% year-over-year, falling to $2.71 billion. The company confirmed that this sharp drop was due to a $16 billion tax charge related to the repatriation of foreign earnings and a recent legal settlement. Adjusted for the one-time hit, Meta’s underlying profitability looked much healthier, though still pressured by higher baseline operating costs.

-

Q3 2025 revenue: $34.15 billion (+23% YoY)

-

Net income: $2.71 billion (down 83% YoY, due to $16 billion tax charge)

-

Adjusted EPS: $4.57 (excluding the one-time charge)

How is Meta’s User Growth Fueling Future Ad Revenue?

A crucial highlight of the Meta Q3 earnings call was continued user expansion across Meta’s core platforms—Facebook, Instagram, WhatsApp, and Threads. The company reported:

-

Daily Active People (DAP): 3.54 billion (+7% YoY)

-

Monthly Active People (MAP): 4.19 billion (+6% YoY)

-

Facebook DAUs: 2.17 billion (+5% YoY)

This ongoing user growth reinforces Meta’s dominance in digital ad delivery, a cornerstone for Meta stock valuation.

Why Are Meta’s Costs Soaring – and What’s the Role of AI?

Meta’s heavy investment in artificial intelligence is becoming a defining theme, as Mark Zuckerberg highlighted in the earnings call. The company channeled $8.2 billion into capital expenditures this quarter, up by 30% year-over-year, much of it earmarked for new data centers, custom silicon chips, and building out AI infrastructure. Meta’s full-year capex is expected at $35–$37 billion, potentially reaching $40 billion in 2026 as the firm pushes ahead with its AI “Superintelligence Lab” and continues hiring top engineering talent.

This clear pivot to AI and infrastructure is designed to secure Meta’s future growth and leadership in the race for next-generation consumer AI products. However, it puts near-term pressure on margins—a point not missed by holders of meta stock.

What Was the Market’s Reaction to Meta Q3 Earnings?

Despite record revenue in the meta q3 earnings report, Meta stock dropped 8% in after-hours trading. Investors were rattled by the outlook for sharply rising capital expenditures next year and into 2026, raising worries about future profitability. As WallstreetCN noted, “Investors were disappointed by the forward guidance, with expense controls and margin stabilization under increased scrutiny.”

Still, a number of Wall Street analysts remain bullish on Meta stock, believing that heavy investment now could secure long-term gains if Meta’s AI initiatives pay off and unlock new monetization avenues.

What’s Next for Meta: Guidance and Strategic Focus

Looking ahead, Meta projects Q4 revenue of $36.5 to $38 billion, consistent with its significant year-on-year growth trend. However, the company warns that capital expenditures will continue to rise, with forecasts for up to $40 billion in 2026 as new AI tools and product launches ramp up. R&D investments and ongoing data center expansion are expected to be the main spending drivers.

Mark Zuckerberg assured investors that “frontloading” these investments is essential for Meta’s leadership in the AI era, while CFO Susan Li cautioned that global ad market volatility and foreign exchange pressures could still impact next year’s results.

Key Takeaways for Investors Considering Meta Stock

-

Meta Q3 earnings underline robust user expansion and dominant ad market positioning.

-

The sharp profit decline was caused by a one-off tax charge, but underlying operations remain strong.

-

Meta is aggressively investing in AI infrastructure, which could secure future growth despite near-term profit pressure.

-

Rising capital and R&D expenditures are central risks, and could continue to weigh on Meta stock in the short term.

-

Future performance will be shaped by AI product rollout success, market expectations for revenue growth, and cost management.

Conclusion

The latest Meta Q3 earnings report presents a classic tradeoff: visionary, high-upside investment for long-term positioning versus short-term profit sacrifices. Investors in meta stock must decide whether they believe Meta’s big AI bet will pay dividends in years to come—or if escalating costs signal caution is warranted in the near term.