Which Bitget Futures Bot Should You Use?

The Trader's Crossroads: Choosing Automated Strategy

Stepping into the world of automated trading with Bitget Futures Bots? Smart move. Our bots are designed to support sustainable trading with thoughtful position scaling, strategic automation, and controls that help you optimize execution without getting steamrolled by market noise or volatility.

Two of our most powerful tools, the Futures Grid and Futures Martingale bots, serve different purposes. One is built to patiently farm volatility in sideways markets; the other is a bold strategy designed to capture powerful reversals. This playbook will help you understand their core logic, choose the right one for the right market, and deploy with the right intention.

Bitget Futures Grid Bot: Your Sideways Market Specialist

The Futures Grid Bot is your workhorse for profiting from market oscillations. It automates the "buy low, sell high" principle by placing a series of buy and sell orders within a price range you define.

Best Market Condition: Sideways / Range-bound markets with lots of fluctuations.

This bot thrives when a trading pair is bouncing between clear support and resistance. It's designed to harvest mid-range volatility while you stay hands-off.

Example: The Slow Bleed

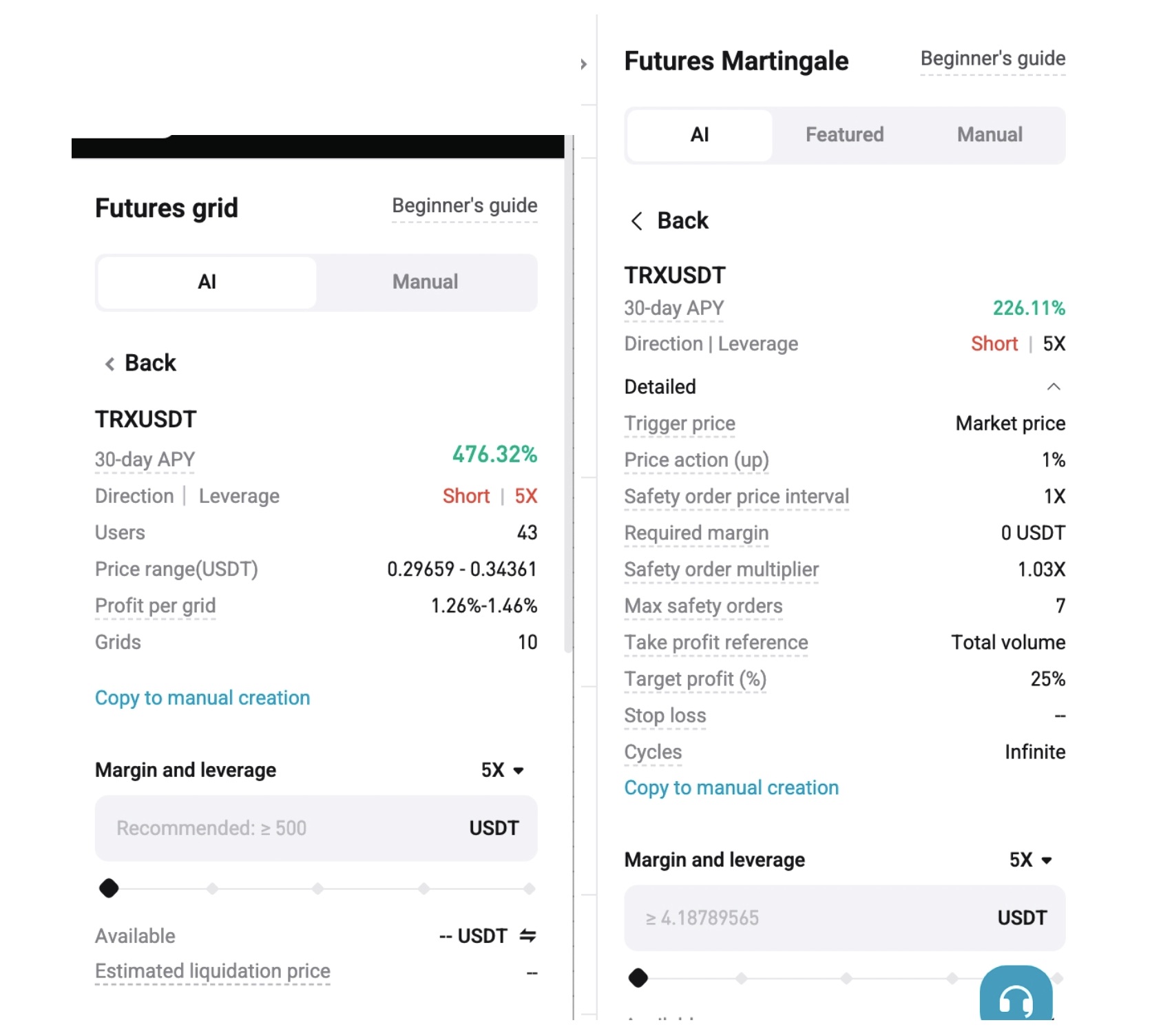

Let's say a volatile altcoin, TRX, currently is in a confirmed downtrend. You launch a TRX/USDT Short bot:

Trader A launches a Short Martingale bot. The price drops, but then a sharp, unexpected bounce occurs. The bot is forced to add a larger safety order at a worse (higher) price, increasing its risk.

