A Complete Guide to Aster Airdrop Farming: Strategies, Aster Price, and Maximizing Rewards

Are you looking to capitalize on the Aster airdrop or seeking new approaches to Aster airdrop farm and arbitrage strategies? Wondering how the Aster price has behaved since the airdrop and what opportunities still exist? This detailed guide explores everything investors need to know: from Aster’s core features and recent developments, to a comprehensive breakdown of the Aster airdrop event, analysis of Aster price movement post-launch, and four powerful arbitrage trading and farming strategies for maximizing returns.

Source: CoinMarketCap

What is Aster?

Aster is rapidly gaining attention as one of the most innovative decentralized perpetual trading platforms in the DeFi space. Designed for both beginners and experienced arbitrage farmers, Aster’s platform offers dual modes: Simple Mode for instant, one-click leveraged trading (up to 1000x), and Pro Mode for sophisticated order book management, advanced analytics, and professional trading tools.

Key standout features of Aster include:

-

Multi-chain accessibility: Supporting BNB Chain, Arbitrum, Ethereum, and Solana.

-

Deep liquidity: Over $258 billion in trading volume processed.

-

MEV-resistant trading: Enhanced protection against front-running, a major risk on DeFi platforms.

-

Yield generation: Unique “Aster Earn” component, allowing liquidity providers to earn through BNB liquid staking (asBNB) and the innovative yield-bearing stablecoin USDF.

-

Community-first focus: Aster’s airdrop-centric token model heavily rewards engaged users and ecosystem contributors.

In the days following the second aster airdrop event, the platform surged in activity—with 710,000 new users joining in a single week and Aster’s spot in DeFi trading volume rankings rapidly climbing.

Aster’s technical infrastructure has shown resilience, swiftly mitigating issues such as the “XPL perp glitch,” further building investor confidence. The combination of seamless user onboarding, reliable tech, and aggressive reward distribution has set a new standard for Aster airdrop and farming platforms.

Aster Price Performance After Airdrop Launch

Following the September 2025 aster airdrop, the aster price witnessed an explosive rally. According to CoinMarketCap , Aster price surged by an unprecedented 7,900%, outperforming most DeFi token launches of the year. This spike reflects surging demand, excitement around trading and farming opportunities, and anticipation of further airdrop-driven growth.

Aster now consistently surpasses competitors such as Hyperliquid in daily trading volume, TVL (Total Value Locked), and 24-hour trading activity. On the airdrop launch day alone, Aster’s cumulative perpetual futures volume shattered records.

Financial analysts are increasingly bullish. Forklog cites expert predictions of a further 480% rise in Aster price, driven by relative undervaluation and superior platform metrics. The Aster price performance is bolstered by active arbitrageurs, high farming yields, and a robust incentive structure for both new and loyal users.

Meanwhile, volatility remains high as speculators, arbitrageurs, and long-term holders all compete in the market. These dynamics present fertile ground for those interested in aster airdrop farm and arbitrage trading.

Aster Airdrop Details: How It Worked & Who Was Eligible

Aster’s second Genesis aster airdrop was one of the largest and most inclusive events in the DeFi landscape. On September 17, 2025, the platform distributed 704 million ASTER tokens, representing 8.8% of its total supply. Here’s what set the aster airdrop apart:

Eligibility Criteria

-

Spectra Genesis participants: Users who accumulated Rh and Au points during Stages 0 and 1.

-

Community and partner rewards: Contributors and early partners actively engaged in the ecosystem.

-

Loyalty and activity points: Users trading on Aster Pro and earning ongoing loyalty rewards.

-

Team and referral bonuses: Incentives for forming trading squads and inviting friends, increasing community engagement.

Claim Process

Aster designed its aster airdrop with user convenience in mind. Claimants used an eligibility checker directly on the Aster website, and successful participants received their tokens straight into their Aster spot accounts. No gas fees, no wallet approvals—reinforcing Aster’s commitment to a seamless user experience.

Airdrop Impact

-

Over 710,000 new users in a week.

-

TVL reached $1.74 billion.

