Research Report|In-Depth Analysis and Market Cap of Rayls (RLS)

Bitget2025/12/01 09:51

By: Bitget

一、Project Overview

Rayls is an EVM-compatible blockchain system combining a public KYC-enforced L2 chain with permissioned private subnets, designed for compliant integration between Traditional Finance (TradFi) and Decentralized Finance (DeFi). Developed by fintech company Parfin, Rayls enables real-world asset (RWA) tokenization, CBDC settlement, and cross-chain transfers while prioritizing institutional privacy, regulatory controls, scalability, and interoperability.

Its architecture consists of three core modules: Rayls Privacy Node (institution-exclusive private EVM chains supporting asset tokenization and confidential transfers), Rayls Private Network (a concentric hierarchical permissioned network enabling data privacy, on-chain governance, and elastic scalability), and Rayls Public Chain (an EVM-compatible public chain featuring USD-pegged predictable gas fees, high throughput, and enterprise-grade usability).

Rayls is built on a high-performance Reth execution client, an RBFT/Axyl consensus mechanism (sub-second block times and large-scale TPS), the Enygma privacy protocol (ZKP + post-quantum encryption for anonymous and confidential transfers), and an on-chain identity service (KYB/KYC proofs supporting compliance with partial anonymity). Differentiators include institution-dedicated privacy nodes, USD-pegged gas, predictable fast finality, MEV-resistant architecture, confidential transactions, Ethereum-grade security inheritance, and a full identity framework—tailored for financial institutions while preserving DeFi liquidity.

As of 2025, Rayls is deployed in production by Núclea (the largest FMI in the Southern Hemisphere) and Cielo (Brazil’s largest card acquirer), and is part of the Brazilian Central Bank’s Drex CBDC pilot. A public testnet launched in June 2025, with TGE set for December 1, 2025. Coinbase has added Rayls to its listing roadmap. The project is currently in global expansion with clear network effects and enterprise-level adoption.

二、Project Highlights

Institution-grade Blockchain Infrastructure Connecting TradFi and DeFi

Rayls adopts an EVM-compatible dual-layer architecture focused on tokenized financial liquidity and cross-border settlement. The cooperative model of private permissioned chains and a public chain allows banks and payment institutions to access compliant, privacy-preserving, and scalable blockchain infrastructure. Rayls is already in production with leading institutions such as Núclea and Cielo and has been deployed across a permissioned network of 25+ global banks.

Advanced Privacy Protection and Compliance-First Design

To meet financial clients’ requirements for data confidentiality and regulatory oversight, Rayls integrates the Enygma privacy protocol, combining ZK proofs and on-chain identity management for verifiable compliance and selective privacy. The identity service supports encrypted KYC/AML validation with auditability. Enygma has been tested and deployed by the Brazilian Central Bank and institutions such as JP Morgan.

High Efficiency and Predictability for Financial Use Cases

The public chain uses USD-denominated fixed gas fees, eliminating fee volatility. Powered by RBFT/Axyl consensus, Rayls ensures sub-second finality with no reorg risk—crucial for real-time financial settlement. Encrypted mempools and fair-ordering mechanisms provide robust MEV protection. The Axyl prototype has demonstrated up to 250,000 TPS.

Tokenomics and Market Progress

RLS is the native asset for all fees, staking, and governance. 50% of every transaction fee is burned (deflationary), and 50% rewards network validators. Rayls has raised $38M from investors including ParaFi, Framework, and Tether, and is listed on the Coinbase roadmap. The testnet has 340,000 users and a 300,000-member community, reflecting strong institutional and retail traction.