Trader B deploys a Short Futures Grid bot with a price range from $0.2965 - $0.3436 to cover the downward channel. As TRX grinds down, the bot works perfectly. It automatically sells the weak bounces and buys back on the dips, taking small, consistent profits from the volatility. It is farming the market noise.

Result: Futures Grid outperforms Futures Martingale.

Why Futures Grid works:

● Profits from volatility, not just direction: Its goal isn't to catch one big move, but to profit from the hundreds of small moves within the trend.

● Avoids risk accumulation: Unlike martingale, it isn't adding to a losing position during counter-trend bounces. It takes profits and resets.

● Maintains structure and discipline: In a chaotic, choppy market, the grid provides a rigid, emotionless framework for execution.

When to use this strategy:

● In clear, grinding trends that have consistent volatility.

● On assets known for choppy price action rather than clean, smooth trends.

● When your goal is to generate steady, smaller profits from market noise rather than betting on one major reversal.

Key Risk: The breakout. The primary risk is a strong breakout where the price moves decisively outside your set grid range, leaving your bot idle.

Tips: Always set a stop-loss in the bot parameters. This is your automated safeguard, protecting your capital if the market trend turns sharply against your grid.

Bitget Futures Martingale Bot: The Reversal Hunter

The Futures Martingale is a more aggressive tool built for a specific conviction: a market reversal is coming.

The basic principle behind the Martingale strategy is for investors to trade in a single direction. If a trade moves against them, a larger position is opened at subsequent intervals. When the market bounces back, the goal is for the next profitable trade to exceed the combined losses of all previous trades, with additional profit.

Bitget's Futures Martingale supports two-way transactions, meaning it can both go long and short to make a profit by leveraging potential market reversals. With customizable leverage and the ability to generate recurring profits, it provides traders with more trading opportunities and flexibility.

Best Market Condition: Trending markets with pullbacks.

This bot excels when you believe an asset is in a general uptrend but is experiencing a temporary dip, or when you believe a downtrend has bottomed out. It is not for flat or sideways markets.

