News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Fed Hawkish Stance; Google Bond Oversubscribed; Robinhood Profit Decline (February 11, 2026)2'If individuals around the globe understood what I do': MicroStrategy's Michael Saylor shares a viral statement regarding MSTR shares and Bitcoin potentially reaching $10 million3Robinhood launches public testnet for blockchain built on Arbitrum

Bank of England Clarifies Stablecoin Limits Are Only Temporary, Aims for Smooth Transition

DeFi Planet·2025/10/16 22:45

Australia Tightens Grip on Crypto ATMs Amid Surge in Scam and Laundering Cases

DeFi Planet·2025/10/16 22:45

Singapore’s MAS Unveils BLOOM Initiative to Advance Global Tokenized Finance

DeFi Planet·2025/10/16 22:45

SEC Chair Paul Atkins Says U.S. Is ‘10 Years Behind’ in Crypto, Pledges Stronger Framework for Innovation

DeFi Planet·2025/10/16 22:45

Jito’s JTO token rises on a16z’s $50 million investment in Solana staking protocol

Coinjournal·2025/10/16 22:42

Ripple (XRP) makes $1B move into corporate finance with GTreasury acquisition

Coinjournal·2025/10/16 22:42

Bitcoin Demand Plummets as Market Momentum Weakens — What’s Next for BTC Price?

