Bloomberg Analyst: BlackRock's BTC holdings in its physical ETF will eventually surpass MicroStrategy

Bloomberg analyst Eric Balchunas posted on the X platform that BlackRock's Bitcoin Spot ETF (IBIT) is most likely to surpass GBTC and become the king of liquidity in Bitcoin spot ETF products. The total trading volume of the U.S. Bitcoin Spot ETF in its first three days was close to $10 billion.

Eric Balchunas pointed out that a total of 500 ETFs were launched in 2023, and now these ETFs have a total trading volume of $450 million. The best-performing one has a trading volume of $45 million, while just BlackRock's IBIT exceeds the combined trading volumes of these 500 ETFs.

Eric Balchunas said: "Half of today's 500 ETFs have a trading volume less than $1 million. It’s hard to get trade volumes, even harder than liquidity because trade volumes must naturally form in the market and cannot be faked; they give an ability for continuous operation to an ETF."

Eric Balchunas also stated that BlackRock's position is strengthening regarding bitcoin holdings; now it’s not about “if” but “when” it will surpass MicroStrategy. Analysis found that the total transaction volume between Blackrock and Fidelity two bitcoin spot ETFS exceeded $3.1 billion, with most being inflows. In contrast, although Grayscale GBTC and ProShares' BITO products had respective transaction volumes reaching $4.65 billion and $3.26 billion accounting for over 60% of total transactions, most were outflows possibly due to investors choosing to sell after recouping losses from last year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street giant Cantor Fitzgerald launches a Bitcoin and gold fund

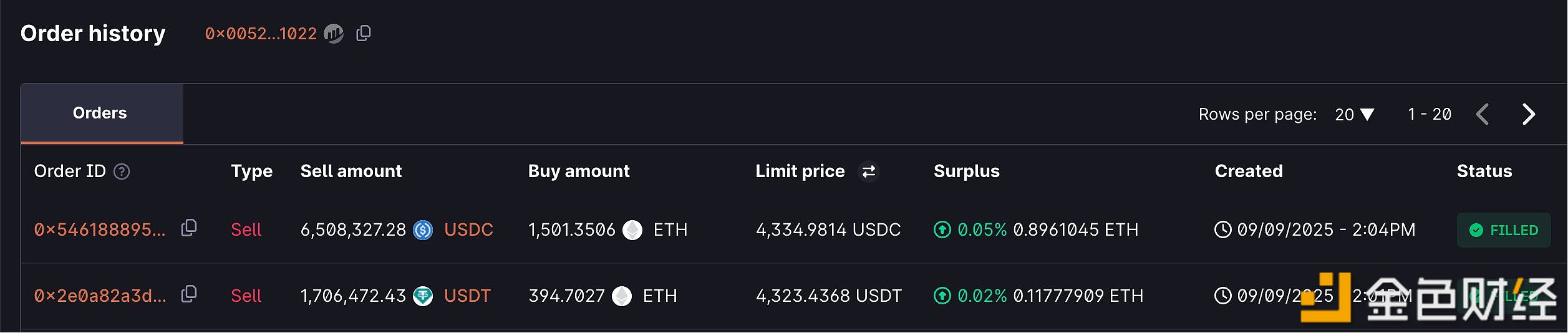

Swing whale pfm.eth spent about $8.21 million to purchase 1,896 ETH within 40 minutes

A certain whale deposited $5.17 million USDC into HyperLiquid and opened a 5x leveraged long position on HYPE.

A swing whale spent 6.508 million USDC and 1.706 million USDT to purchase 1,896 ETH.