Example: The V-Shaped Recovery

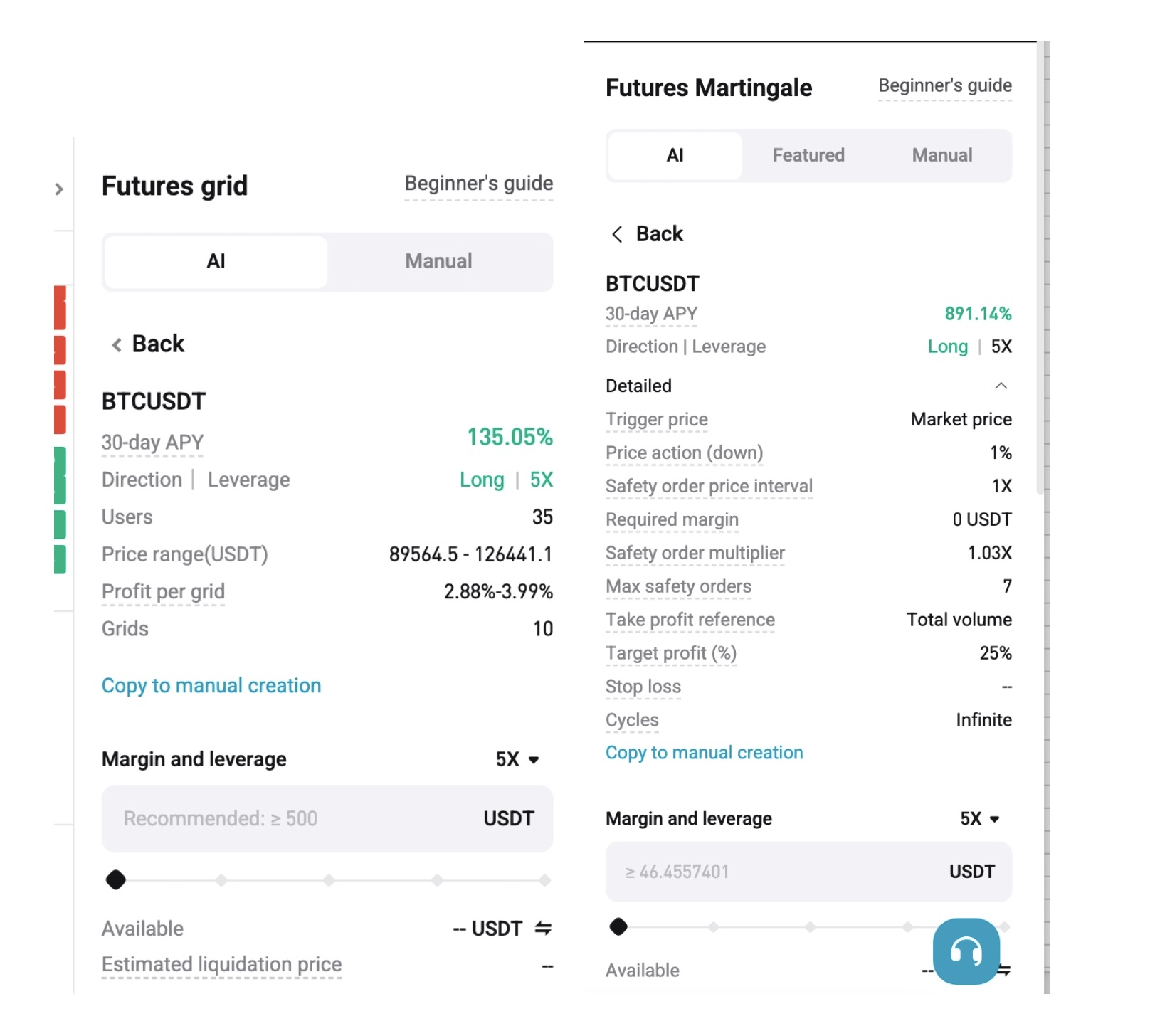

Let's say BTC is trading steadily. You launch a Long bot with the following parameters:

Suddenly, the market panics, and BTC plummets.

Trader A with a static Futures Grid bot running in a fixed range watches as the price falls straight through the grid floor. The bot's buy orders are filled, but then it goes idle, missing the explosive rally that follows.

Now, consider Trader B who deployed a Futures Martingale bot. As the price crashes, the bot automatically executes its larger "safety orders" at deeper price levels, aggressively buying the dip and dramatically lowering its average entry price. When the V-shaped recovery begins, the entire, now-large position becomes highly profitable long before the price returns to its original level.

Result: Futures Martingale outperforms.

Why Futures Martingale works:

● Turns fear into opportunity: While others panic, the bot systematically executes a plan to buy low.

● Automates Dollar-Cost Averaging (DCA): It removes emotion and averages down your entry at scale, which is hard to do manually in a fast-moving crash.

● Maximizes profit from the rebound: Because the average entry price is so low, even a partial recovery can lead to significant gains.

When to use this strategy:

● During sharp, V-shaped market reversals.

● When you have a strong conviction that a dip in a bluechip asset (like BTC or ETH) is temporary.

● After a major liquidation cascade has cleared out leverage and the market is poised for a bounce.

Key Risk: The trader's high-wire act. The main risk is liquidation if the market trends strongly against you without reversing. This is a higher-risk strategy that demands good risk control and discipline.

Tips: Use Bitget's built-in risk controls to trade responsibly:

● Use lower leverage. This gives your position more room to breathe.

● Set a maximum number of safety orders to limit your total exposure.

● Start small. Allocate only a small portion of your portfolio that you are comfortable risking.

Quick Comparison Table: Your Bot Cheat Sheet

|

|

Futures Grid |

Futures Martingale |

| Best Market |

Sideways / range-bound |

Trending with pullbacks/reversals |

| Core Strategy |

Buy low, sell high in a range |

Average down on dips (DCA) |

| Profit Style |

Small, consistent gains |

Large gains from recovery |

| Risk Level |

Lower risk (in sideways market) |

High (needs good risk control) |

| Trader Profile |

The range farmer |

The reversal hunter |

Conclusion: Match the Tool to the Trend

The most effective bot is the one that's aligned with the current market. The Futures Grid is your tool for maintaining structure and discipline in choppy markets, while the Futures Martingale is your high-conviction play for capturing reversals.

By correctly identifying the market, you move from guessing to strategizing. You are ready to build familiarity, gain insight, and let Bitget's bots do what they’re built for: opportunity capture in dynamic markets.

● Market looking choppy? Launch a Futures Grid Bot and farm volatility.

● Confident in recovery? Set up your Futures Martingale Bot with smart risk controls.

Disclaimer: Nothing in this article should be construed as financial advice. Profitability is affected by many factors, and the data in the above examples is for illustrative purposes in an ideal situation. Past performance is not a guarantee of future results.

Digital asset prices are highly volatile and may undergo significant fluctuations. Investors should only invest funds they can afford to lose. The value of your investment may change, and there is no guarantee of achieving financial goals or recovering your principal. Investors are advised to seek independent financial advice and carefully assess their own financial experience and circumstances. Bitget assumes no liability for any potential losses. For more information, refer to our Terms of Use and Futures Service Agreement.