Greeks.live: Options block trades are starting to see active put buying suggesting institutional investors are not very bullish on the ETF market

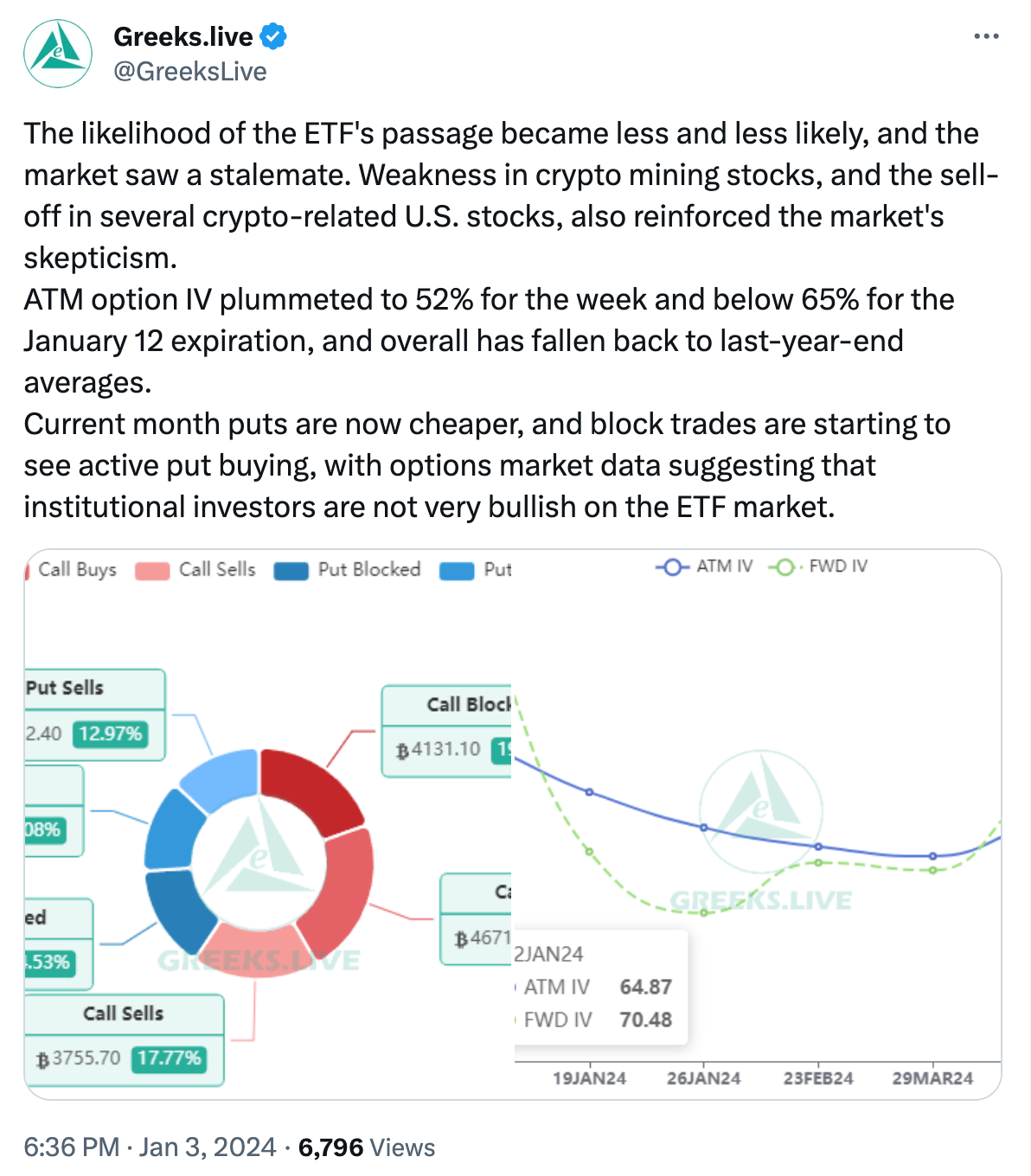

The likelihood of the ETF's passage became less and less likely, and the market saw a stalemate. Weakness in crypto mining stocks, and the sell-off in several crypto-related U.S. stocks, also reinforced the market's skepticism. ATM option IV plummeted to 52% for the week and below 65% for the January 12 expiration, and overall has fallen back to last-year-end averages. Current month puts are now cheaper, and block trades are starting to see active put buying, with options market data suggesting that institutional investors are not very bullish on the ETF market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Byreal leads the Solana XAUt0 market with a 93% market share and a 24-hour trading volume of 640.72K

Bank of Korea warns of stablecoin depegging risks, calls for banks to lead issuance

Strive increases its holdings by 72 bitcoins, now holding a total of 5,958 bitcoins.

Stablecoin company Loon completes approximately $2.15 million seed round financing