Cryptoticker·2025/10/16 22:33

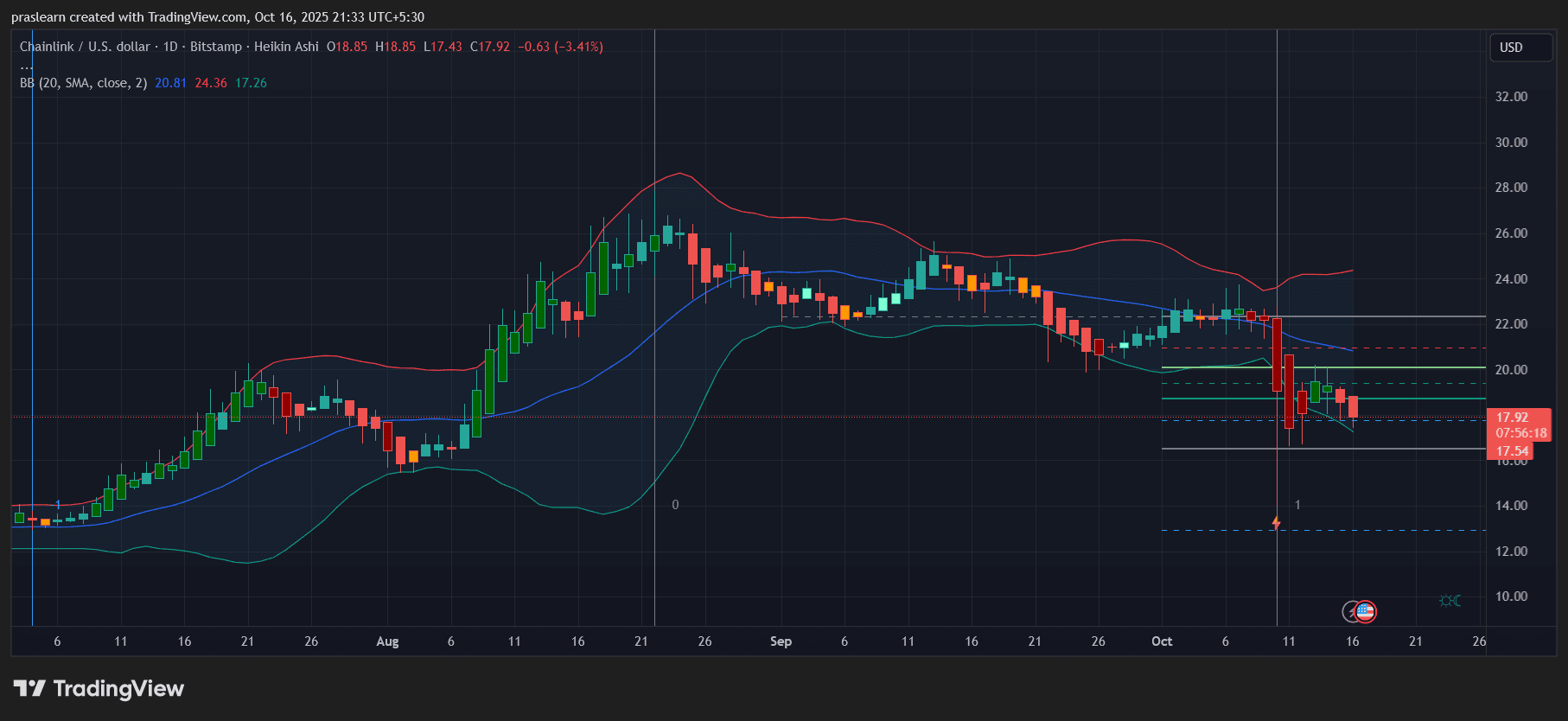

Will Chainlink’s MegaETH Integration Trigger the Next Big Rally?

Cryptoticker·2025/10/16 22:33

Hyperliquid Leads $1.4 Billion Token Buyback Wave Sweeping Crypto in 2025

Token buybacks have exploded in 2025, surpassing $1.4 billion as protocols like Hyperliquid, LayerZero, and Pump.fun lead the charge. The trend reflects growing profitability and a shift toward sustainable, value-driven tokenomics.

BeInCrypto·2025/10/16 22:10

Nearly $6 Billion in Bitcoin and Ethereum Options Expire Amid Bearish Market Sentiment

Bitcoin and Ethereum options markets flash warning signs as traders load up on downside protection, reflecting fragile confidence after renewed volatility, macro uncertainty, and the Selini Capital crisis.

BeInCrypto·2025/10/16 21:59

Flash

11:36

Investment firm D.A. Davidson has announced an upgrade of Tyler Technologies' stock rating from "Neutral" to "Buy"However, the institution has simultaneously lowered its target share price from $510 to $460.

11:33

Odaily Evening News1. A certain exchange has partnered with Franklin Templeton to launch an institutional OTC collateral program; 2. Non-farm payrolls are expected to see the largest annual downward revision in history, and the US Dollar Index is expected to remain volatile before the data is released; 3. Matrixport: Retail buying demand remains insignificant, extending the current consolidation phase; 4. Strategist: The Federal Reserve's anti-inflation battle is nearing its end, and the inflationary impact of tariffs is expected to gradually fade in the second half of the year; 5. Hyperliquid's largest ETH long position increased by 5,000 ETH, with a current total unrealized loss of $10.43 million; 6. Trend Research's ETH long position ultimately lost $869 million; 7. The "ETH long address with $204 million" increased its ETH long position by 5,000 in the past 50 minutes, with a total unrealized loss exceeding $10.03 million; 8. A major trader who previously profited $673,000 has built a position of 3,700 ETH; 9. Machi Big Brother's 25x leveraged ETH long position was partially liquidated again, with cumulative losses exceeding $27.52 million; 10. A whale suspected to be related to Matrixport went long 105,000 ETH on Hyperliquid, with a current unrealized loss exceeding $10 million.

11:30

Consensys founder predicts a breakthrough in the DeFi sector by 2026Consensys founder and CEO Joe Lubin stated in an interview at Consensus Hong Kong 2026 that the security of "blue-chip" decentralized finance (DeFi) protocols is now on par with traditional finance. He believes that global banks are being "devalued" and becoming less secure, predicting that the DeFi sector will experience a true breakthrough in 2026. Regarding bitcoin, Lubin mentioned that "Q Day" (the moment when quantum computers may break current cryptographic technology) poses an "existential issue" for bitcoin, but he believes this moment is still far off, while artificial intelligence will accelerate technological development. He stated that Ethereum will soon be in a good state, while other blockchains may face technical challenges and systemic risks in the future.

News