Fed’s ‘Skinny Master Account’ Proposal Could Benefit Ripple’s RLUSD and XRP Integration

The Federal Reserve’s new proposal for a “skinny master account” could reshape how fintechs, stablecoin issuers, and crypto-focused banks access the US financial system — with Ripple standing to benefit significantly.

Governor Chris Waller announced the plan at the Fed’s Payments Innovation Conference. He introduced a limited-access account that will allow all legally eligible firms to connect directly to the Fed’s payment rails.

Ripple Can Plug Directly into the US Payments System

The Fed’s payment rails are the backbone of the US banking system. They move money between financial institutions instantly, powering services like wire transfers and clearing settlements.

Today, only chartered banks can use these rails directly. The latest announcement would give fintechs and blockchain companies real-time settlement access without relying on partner banks.

🚨BIG NEWS out of the @federalreserve Payments Innovation Conference this morning.Governor Chris Waller announced the central bank is proposing a new type of limited-access master account (or what he calls a “skinny master account”) for ALL legally eligible institutions to…

— Eleanor Terrett (@EleanorTerrett) October 21, 2025

Ripple, which has applied for a Fed master account earlier this year, could see this as a major breakthrough.

The company has long aimed to bridge blockchain settlements with traditional financial infrastructure, most recently through its RLUSD stablecoin and enterprise liquidity network.

Unlike a full master account, the “skinny” version would not grant privileges like borrowing from the Fed or earning interest on reserves.

However, it would provide critical payment capabilities — the same rails commercial banks use for domestic transfers.

Ripple Continues To Expand Institutional Operations

This development comes as Ripple expands its institutional footprint.

In mid-October, Ripple announced a $1 billion acquisition of GTreasury, a global treasury management platform serving over 1,000 enterprise clients.

Moreover, the deal positions Ripple to embed blockchain liquidity solutions within corporate treasury systems, complementing its efforts to secure regulatory access to payment infrastructure.

Ripple also backed Evernorth, a newly listed entity seeking over $1 billion to hold and deploy XRP as an institutional liquidity asset.

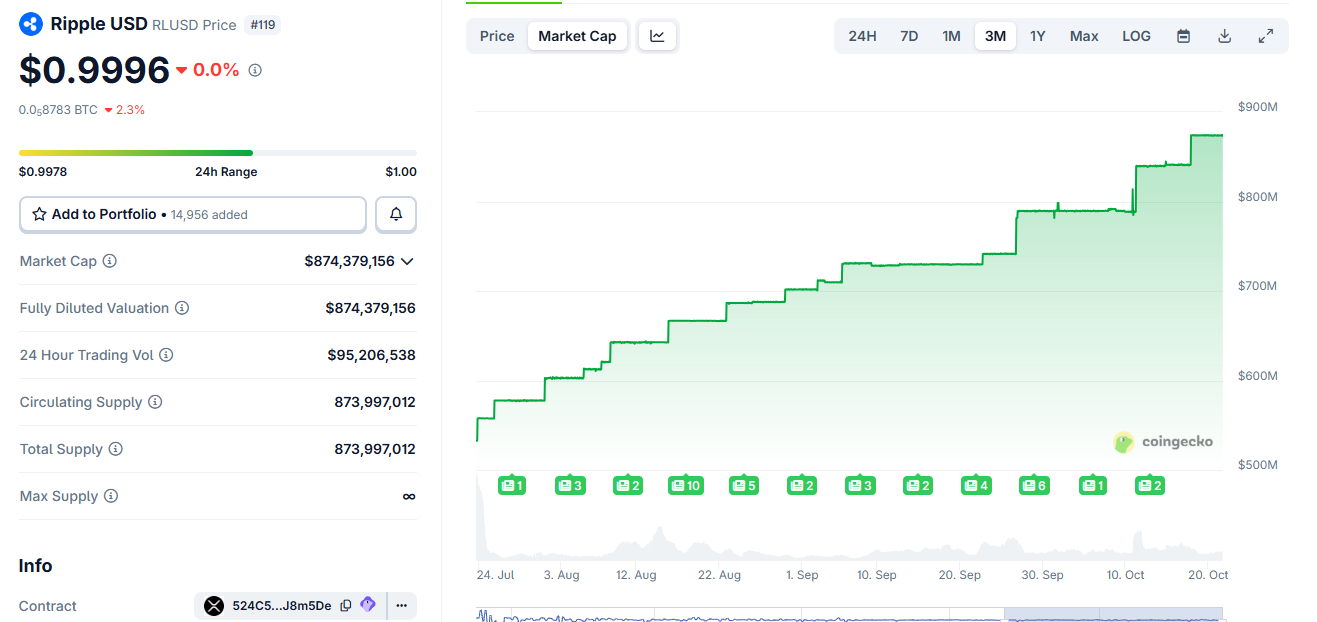

The initiative coincides with RLUSD’s rise toward a $1 billion market capitalization, signaling growing use of Ripple’s ecosystem for real-world settlements.

Ripple RLUSD Stablecoin Market Cap Chart. Source:

Ripple RLUSD Stablecoin Market Cap Chart. Source: If adopted, the Fed’s limited-access master account framework could provide the regulatory bridge Ripple has sought since its court battles with the SEC.

It would allow legally recognized entities like Ripple to plug RLUSD and XRP liquidity directly into US payment networks, reducing reliance on intermediaries.

Such access could validate compliant blockchain-based payment models and accelerate stablecoin integration into enterprise finance.

It may also strengthen Ripple’s case for treating RLUSD as a payment instrument.

For the Fed, the proposal reflects a cautious openness toward innovation. It expands access to core payment infrastructure while limiting monetary tools and risk exposure.

For Ripple and other regulated digital asset firms, it could mark the closest step yet toward operating alongside traditional banks on equal settlement terms.