The ZKsync praised by Vitalik had already developed the fastest zkVM.

Original author: Eric, Foresight News

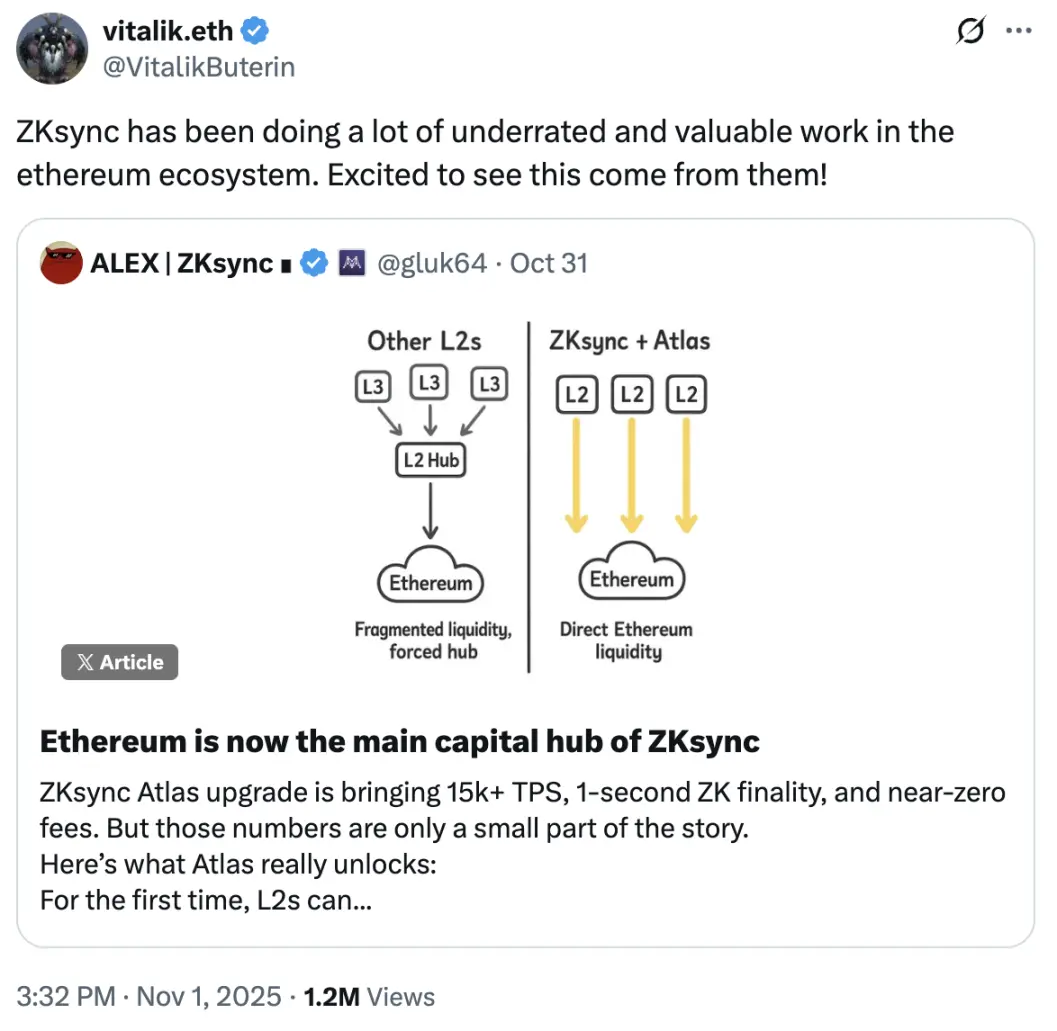

On November 1, Vitalik quoted a tweet from the founder of ZKsync about the ZKsync Atlas upgrade and praised ZKsync for doing a lot of "underrated but valuable work for the Ethereum ecosystem."

The market quickly responded to Vitalik's comments, with the price of ZK surging more than 2.5 times over the weekend. Tokens in the ZK ecosystem, including ALT (AltLayer), STRK (Starknet), SCR (Scroll), MINA (Mina), and others, also saw significant gains.

After learning about the ZKsync Atlas upgrade, we found that what ZKsync has accomplished may indeed have been underestimated.

