On-chain High-Stakes Gamble: Monad FDV Sparks Controversy, Is It Urgent for Polymarket to Refine Its Rules?

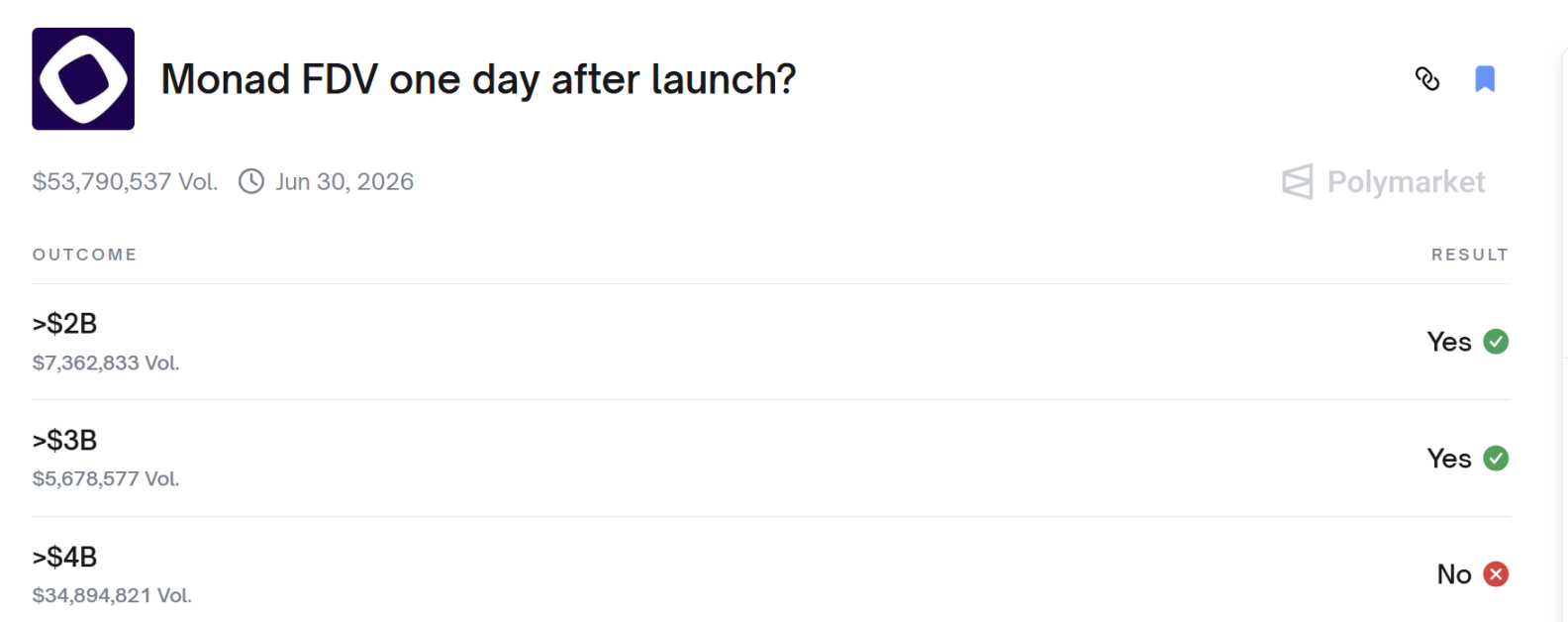

Monad's FDV exceeded 4 billions the day after launch?

Written by: 1912212.eth, Foresight News

At around 10:00 PM on November 24 (UTC+8), Monad mainnet went live, and MON officially began token trading. Although its price briefly fell below the initial offering and then rebounded sharply, on November 25, some players on Polymarket were in heated debate. Perhaps they didn’t participate in the Coinbase public offering, nor did they bet on MON token price movements in the secondary market, but they were all focused on the results of a prediction market: "Will Monad's FDV exceed 4 billions the day after launch?"

The result showed it did not exceed 4 billions, and players who bet YES were instantly outraged, expressing their dissatisfaction with the ruling, because the MON token price exceeded $0.04 within the specified time, meaning the FDV surpassed 4 billions.

