Bitcoin and Ethereum Options Markets Show Mixed Signals, with Dominance of Bearish Options

Reportedly, as the price of Bitcoin maintains around $44,000, the options market is displaying mixed signals. According to data from the options tracking website Greeks.Live, in the bulk trading of Bitcoin and Ethereum, the dominant trend is the purchase of bearish options, with a total value reaching $100 million. Specifically, bearish options for Bitcoin amount to $13 million, while those for Ethereum amount to $88 million. This suggests a prevailing inclination among institutional investors towards a bearish outlook. Of particular note is the involvement of large transactions related to out-of-the-money options, such as Bitcoin's P1,600 and Ethereum's P37,000, set to expire at the end of January. These trades highlight that market giants, often referred to as whales, are increasing their bearish positions amid the bullish sentiment in the market. Greeks.Live advises traders to exercise caution, recognizing the downside risks in the options market.

Since mid-October, the price of Bitcoin has experienced a significant increase, surpassing a growth of over 60%. This optimistic sentiment resurgence stems from expectations of changes in the Federal Reserve's monetary policy and the increased likelihood of the launch of a spot Bitcoin ETF. Regarding the latter, Derebit recently revealed that traders in the options market are increasingly betting on Bitcoin reaching $50,000 in January. This aligns with the prediction of the digital asset financial services platform Matrixport, which forecasted a Bitcoin price of $50,000 by the end of January 2024 following SEC approval.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

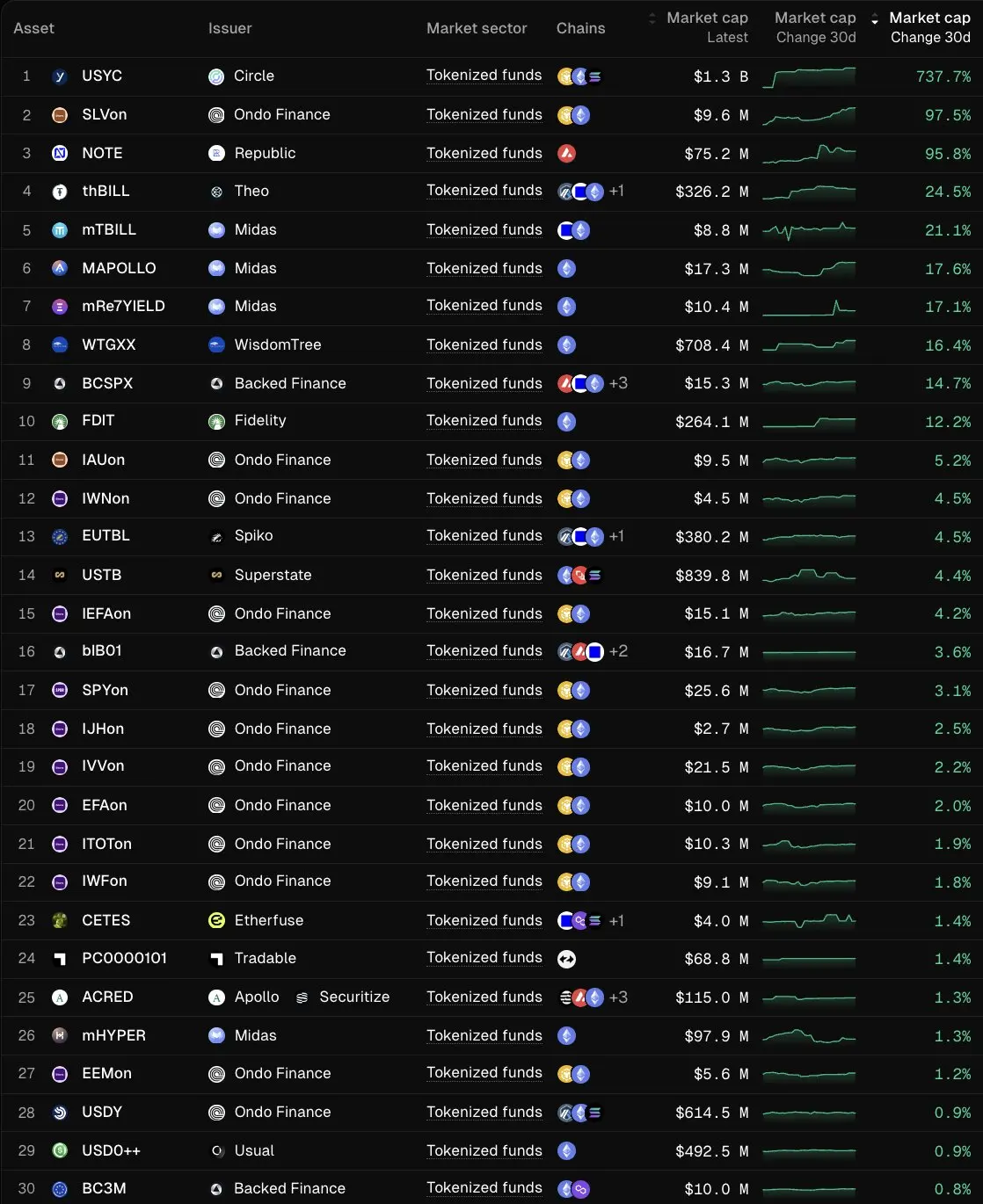

Circle CEO: Tokenized Fund USYC Sees 737.7% Market Cap Growth in the Past 30 Days

Data: Hyperliquid open interest reaches $7.73 billions, marking seven consecutive days of growth

AllScale: A total of $5 million in invoice settlements has been completed.