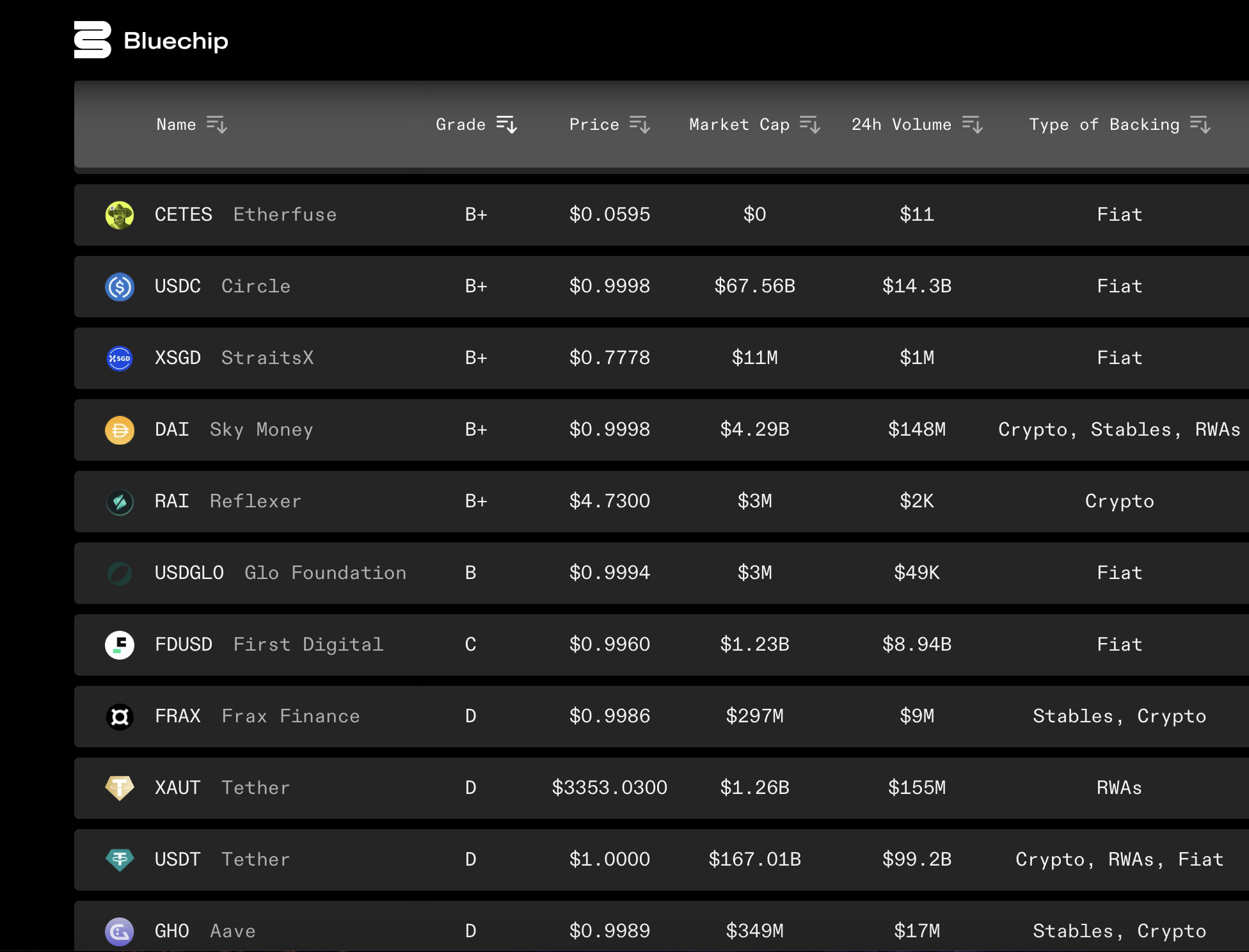

Is Tether (USDT) the Safest Stablecoin? Bluechip’s Security Assessment Says Not Necessarily

Tether minted 1 billion USDT on Ethereum, expanding supply and reinforcing dominance across on-chain markets and centralized exchanges. The move spotlights liquidity strength—but also revives a key question: does scale equal safety?