Fast, Small but Expensive ZKP

The Ethereum Foundation has been promoting ZKP (Zero-Knowledge Proofs) from an early stage, essentially aiming to solve the problems of slow verification speeds and large amounts of data to be verified.

ZKP is essentially a mathematical probability problem. To illustrate its principle with a not entirely accurate example: suppose someone claims to have solved the "Four Color Theorem." How can we confirm this person's solution without fully disclosing it? The zero-knowledge proof approach is to select some parts of the entire graph and prove that no two adjacent regions in these parts have the same color. When the number of selected parts reaches a certain value, the probability that this person has solved the Four Color Theorem reaches 99.99...%. At this point, we have proven the solution without knowing the full details.

This is the commonly heard "proving something was done without knowing how it was done" aspect of zero-knowledge proofs. The reason for vigorously promoting ZKP in the Ethereum ecosystem is that, in theory, ZKP can achieve much faster speeds than verifying each transaction individually, and the proof generated itself is very small in data size.

The speed advantage comes from the fact that ZKP does not require knowledge of the entire process, only a challenge. For example, to verify an Ethereum block, the current method is for each node to verify basic issues such as whether the execution address of each transaction has sufficient balance. But if only one node verifies each transaction via ZKP and then generates a "proof," other nodes only need to verify the reliability of the "proof" itself. More importantly, the data size of this "proof" is very small, so transmission and verification are extremely fast, and storage costs are lower.

The reason this seemingly all-advantageous technology is not widely used is simply because it is too expensive.

Although ZKP does not require reproducing the entire process, the challenge itself consumes a lot of computing power. If you stack GPUs as crazily as in the AI arms race, you can achieve faster speeds, but not everyone can afford such costs. However, if algorithmic and engineering innovations can reduce the required computing power and the time to generate proofs under low computing power to a certain level, achieving a balance between "price increases driven by more applications due to technological innovation" and "the cost of setting up nodes and buying GPUs," then this becomes a worthwhile endeavor.

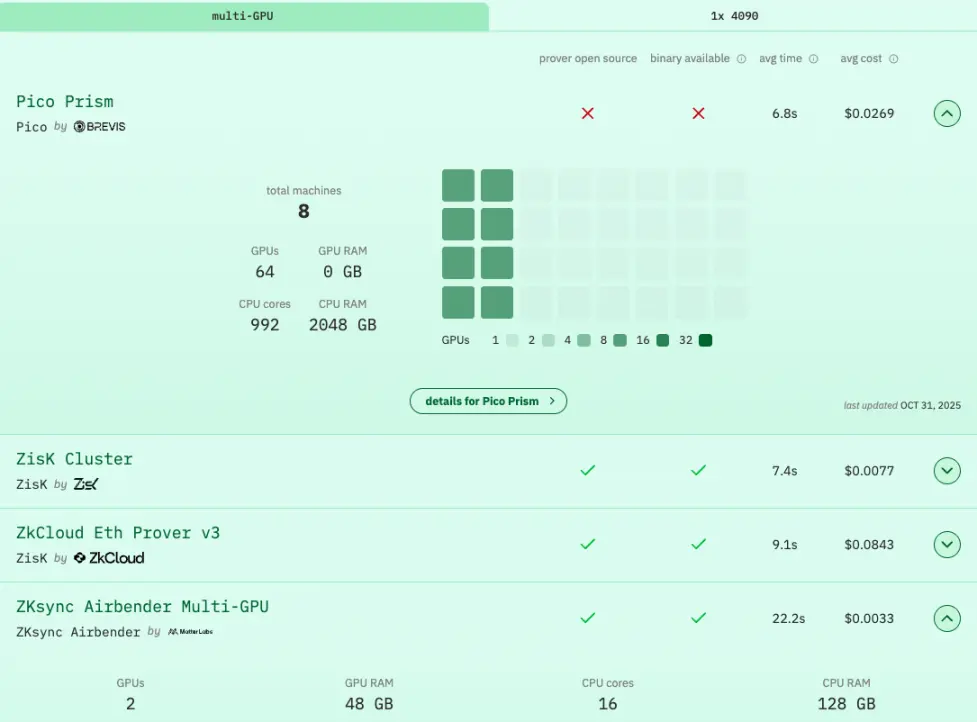

Therefore, many ZK concept projects or open-source developers in the Ethereum ecosystem focus on generating ZK proofs at lower costs and faster speeds under low costs. Recently, the Brevis team achieved an average of 6.9 seconds to prove an Ethereum block (99.6% of proof times are less than the current Ethereum block time: within 12 seconds) using only half the cost (64 RTX 5090 GPUs) of the SP1 Hypercube solution, which earned collective praise from the Ethereum community.

