Bitcoin Breaks $90K but Exchange Data Shows Rising Selling Pressure

Bitcoin has surged past $90,000, and Ethereum is trading above $3,000. However, mixed on-chain data reveals a market split between selling pressure and substantial outflows.

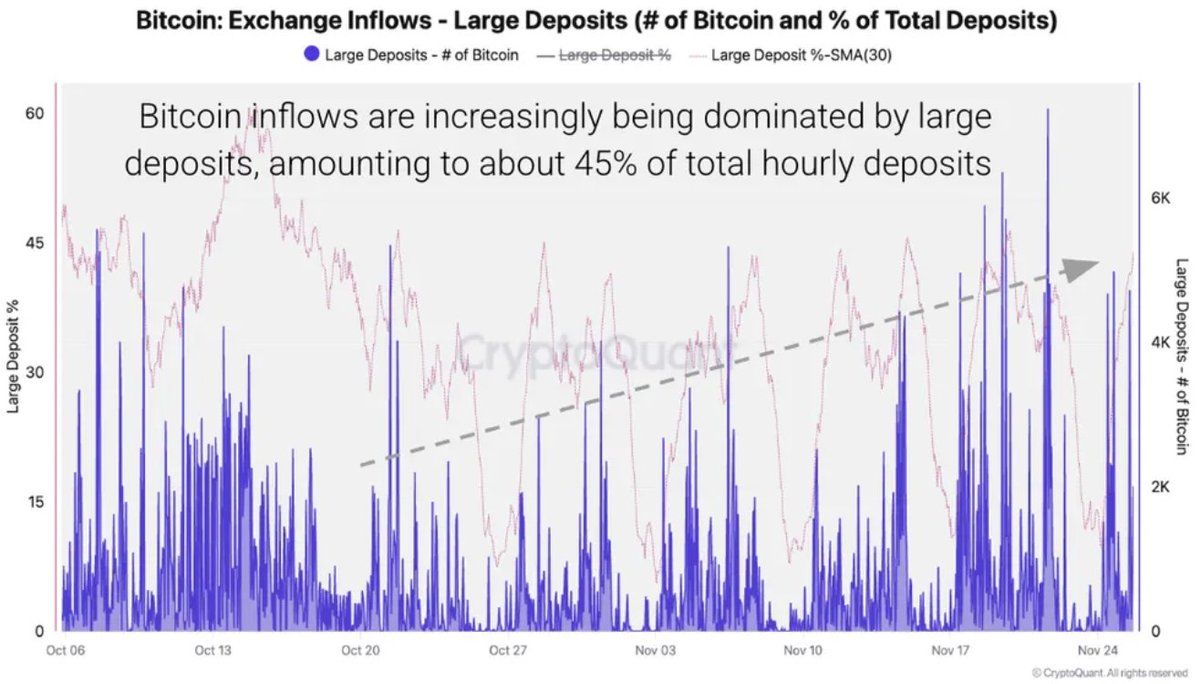

Large deposits to exchanges now represent 45% of all Bitcoin inflows, reaching 7,000 BTC on November 21, according to CryptoQuant. At the same time, an unprecedented withdrawal of 1.8 million BTC from exchanges overnight has fueled speculation about institutional moves. Binance’s stablecoin reserves stand at a record $51.1 billion, suggesting traders are preparing for greater market volatility.

Price Recovery Hides Complex Exchange Activity

Bitcoin trades at $90,418, gaining 3.12% in the past 24 hours. It peaked at $126,080 on October 6, 2025, but is now 30% below its all-time high. Ethereum shows a similar pattern, trading at $3,023.74 with a 1.74% daily increase after reaching $4,946.05 in August 2025.

The price recovery follows a correction that took Bitcoin down to temporarily $80,000 last week, prompting strong reactions in the market. Trading volumes reveal this volatility: Bitcoin’s 24-hour volume hit $69.56 billion, and Ethereum’s reached $21.27 billion.

Yet, price alone does not tell the whole story. On-chain data highlights a complicated environment. Different types of market participants are making contrasting moves, as shown by the split between price direction and exchange flows.

Rising Exchange Inflows Indicate Selling Pressure

Exchange inflow statistics raise concerns for Bitcoin bulls. CryptoQuant data reveals that large Bitcoin deposits to exchanges have climbed steadily since November 24, nearing levels last seen at the end of October. The 30-day moving average of large deposits points to sustained selling pressure.

Deposits of 100 BTC or more now account for 45% of exchange inflows, suggesting whales are preparing for major portfolio changes or liquidations.

This activity matches Bitcoin’s recent drop. Past patterns show that large deposits can lead to further price declines as major holders reduce their positions or shift strategies.

BTC and ETH inflows have totaled $40 billion this week, with Binance and Coinbase taking the lead. Increased deposits often indicate coming liquidity events or active trading strategies.

Bitcoin exchange inflows are rising as the price drops to ~87K, a seven-month low.

Large deposits (100+ BTC) now make up 45% of all inflows, hitting 7K BTC on Nov 21.

Large holders are increasingly sending BTC to exchanges, reinforcing the current downtrend. pic.twitter.com/UpN4rAL0FH

Analysts at CryptoQuant warn that these trends might reflect technical changes, such as the addition of new exchange wallets to tracking systems. Still, the overall upward trend points to real market forces at work, not just technical noise.

Massive Bitcoin Outflow Fuels Accumulation Theories

In contrast to rising inflows, a significant withdrawal stunned observers. An estimated 1.8 million BTC—about $162 billion at current prices—left exchanges in a single overnight session.

1.8 MILLION $BTC LEFT EXCHANGES OVERNIGHT

This is not normal

Someone knows something is coming pic.twitter.com/TT8PzFjpn8

This enormous outflow has led to intense speculation about institutional accumulation or strategic portfolio moves. Exchange reserves are now about 1.83 million BTC, sharply down from previous levels. Historically, falling reserves have often accompanied bullish shifts and suggest coins are moving into long-term storage.

The scale of this withdrawal dwarfs regular daily activity, signaling likely coordination among major participants. Still, experts urge caution—some of the movement could result from technical changes, treasury actions, or shifts in institutional custody.

Record Stablecoin Reserves Show Market on Edge

Adding to the uncertainty, Binance’s stablecoin reserves now stand at an all-time high of $51.1 billion. Traders appear to be positioning for buying chances or hedging against more price swings as stablecoins build up on exchanges.

This accumulation of stablecoins comes amid a market correction and wild swings in trading volume. Spot trading volumes peaked near $120 billion, then stabilized. Binance and Coinbase continue to dominate both spot and derivatives action.

Ethereum has moved in tandem with Bitcoin throughout this period. Like Bitcoin, it faces increased deposits and active trading, showing both potential selling and ongoing market engagement.

The post Bitcoin Breaks $90K but Exchange Data Shows Rising Selling Pressure appeared first on BeInCrypto.