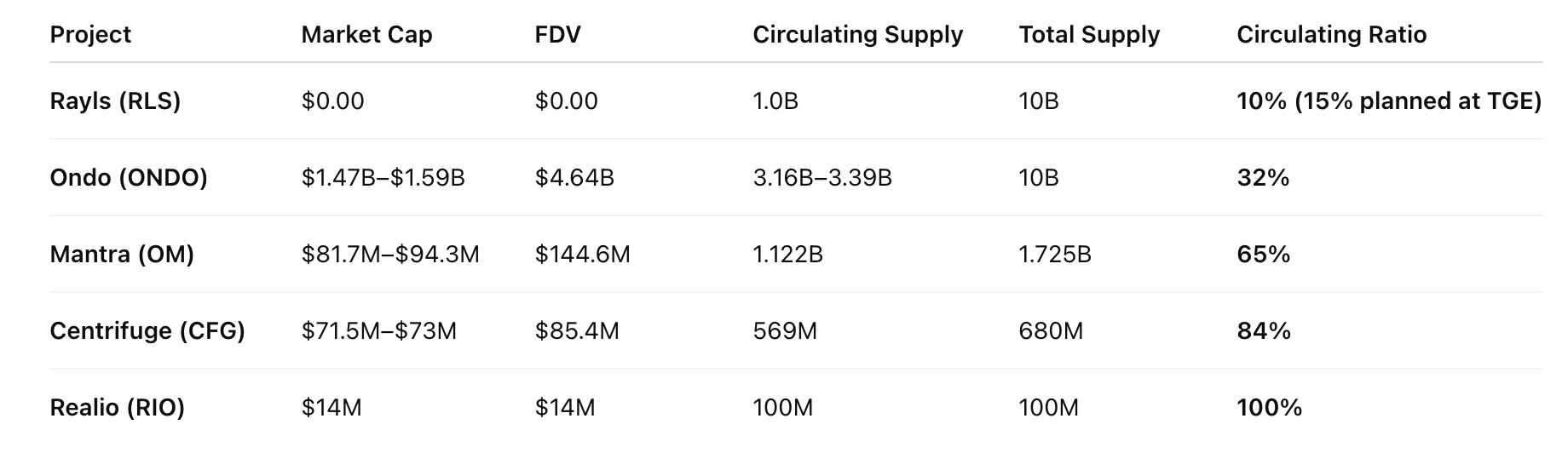

三、Market Cap Expectations

Rayls is positioned as a leading project in compliant blockchain infrastructure, leveraging a hybrid privacy network and dual-chain architecture. Public data shows it has raised $38M with an $800M valuation, over 25 enterprise deployments, and 340,000+ testnet users, placing Rayls among the strongest candidates in the global RWA infrastructure sector.

