- Tokenized real-world assets on Solana hit a record $707.79M.

- RWA holders jumped 18% the past month, indicating amplified adoption.

- Stablecoin activity on the SOL blockchain increased by 68% the last 30 days.

Amid the gloomy broader sentiments , the Solana community celebrated a key milestone.

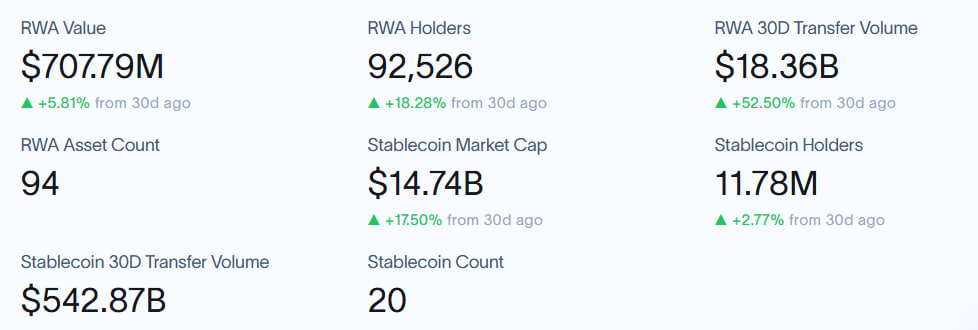

According to RWA.xyz data , the total value of tokenized real-world assets (RWAs) on the Solana network increased by 5.8% the past month to $707.79 million, setting a fresh all-time high.

The surge reflects the current trend where traditional markets are merging with blockchain platforms.

Notably, RWA tokenization involves digitizing ownership of intangible or tangible real-world assets, including artwork, digital assets, and real estate, using blockchain technology.

Solana’s capability of handling massive transactions at cheaper costs has made it perfect for these innovations.

With its unique proof-of-stake and proof-of-history mechanisms, the crypto project can process over 65,000 TPS (transactions per second).

Syndica’s latest blog shows Solana has maintained 6x faster TPS than any other chain for eight consecutive months.

That’s the type of speed essential for handling large-scale real-world asset tokenization.

Increasing holders signal confidence

The data shows RWA holders on Solana surged to 92,526 after an 18.28% uptick in the last 30 days.

This confirms increased trust from institutional and individual investors who see Solana as the blockchain for streamlined tokenization.

Furthermore, the remarkable jump reflects the new trend of market players viewing tokenized investments as viable alternatives to traditional assets.

In total, Solana currently has 94 distinct tokenized RWAs, ranging from real estate and treasury bills to commodities.

Such diversification strengthens the SOL ecosystem. Moreover, they reduce risks as users have multiple channels for exposure.

As mainstream finance moves on-chain, Solana appears as a leading destination for tokenized products.

Its low fees, high interoperability, and speed might continue attracting serious capital in the coming months and years.

Stablecoins strengthen Solana’s on-chain economy

Besides the thriving RWA market, Solana’s stablecoin market cap soared 17.5% the previous month to $14.74 billion.

These stable tokens serve various purposes across the SOL platform, including trading, on-chain payments, and lending.

Moreover, stablecoin holders jumped 2.77% in 30 days to 11.78 million.

Most impressively, stablecoin transactions skyrocketed 68.44% in a month to $542.87 million.

Solstice Finance debuted its USX stablecoin on Solana on September 30.

Most stablecoins force you to choose. Stability OR yield. Never both.

Solstice breaks this false choice.

Layer one: Solana-native USX is your stablecoin. Built for Internet Capital Markets.

Layer two: YieldVault provides onchain access to Wall Street, delta-neutral strategies.… pic.twitter.com/r4atpTbBEw

— Solstice (@solsticefi) October 23, 2025

SOL price outlook

Solana is trading at $189. It has lost nearly 15% of its value in the past month as broader market bearishness outweighed optimism surrounding the tokenization updates.

SOL gained more than 2% the past 24 hours, though the 13% slump in daily trading volume reflects bearish sentiment.

The token reflects the prevailing overall market downturn, but institutional interest positions it for impressive comebacks amid broad-based bull runs.

The incredible success in the tokenization industry signals Solana entering a new era of growth, fueled by real-world adoption.