-

$211 billion 24-hour volume—outpacing the next competitor by more than 2x.

-

Unique structures like aster airdrop farm enable ongoing community rewards beyond the initial distribution.

Four Top Arbitrage & Airdrop Farming Strategies on Aster

With the launch of the Aster airdrop, the platform’s diverse ecosystem supports a wide array of aster airdrop farm and arbitrage strategies for both risk-tolerant traders and conservative yield seekers. Drawing from comprehensive user experience and on-chain data, the following four strategies are the leading approaches to maximizing value after the Aster airdrop event:

1. Funding Rate Arbitrage

Aster’s perpetual futures market frequently displays large funding rate divergences with similar assets on centralized exchanges and other DEXs—for example, trading BTC, ETH, or SOL perps. Traders can profit by constructing fully delta-neutral positions:

-

Go long on Aster while shorting an equivalent position on an exchange like Binance or Bybit, or vice versa.

-

The key is to collect a higher positive funding rate from one platform, while paying a lower (or negative) funding fee on the other.

-

According to PANewsLab, during periods of high volatility, net funding can reach as much as 0.35% per 8 hours, producing a sizeable passive return on capital for attentive traders.

This approach not only captures the funding spread but also increases user activity—which may multiply your Aster airdrop allocation by boosting trading volume and loyalty points in the ongoing Aster airdrop farm rounds.

2. Cross-Platform Orderbook Arbitrage

Due to the explosive user growth and extreme trading activity post-Aster airdrop, token prices (both in the spot market and perpetuals) can show significant discrepancies between Aster, Backpack, and other top-tier platforms:

-

Monitor the aster price and other major assets’ prices across platforms in real time.

-

When a price difference emerges, rapidly buy the undervalued asset on one platform and sell (or short) the overvalued one on another, pocketing the net spread.

-

PANewsLab notes that while many bots and professional traders monitor these spreads, successful arbitrage depends on low-latency execution, efficient cross-chain withdrawals (where possible), and fee assessment.

This method is especially potent for those equipped with automation tools or high-speed manual trading skills, looking to exploit micro-gaps triggered by intense aster airdrop related activity.

