Crypto treasury firms mirror CDO risks from 2008 financial crisis: Crypto exec

Bitcoin (BTC) and crypto treasury firms pose similar risks to collateralized debt obligations (CDOs), securitized baskets of home mortgages and other types of debt that triggered the 2007-2008 financial crisis, Josip Rupena, CEO of lending platform Milo and former Goldman Sachs analyst, told Cointelegraph.

Crypto treasury companies take bearer assets with no counterparty risk and introduce several layers of risk, including the competence of the corporate management, cybersecurity, and the ability of the business to generate cash flow, Rupena said. He added:

“There's this aspect where people take what is a pretty sound product, a mortgage back in the day or Bitcoin and other digital assets today, for example, and they start to engineer them, taking them down a direction where the investor is unsure about the exposure they’re getting.”

Rupena told Cointelegraph that while he does not expect crypto treasury companies to be the cause of the next bear market, overleveraged firms could “exacerbate” a market downturn through forced selling, but it is still too early to tell what the exact effects will be.

Several market analysts have issued warnings about the potential of overextended crypto treasury companies to cause a market-wide contagion through forced selling, depressing crypto prices in a rush to cover debts.

Related: Peter Thiel vs. Michael Saylor: Crypto treasury bet or bubble?

Companies diversify into altcoin holdings, leaving market investors divided

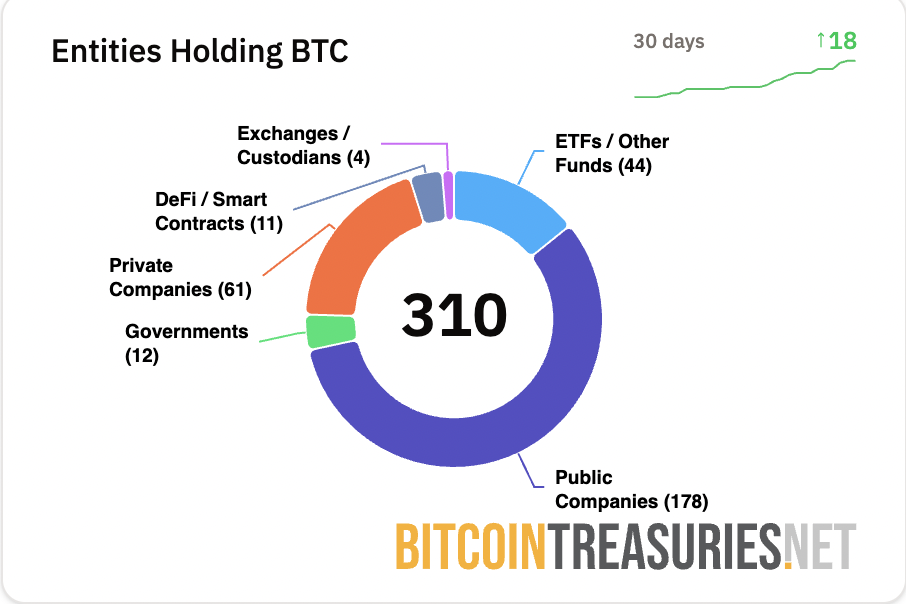

Traditional financial companies are going beyond the Bitcoin treasury strategy popularized by BTC advocate Michael Saylor and diversifying into altcoin treasuries.

During July and August, several firms announced Toncoin (TON), XRP (XRP), Dogecoin (DOGE), and Solana (SOL) corporate treasury strategies, for example.

Companies adopting crypto treasury strategies have seen mixed effects on their stock prices, as markets react to the growing tide of companies pivoting to digital assets.

Safety Shot, a maker of health and wellness beverages, announced it would adopt the BONK (BONK) memecoin as its primary reserve asset in August, sending shares of the company plummeting by 50% on the news.

Similarly, the share prices of many Bitcoin treasury firms have slumped in the second half of 2025, as the field becomes increasingly crowded.

Magazine: South Koreans dump Tesla for Ethereum treasury BitMine: Asia Express