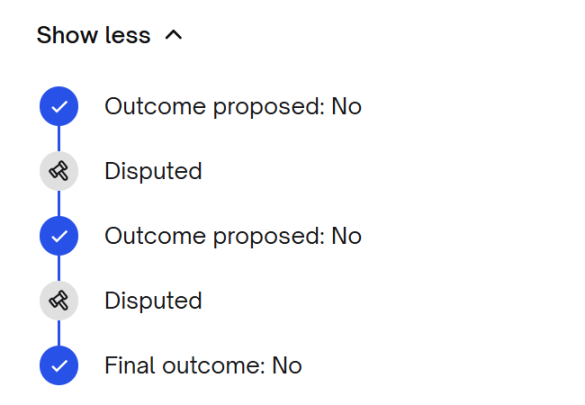

After the result was disputed, the first arbitration vote still showed NO, and after a second round of controversy, it was still ruled as NO.

So, what exactly were the rule details for this prediction market?

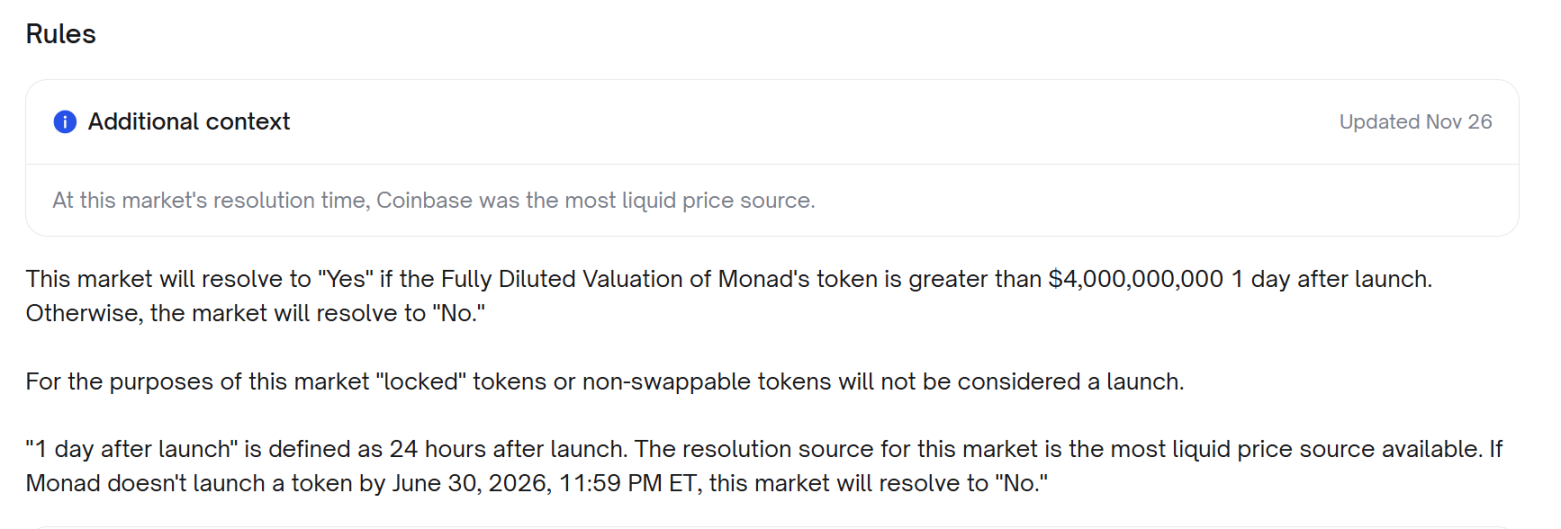

According to the rules, if Monad's token has a fully diluted valuation exceeding 4 billions USD 24 hours after issuance, the market outcome is "YES". Otherwise, the outcome is "NO". For this market, the issuance of "locked" or non-tradable tokens is not considered official issuance. "24 hours after issuance" is defined as 24 hours after the token launch. The market's judgment will use the most liquid price source available. If Monad fails to issue tokens by 11:59 PM ET on June 30, 2026, the market outcome is "NO".

Note that Coinbase was added as a price source on November 26, which was after the result was announced.

MON officially began trading on the evening of November 24. Now the key question: who is the most liquid price source? Did the price from that source exceed $0.04 on November 25?

Dispute Between Coinbase and Upbit as Price Sources

The "YES" supporters argued that the rules required using the most liquid trading venue at the T+24 hour mark (determined by actual trading volume). According to CoinGecko, Upbit accounted for 35.88% of global spot trading volume, while Coinbase accounted for 18.39%, indicating that Upbit was the most liquid price source at the time of judgment. At that time, Upbit's MON price was about $0.0403, meaning its FDV exceeded 4 billions USD.

