News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Gold and Silver Rebound with Gold Back Above 5000; Nikkei 225 Hits New Historical High; US-India Reach Interim Trade Framework (February 9, 2026)2Why Alphabet's Free Cash Flow May Remain Resilient Even as the Market Worries - Strategies for Investing in GOOGL3Bitcoin Price Prediction 2026-2030: Unveiling the Critical Path for BTC’s Future Value

a16z crypto division invests $50 million in Jito for token allocation

PANews·2025/10/16 13:49

Chainlink has chosen to implement a unique native real-time oracle on MegaETH, driving the birth of the next generation of high-frequency DeFi applic

Establishing High Performance Standards: The Chainlink Oracle Network brings ultra-low latency market data to the first-ever real-time blockchain, ushering in a new narrative for on-chain finance.

BlockBeats·2025/10/16 13:16

Hodl or take profits? Bitcoin bear market cycle started at $126k

CryptoSlate·2025/10/16 13:00

Seascape is launching its first BNB Vault Strategy on the BSC chain.

Seascape Foundation will launch its first on-chain BNB Treasury Strategy

BlockBeats·2025/10/16 13:00

Stop fantasizing, the altcoin season may not come

Bitpush·2025/10/16 12:16

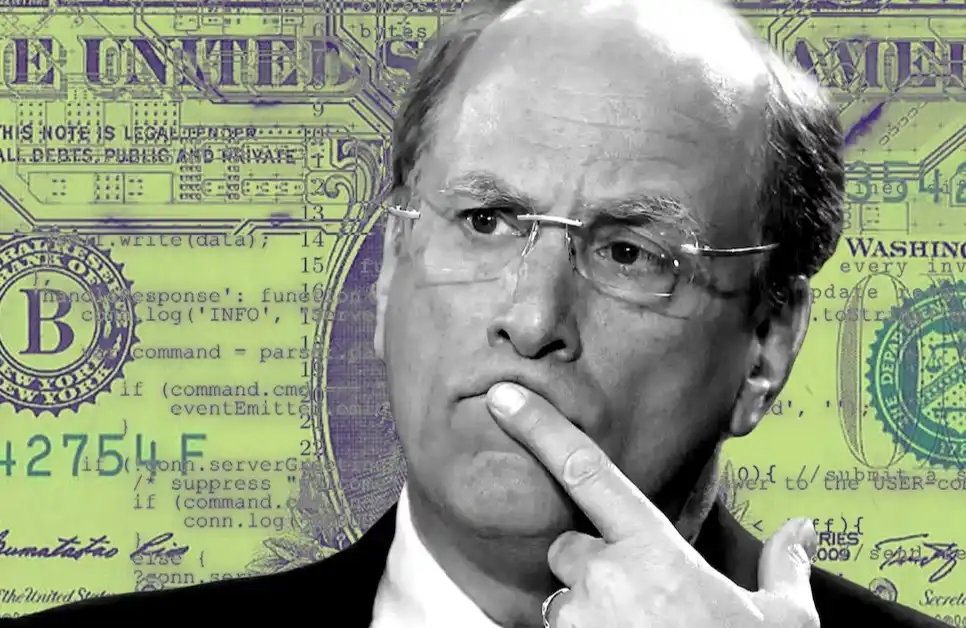

BlackRock CEO: Crypto Wallets Hold Over $4 Trillion in Assets, 'Asset Tokenization' Is the Next Financial Revolution

BlackRock has revealed that its goal is to bring traditional investment products such as stocks and bonds into the digital wallet, which is over a $4 trillion ecosystem.

BlockBeats·2025/10/16 12:00

220,000 Bitcoin Addresses Vulnerable: US Government Revealed Novel Exploit

A hidden Bitcoin wallet flaw has surfaced after a $15 billion seizure by the US government. With 220,000 wallets exposed, users should act quickly to check their security and abandon compromised addresses.

BeInCrypto·2025/10/16 11:44

Flash

12:08

Deutsche Bank raises Eli Lilly's target price to $1,285Glonghui, February 9th|Deutsche Bank: Raised Eli Lilly (LLY.US) target price from $1,200 to $1,285.

12:00

A certain exchange's Ventures: Market operates under pressure amid increasing macro uncertainty, with both defensive capital strategies and structural opportunities coexisting.PANews, February 9 – According to the latest crypto weekly report released by a certain exchange, since the beginning of February, global macro uncertainty has continued to intensify. Divergences remain regarding expectations for the rate cut path, the pace of balance sheet reduction, and the coordination of fiscal and monetary policies. Several key macroeconomic data will be released intensively this week, becoming important variables for short-term market pricing. Against this backdrop, the overall crypto market has been under pressure, with bitcoin and ethereum dropping 8.6% and 7.9% respectively over the week. Related ETFs have seen historic net outflows, and market sentiment remains in the "extreme fear" range. Meanwhile, gold and risk assets have fluctuated in tandem, reflecting continued caution in overall financial market risk appetite. At the industry level, structural progress continues. Polymarket and Circle announced a partnership, migrating their settlement system to native USDC, further strengthening the application of compliant stablecoins in on-chain scenarios. In terms of investment and financing, a total of 12 financing deals were completed last week, with funds mainly flowing into the infrastructure sector. Among them, Tether made a strategic investment of $100 million in Anchorage Digital, further expanding its compliant crypto infrastructure layout; TRM Labs completed a $70 million financing round, continuing to expand its crypto intelligence and compliance capabilities. Overall, short-term market volatility pressures persist, but capital and industry development are gradually focusing on defensive attributes and long-term structural opportunities.

11:55

Bitcoin and major tokens decline as derivatives data indicate risk-off sentimentBitcoin continues its recent downward trend, stabilizing below $70,000. Derivatives data shows a clear risk-averse sentiment in the market, including a decline in futures open interest, negative funding rates, an increase in short positions, and rising implied volatility, indicating strong demand for short-term downside protection. In addition, the new token RNBW from crypto wallet Rainbow has dropped about 75% from its ICO price due to distribution delays and infrastructure issues.

News