Bitcoin ETFs Have Traded $10B Since Launch, Hold 34.5K BTC

Trading for newly launched spot Bitcoin exchange-traded funds has been booming in the three days since they went live on exchanges.

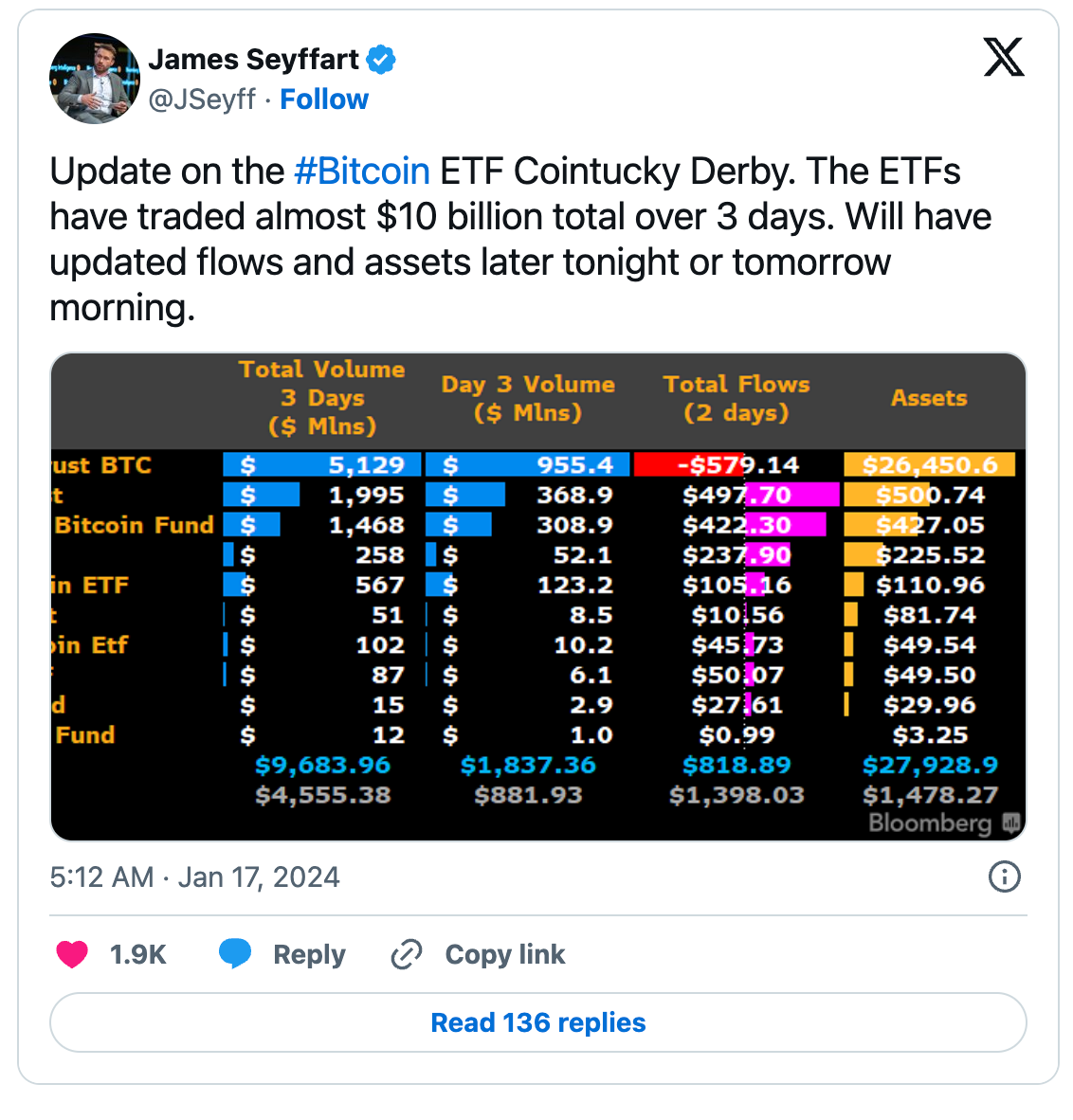

Almost $10 billion has been traded in spot Bitcoin ETFs in the first three days since they launched last week.

On Jan. 17, Bloomberg ETF analyst James Seyffart posted the updated figures revealing $9.7 billion in volume.

Moreover, Grayscale has the lion’s share of this, with 52% or $5.1 billion in trade volume .

Update on the #Bitcoin ETF Cointucky Derby. The ETFs have traded almost $10 billion total over 3 days. Will have updated flows and assets later tonight or tomorrow morning. pic.twitter.com/OnpCshjYJP

— James Seyffart (@JSeyff) January 16, 2024

ETF Trading Surges

However, it is not all capital inflows since many investors were switching strategies. Some have sold GBTC to move into alternatives with better fees, and others have switched out of futures-based funds in preference for a spot-based product.

According to data from CC15Capital posted on Jan. 17, Grayscale’s Bitcoin Trust saw outflows of 11,188 BTC.

Moreover, the total number of BTC held was 34,589, worth an estimated $1.48 billion at current prices.

LATEST #Bitcoin Holdings tracking schedule 👇

1.) $GBTC finally updated 1/12 data, showing 11,188 $BTC outflow

2.) Net increase on Day 1 (1/11) of 10,625 $BTC

3.) Net increase on Day 2 (1/12) of 5,011 $BTC $IBIT $FBTC $ARKB $BITB $BRRR $BTCO $HODL $EZBC $BTCW $DEFI $GBTC pic.twitter.com/5qGXa7VGk7

— CC15Capital 🇺🇸 (@Capital15C) January 17, 2024

“Today is likely to be a net outflow day for the Bitcoin ETFs,” said Seyffart, who added:

“Estimating ~$594 million left GBTC for a total of $1.173 billion in outflows. Most others saw inflows but doubt its enough to offset nearly $600 mln out of GBTC,”

BitMEX Research posted its figures, which included flows for each fund. On day three of trading, Bitwise (BITB) had an inflow of $17.3 million, it reported .

Crypto Podcaster “MartyParty” observed that BlackRock removed 11,500 BTC from Coinbase on Jan. 14 and has just returned it, posing the question:

“Could this be to introduce artificial scarcity? That’s half a billion out and half a billion back in.”

ETF Latest News

On Jan. 17, senior ETF analyst Eric Balchunas reported that ProShares had just filed for a bunch of leveraged spot bitcoin ETFs. “They could have up to a dozen of these on the market in a few months,” he added.

The five new applications for leveraged funds from the firm included ones to short Bitcoin. The ProShares UltraShort Bitcoin ETF (-2x), ShortPlus Bitcoin ETF(-1.5x), and Short Bitcoin ETF (-1x) all give speculators the option to short the asset with leverage.

Additionally, it filed for ProShares Plus Bitcoin ETF (+1.5x) and ProShares Ultra Bitcoin ETF (+2x).

Meanwhile, Fidelity Digital Assets posed a question on Jan. 17, asking whether it was likely or possible for a competitor to replace Bitcoin. “While technically possible, we believe it’s unlikely,” it said before adding:

“For one, Bitcoin’s open-source software can be copied, but its community and network effects cannot.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.

x402 V2 Released: As AI Agents Begin to Have "Credit Cards", Which Projects Will Be Revalued?

Still waters run deep, subtly reviving the narrative thread of 402.

When Belief Becomes a Cage: The Sunk Cost Trap in the Crypto Era

You’d better honestly ask yourself: which side are you on? Do you like cryptocurrency?