Bluechip, an independent evaluator, assesses stablecoin safety using its SMIDGE framework—Stability, Management, Implementation, Decentralization, Governance, and Externals—prioritizing long‑term peg protection over market share. In this article, we will dive into how its rating framework works, what the current methodology implies for Tether (USDT), how other major stablecoins compare, and practical takeaways for traders and institutions.

Who is the rating company

Bluechip positions itself as an independent evaluator of stablecoin safety, aiming to guide both retail and institutional users. The organization notes that its framework will evolve with market feedback and new data sources, and that it seeks to raise industry standards by promoting sound design, prudent operations, and greater transparency from issuers.

Source: bluechip.org

How it was rated

Bluechip’s evaluation emphasizes internal and external control mechanisms that minimize loss of value to holders. For fiat- and asset‑backed stablecoins, governance is assessed on three pillars:

-

Holder Protection: What rules, statutes, or code protect the interests of stablecoin holders?

-

Reserves Verification: What checks confirm the existence of reserves?

-

Redemptions: Are redemption terms transparent and reasonable?

For on‑chain native stablecoins, the governance lens shifts to:

-

Voting Systems: Are votes binding with automated on‑chain execution?

-

Anti‑Governance Attack Measures: Are there preventive and reactive defenses against governance attacks?

Bluechip also acknowledges risks arising from smart contracts and oracles for redemption and stabilization, but notes that a full Implementation risk review was not part of its initial launch scope. The framework is designed to adapt over time as new information and models emerge, with a view to supporting better user decisions and higher issuer accountability.

Tether (USDT): key insights under the framework

As the most widely used dollar‑pegged token, Tether (USDT) is central to crypto liquidity and settlement. Applying Bluechip’s criteria provides a structured way to interpret its risk profile without relying on market sentiment alone.

What supports stability today

-

Market depth and liquidity: Tether (USDT) benefits from broad listings, deep order books, and global reach. Strong secondary‑market liquidity helps maintain tight spreads and can aid peg recovery during short‑term volatility, which aligns with Bluechip’s focus on external mechanisms that prevent value loss.

-

Reserve verification practices: Issuer attestations offer periodic snapshots of reserve composition and collateral quality. While attestations are narrower than full audits, they contribute to the Reserves Verification lens and inform assessments of collateral safety and liquidity.

-

Redemption infrastructure: Institutional redemption channels and active market makers help translate reserve strength into practical peg defense during stress events, directly tying into the Redemptions pillar.

Risk considerations to monitor

-

Governance and disclosure clarity: Centralized decision rights, limited real‑time visibility into counterparties, and the scope of attestations versus full audits remain core topics. These factors influence Holder Protection, Reserves Verification, and Redemptions assessments under Bluechip’s governance framework.

-

Asset mix and concentration: Exposure to short‑duration government securities and cash equivalents generally supports liquidity, but concentration in specific instruments or jurisdictions introduces policy and access risks. Any friction around reserve accessibility can affect redemption performance and perceived stability.

-

Non‑cash allocations: Allocations beyond cash and Treasuries (e.g., secured loans or other assets disclosed by the issuer) add variability and warrant ongoing scrutiny from a Stability and risk‑management perspective.

-

Policy and market shocks: Shifts in banking relationships, regulatory posture, or macro liquidity can create transient off‑peg prints. Monitoring basis behavior, redemptions, and market microstructure helps users respond quickly to changing conditions.

Other stablecoin security ratings: context for comparison

While users should consult Bluechip’s site for current Safety Scores, the same governance pillars help compare leading alternatives:

-

USDC: Strong emphasis on regulated issuance, detailed reserve reporting, and frequent attestations; key dependencies include U.S. banking rails and policy decisions that can affect transfers and redemptions.

-

DAI: Overcollateralized design with on‑chain governance; increasing exposure to real‑world assets and centralized collateral introduces hybrid risk that should be evaluated against voting safeguards and anti‑attack measures.

-

PYUSD, FDUSD, TUSD, and others: Differences in issuer oversight, attestation practices, banking relationships, and on‑chain controls lead to varied outcomes across Holder Protection, Reserves Verification, and Redemptions. Liquidity depth is a major differentiator in real‑world resilience.

Practical takeaways for Bitget users

-

Diversify where operationally feasible to reduce single‑issuer dependency.

-

Prioritize liquidity and governance together: deep markets help in the short term, but robust protections and transparent redemptions underpin long‑term confidence.

-

Revisit disclosures regularly; issuer transparency and policy changes can materially shift the risk profile.