Supporters pointed out that the market creator only added "Coinbase is the most liquid source" as a condition near the end of the market, which was essentially a retroactive rule change, since the original rules never specified Coinbase and clearly required using the most liquid trading venue. Supporters also mentioned that during the relevant period, Coinbase's API candlestick chart showed its price reached about $0.04168, corresponding to a fully diluted valuation between 4 billions and 4.16 billions USD, contradicting the claim that "Coinbase price never exceeded the threshold."

Furthermore, further analysis of order book depth and 24-hour trading volume showed that Upbit provided better quantifiable liquidity for MON than Coinbase, and independent liquidity assessments also confirmed that Upbit's liquidity was deeper and more active. At the T+24 hour mark, Upbit's 1-second chart showed MON's KRW price at 5,920 KRW, which, converted at the standard exchange rate, exceeded $0.04. If the correct liquidity source was used, its fully diluted valuation would also exceed 4 billions USD.

The dispute between Coinbase and Upbit was essentially a battle over which had superior liquidity.

The "NO" side consistently cited the "liquidity score" from CoinMarketCap.

But YES supporters argued that anyone truly involved in trading knows: liquidity = actual traded amount, and real liquidity is where the money actually flows. At the time, Upbit's trading volume was about $448 millions, while Coinbase's was about $232 millions, with the former being twice the latter. This was indisputable.

"You can't just ignore a venue that accounts for half the global trading volume simply because its price doesn't fit your narrative."

So how does UMA's mechanism on Polymarket generally handle disputed results?

UMA (Universal Market Access) is a "decentralized oracle + arbitration system" for on-chain contracts, with its core function being to provide an "optimistic" data verification method.

Typically, there are four roles in the market: proposer, challenger, UMA's Optimistic Oracle, and DVM (Data Verification Mechanism).

After the market closes, the person submitting the "result statement" (the proposer) stakes a deposit to back their statement. If someone believes the statement is wrong, a challenger can initiate a dispute during the challenge period by staking an equal deposit. UMA's Optimistic Oracle will escalate the issue to the DVM if the result is challenged. Finally, UMA token holders/stakers vote (usually via commit/reveal) to determine the final outcome, with rewards for the correct side and penalties for those who vote incorrectly or abstain.

The dispute resolution process between Polymarket and UMA went through three rounds:

- First round: The data team directly proposed No based on Coinbase price.

- Second round: YES holders immediately initiated a Dispute, submitting evidence that Upbit's 24-hour trading volume was actually higher than Coinbase's, and CoinGecko showed the average FDV had exceeded 4 billions, causing UMA voting to briefly lean toward reversal.

- Third round: The No side submitted more detailed on-chain and order book data, proving Upbit's depth was very poor, the premium was mainly caused by a few addresses aggressively sweeping orders, and Coinbase's 10% buy/sell depth was more than 15 times that of Upbit. UMA finally confirmed No on November 28.

The entire process took dozens of hours (UTC+8), and also consumed a lot of players' trust.

Only Specific Rules Can Prevent Disputes

This controversy exposed the most fatal rule loophole in prediction markets, which will continue to create systemic unfairness if not fixed.

The definition of "most liquid price source" is vague, and subsequent rules referred to using Coinbase as the price source, which was hard to convince the public. If it had been stated in advance that among Coinbase, OKX, Binance, and Upbit, whichever exchange first officially launched spot trading would be used as the price source, there probably would have been no controversy.

After the incident, some players publicly mocked the so-called "decentralized prediction market has died from centralized manipulation."

The deeper lesson is: what prediction markets truly lack is not liquidity, but credible final adjudication.

Whenever rules leave any gray area, the side with the most capital can always muddy the waters by manipulating local markets or initiating disputes, ultimately turning retail investors into targets for harvesting. If Polymarket continues with the current "creator writes rules → UMA votes as backstop" model, similar farces will inevitably repeat.

The solution may be to standardize, template, and make unchangeable the core rules for all high-value markets.

First, the price source must be one of three options, and cannot be changed after creation:

A. CoinGecko 24h volume-weighted average price

B. A specified single CEX (must be locked in advance)

C. CoinGecko average price after removing the highest/lowest 20% of exchanges, then taking the arithmetic mean

Second, rules should be more detailed to prevent manipulation: if any exchange's price deviates from the weighted average price by ±30% for more than 2 hours, that exchange's data is automatically excluded.

As long as a few such rules are written into the platform agreement rather than individual market descriptions, incidents like Monad will not happen again. Otherwise, the next 4 billions or even 40 billions FDV market will still become a major point of controversy, or even a slaughterhouse where market makers and rule loopholes jointly harvest retail investors.