Although GPU costs still exceed $100,000, at least the proof speed has dropped to the current level without ZKP, and the next task is to reduce costs further.

The Atlas Upgrade Achieves 1-Second ZK Finality

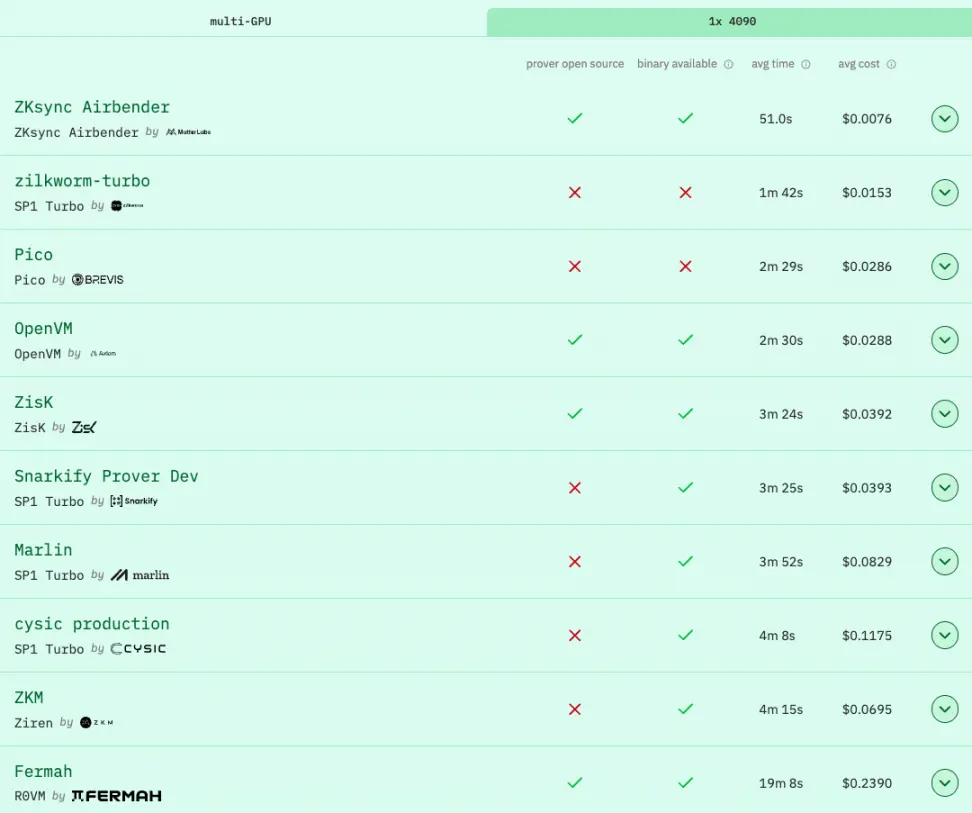

Perhaps many people don't know that ZKsync's open-source zkVM, ZKsync Airbender, is the fastest zkVM for single GPU verification. According to Ethproofs data, using a single 4090 GPU, ZKsync Airbender achieves an average verification time of 51 seconds at a cost of less than one cent, both of which are the best results among zkVMs.

According to data provided by ZKsync, excluding recursion, Airbender uses a single H100 and the ZKsync OS storage model to verify the Ethereum mainnet with an average time of 17 seconds. Even including recursion, the total average time is only about 35 seconds. ZKsync believes this is much better than needing dozens of GPUs to achieve verification within 12 seconds. However, since there is currently only data for two GPUs averaging 22.2 seconds, the actual performance is still inconclusive.

