Bitcoin Defends $41K Level, Chainlink Gains 5% Daily (Weekend Watch)

BTC’s troubles continue even though the asset remains above $41,000.

Bitcoin dumped once more yesterday to a new monthly low of under $40,500, but it reacted well and dumped above $42,000 hours later.

The altcoins continue to be quite sluggish, with little to no movements, aside from LINK, which has jumped by around 5%.

BTC’s Declines

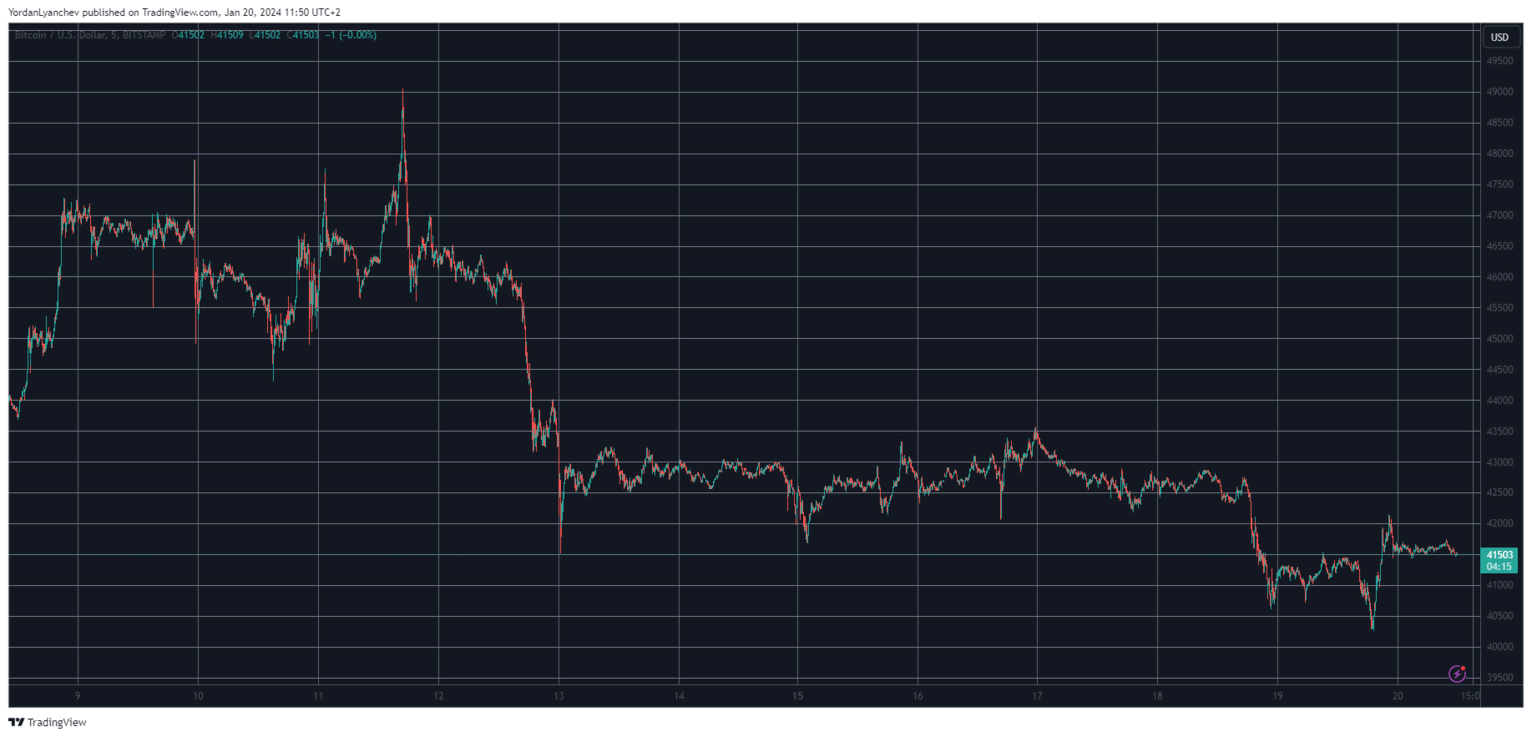

The primary cryptocurrency had two completely different weeks. Last week, it soared past $49,000 on the day that 11 spot BTC ETFs reached the US markets and dumped by more than three grand later. The landscape worsened as Friday was coming to an end. Overall, BTC had lost over $7,000 in about 36 hours in what turned out to be a sell-the-news event .

After recovering some ground and reaching $43,000 during the weekend, the asset calmed and traded sideways for almost a week. However, another price decline occurred yesterday when Bitcoin dropped below $41,000 and then to $40,400 (on Bitstamp) for the first time in over a month.

It managed to bounce off and even soared past $42,000 briefly, but the overall negative sentiment kept the pressure on, and BTC dropped back down to $41,500, where it stands now as well.

Its market capitalization stands inches above $810 billion, and its dominance over the alts is still below 50%.

LINK Defies Market Sentiment

Chainlink is among the few notable gainers from the larger-cap alts on a daily scale. LINK has jumped by more than 5% and trades above $16. Cardano’s native token follows suit with a 3% increase that has pushed the asset to over $0.5. Uniswap and Litecoin are also well in the green, followed by Dogecoin, Tron, and Binance Coin.

In contrast, Avalanche has retraced by 4% to $32, Solana is down by 3% and is close to breaking below $90, and MATIC has shed 3% of value and is down to $0.76.

Further losses come from the likes of ARB, LDO, OP, INJ, and NEAR. The total crypto market cap has declined by about $10 billion overnight but still stands inches above $1.6 trillion on CMC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.

x402 V2 Released: As AI Agents Begin to Have "Credit Cards", Which Projects Will Be Revalued?

Still waters run deep, subtly reviving the narrative thread of 402.

When Belief Becomes a Cage: The Sunk Cost Trap in the Crypto Era

You’d better honestly ask yourself: which side are you on? Do you like cryptocurrency?