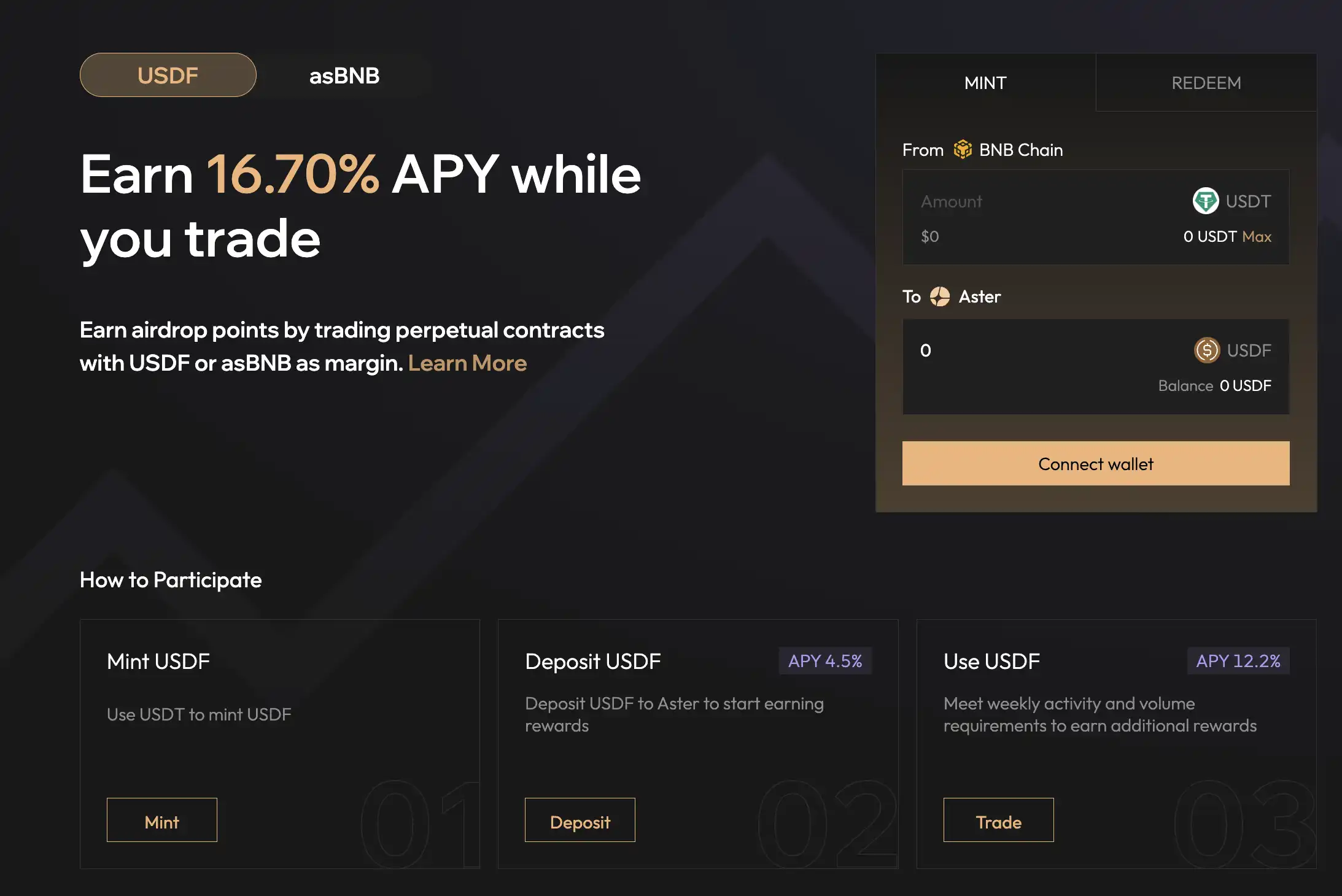

3. Stablecoin Yield & Collateral Farming

Aster offers unique stablecoin farming opportunities that cater to USDT and USDF holders:

-

Deposit USDT as collateral to mint or borrow USDF, then stake USDF in Aster’s high-yield liquidity pools or vaults.

-

PANewsLab highlights the popular "looping" technique: Users can leverage their liquidity position by repeatedly depositing, minting, and staking, thereby multiplying both the yield and their contribution score for the aster airdrop farm event.

-

Some users pair Aster’s on-platform yield with external liquidity mining protocols, harvesting dual rewards and compounding their airdrop eligibility.

-

Keep in mind that yield rates and Aster’s parameters can fluctuate during Aster price swings and large-scale airdrop claims.

This strategy is optimal for users seeking to maximize their capital efficiency with lower directional risk, all while stacking potential Aster airdrop bonuses.

4. Team-Based & Referral Incentive Farming

Aster’s unique social and collaborative farming mechanism is highlighted by the “Squads” and “Inviter” leaderboard features:

-

Users join teams or form their own. Trading, liquidity provision, or farming activity by any member contributes points to the whole squad, lifting everyone’s ranking for additional aster airdrop farm rewards.

-

Referring new users with your invitation code not only increases your direct reward pool, but also generates downstream bonuses as new participants engage with the platform—a key dynamic noted by PANewsLab.

-

Top teams and super-connectors have already reported receiving up to dozens of multiples more in airdrop share compared to solo farmers, thanks to leaderboard multipliers and exclusive team tasks.

-

The community emphasis encourages ongoing user activity and staking, ensuring continued TVL and platform growth even after initial aster airdrop rounds.

For anyone serious about scaling up their aster airdrop farm returns, joining an active team and optimizing referral outreach is a strategic essential.

By leveraging funding rate mismatches, cross-platform price spreads, stablecoin-based yield loops, and powerful social farming via teams and referrals, users can unlock the full spectrum of aster airdrop and aster airdrop farm opportunities. As Aster’s ecosystem matures, combining these methods—rather than relying on just one—will be key to capturing maximum aster price and airdrop upside in both current and upcoming reward seasons.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.