And all this is not solely the credit of Airbender; algorithmic and engineering optimizations are only part of it. The deep integration with the ZKsync technology stack is the key to maximizing results. More importantly, it demonstrates that real-time proof of the Ethereum mainnet using a single GPU is possible.

At the end of June, ZKsync launched Airbender, and on the penultimate day of the National Day holiday, the Atlas upgrade went live. This upgrade, which integrates Airbender, has significantly improved ZKsync's throughput, confirmation speed, and costs.

In terms of throughput, ZKsync optimized the sequencer at the engineering level: by using independent asynchronous components to minimize the consumption caused by synchronization; separating the state required by the virtual machine, the state required by the API, and the state required to generate zero-knowledge proofs or verify zero-knowledge proofs on L1, thereby reducing unnecessary overhead of components.

According to ZKsync's field tests, TPS for high-frequency price updates, stablecoin transfers in payment scenarios, and native ETH transfers reached 23k, 15k, and 43k, respectively.

Another huge qualitative leap comes from Airbender, which helps ZKsync achieve 1-second block confirmation and a single transfer cost of $0.0001. Unlike verifying mainnet blocks, ZKsync only verifies the validity of state transitions, so the computational load is much less than verifying mainnet blocks. Although transactions with ZK finality still require mainnet verification to achieve L1 finality, ZK verification already indicates the validity of the transaction, and L1 finality is more of a procedural guarantee.

In other words, transactions executed on ZKsync only need ZKP verification to be fully confirmed as valid, and with significantly reduced costs, ZKsync has achieved, in their own words, application scenarios that only Airbender can bring:

First, naturally, are applications such as on-chain order books, payment systems, exchanges, and automated market makers. Airbender enables the system to verify and settle at extremely fast speeds, reducing the risk of rollbacks for these on-chain applications.

The second point is something that many L2s currently cannot achieve: supporting public and private systems (such as ZKsync's Prividiums) to interoperate without third parties. Prividiums is infrastructure launched by ZKsync to help enterprises build private chains. For enterprises, the requirements for blockchain are fast settlement and privacy. Fast settlement needs no further explanation, and the inherent privacy of ZKP allows enterprise private chains to verify transaction validity when interoperating with public chains without exposing the ledger information of the chain itself. The combination of the two even meets the settlement time requirements for on-chain securities and forex trading under compliance regulations.