四、Token Economics

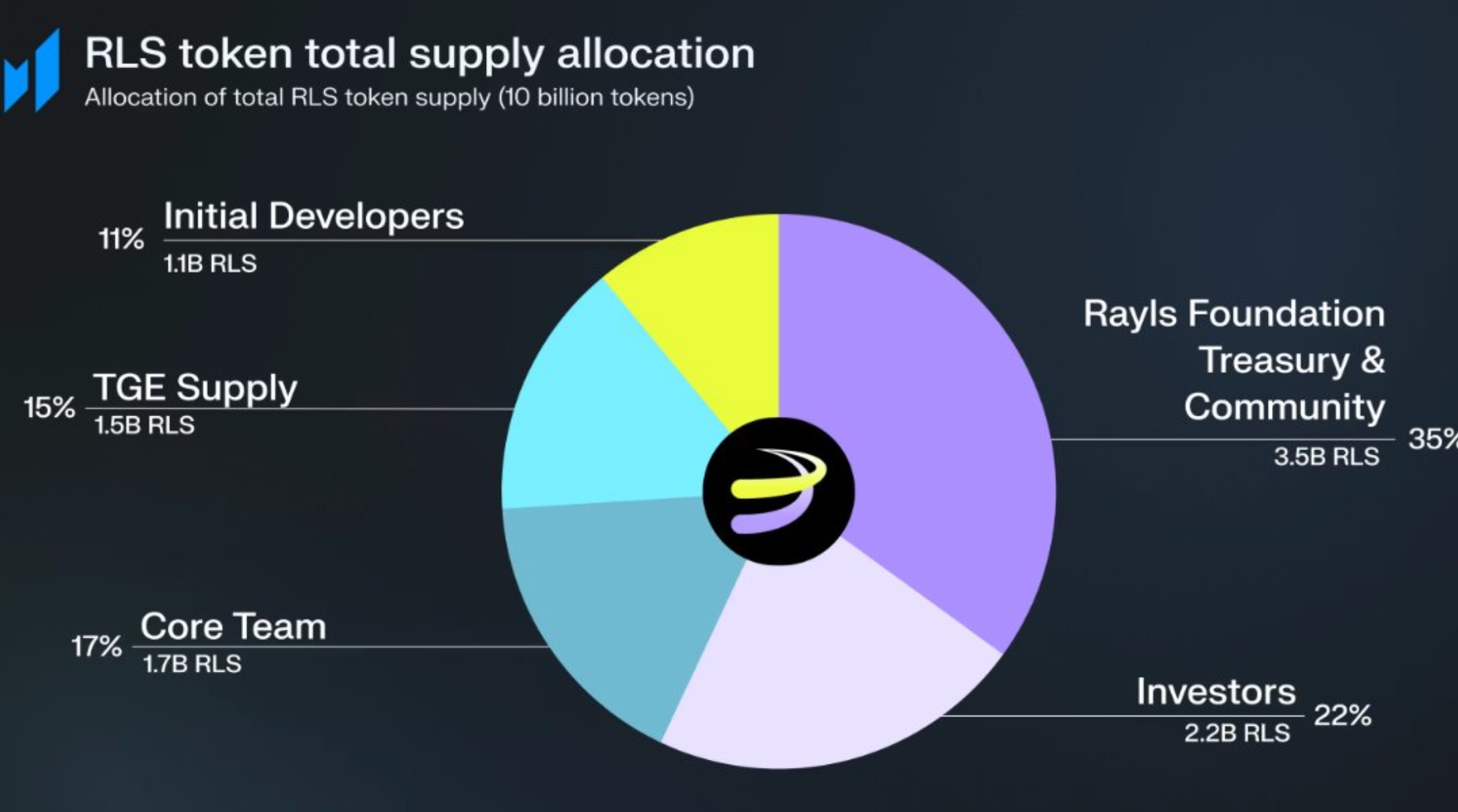

Total Supply: 10 billion RLS

Foundation / Community / Treasury – 35%, Allocated to ecosystem incentives, partner expansion, and long-term project development.

Investors – 22%, Distributed to early institutional investors and strategic partners.

Core Team – 17%, Reserved for core contributors with long-term lockups and linear vesting schedules.

Early Developers – 11%, Rewards for early technical contributors and builders.

Other / Public & Liquidity Programs – 15%, Used for public sales, liquidity programs, market expansion, and initial TGE circulation (15%).

Token Utility

Staking: RLS secures the network; stakers receive rewards.

Transaction Fees: All transactions and services require RLS; 50% of fees are burned and 50% go to validator incentives.

Governance: Used for proposals and voting on key protocol parameters.

Network Value Capture: Institutional adoption drives long-term demand for RLS.

Deflationary Design

Greater network activity results in more RLS burned, reducing circulating supply over time and strengthening value capture.

五、Team and Funding Information

Team Overview

Marcos Viriato, Co-Founder & CEO of Parfin and Rayls, has 25+ years of banking and fintech experience, including CTO and CEO roles at BTG Pactual.

Alex Buelau, Co-Founder & CPO/CTO, has built crypto infrastructure since 2013 and founded CoinSchedule, one of the largest ICO platforms during 2016–2017.

Tom Dickens, CMO, has 17+ years of global brand and Web3 marketing experience, focusing on growth strategies and regulatory-aligned blockchain adoption.

Peter Bidewell, Head of Product, is an enterprise blockchain expert leading product development and go-to-market efforts.

Dr. Jacob Mendel, Co-CTO, holds a PhD in cybersecurity and distributed systems and previously worked at Intel and State Street Bank.

Jiten Varu, Head of Growth, has 20+ years of fintech and banking experience, including prior roles at AWS and Credit Suisse.

The team is composed of experienced professionals from TradFi, blockchain engineering, and enterprise products, with transparent identities and no notable red flags.

Funding History

Rayls (via Parfin) has raised $32.3M–$38M across multiple rounds:

2021 Seed: $1.3M led by Valor Capital Group.

2021 Seed Extension: $6M led by Valor Capital and Alexia Venture Capital.

January 2023 Seed Round: $15M led by Framework Ventures and Valor Capital.

2023 Strategic Investment: Accenture Ventures (amount undisclosed).

May 2024: Mastercard Start Path incubation support.

August 2024 Series A: $10M led by ParaFi Capital with participation from Framework, L4 Venture Builder, and Núclea.

November 2025 Strategic Round: Led by Tether (amount undisclosed).

These investments support development from early architecture to global mainnet deployment.

六、Risk Warning

Rayls begins with a low initial circulating supply of 10–15%, while investors and the team collectively hold 39% that will unlock over time, creating structural sell-pressure risk. With limited early TVL and still-developing on-chain use cases, demand may initially be insufficient to absorb upcoming unlocks.

七、Official Links

Website: https://www.rayls.com

X (Twitter): https://x.com/RaylsLabs

Disclaimer: This report is AI-generated and manually verified for information accuracy. It does not constitute investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

Lock now!

You may also like

Crypto prices

MoreBecome a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now