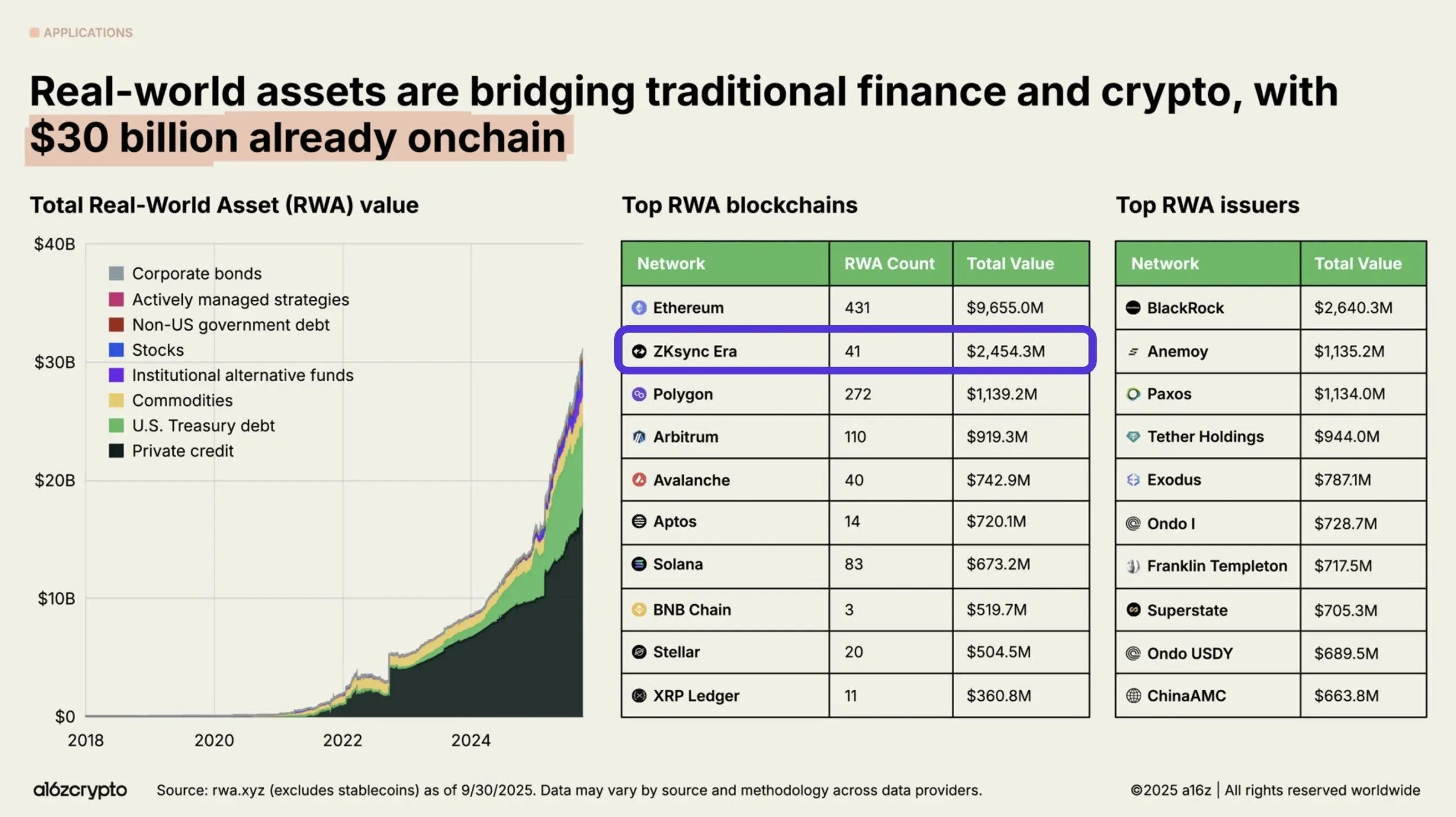

This may also be the reason why ZKsync has become the second largest tokenized RWA asset issuance network after Ethereum.

ZKsync also proudly states that all of this is only possible under the Atlas upgrade: the sequencer provides low-latency transaction packaging, Airbender generates proofs within one second, and then Gateway verifies and coordinates cross-chain messages.

Connecting L1 and L2

As Vitalik retweeted, ZKsync founder Alex believes that after the Atlas upgrade, ZKsync has truly achieved connectivity with the Ethereum mainnet.

Now, ZKsync's transaction final confirmation time (about 1 second) is shorter than the Ethereum mainnet block time (average 12 seconds), which means that institutional and RWA transactions conducted on ZKsync are essentially the same as those on the Ethereum mainnet, just waiting for mainnet confirmation. This means that ZKsync does not need to build a liquidity center on L2; it can directly use the mainnet's liquidity, because ZK Rollup's cross-chain with the mainnet does not require a 7-day challenge period like OP Rollup, and the Atlas upgrade further accelerates the process.

This improves the L2 fragmentation issue recently discussed in the Ethereum community. L2 and L1 are no longer two separate chains, but are connected as one through fast confirmation and verification, and for the first time, L2 can truly be called a "scaling network."

Recall that when ZKsync and Scroll first launched on the mainnet, transaction confirmation speed and gas fees were the same as or even higher than the mainnet. This was essentially because there had not yet been systematic algorithmic and engineering optimizations for ZKP, resulting in slow verification and high costs, which at the time triggered a trust crisis for ZK Rollup. Today, Optimism and Arbitrum are gradually transitioning from OP Rollup to ZK Rollup (or a combination of both), and the further improvements in cost and speed by ZKsync and other ZK Rollups, as well as Scroll's decentralized ZKP, have turned what was once considered "nonsense" into results worth looking forward to.

From being criticized by everyone to becoming highly sought after, ZK has ushered in a new dawn. After the sequencer and cross-chain bridge multisig are fully decentralized, perhaps it will truly be possible to achieve what Dragonfly Managing Partner Hasseb Qureshi called "can't be evil."