Bitcoin ( BTC ) hit its lowest levels since the start of December after the Jan. 23 Wall Street open as anger grew over market selling.

Bitcoin ( BTC ) hit its lowest levels since the start of December after the Jan. 23 Wall Street open as anger grew over market selling.

Data from Cointelegraph Markets Pro and TradingView followed BTC price action as it slumped to $38,505 on Bitstamp.

Barely recovered at the time of writing, Bitcoin faced a now-familiar cocktail of institutional sell-offs and low demand to retrace nearly two months’ gains.

Attention focused on the Grayscale Bitcoin Trust (GBTC), a giant investment vehicle still with more than $20 billion in assets under management despite billions of dollars of Bitcoin offloaded this month.

Jan. 23 saw approximately another 15,200 BTC ($590 million) transferred from known GBTC holdings to custodian Coinbase, per data from crypto intelligence firm Arkham.

Grayscale deposited 15,222 $BTC ($588.5M) to #CoinbasePrime again 10 mins ago. #Grayscale has deposited 79,213 $BTC ($3.27B) to #CoinbasePrime since the #ETF was passed, .

— Lookonchain (@lookonchain) January 23, 2024

According to Arkham, #Grayscale currently holds 535,755 $BTC ($20.68B). https://t.co/CdjVrnKSYx pic.twitter.com/Oq9RglF7Fz

This was slightly less than the day prior, but with the final figures not yet confirmed, commentators remained skeptical.

“Decrease from yesterday at the very least,” popular trader Daan Crypto Trades wrote in part of a reaction on X (formerly Twitter).

“Yesterday's net flows on all ETFs were slightly negative so the other ETFs doing a decent job absorbing still.”

Daan Crypto Trades referenced the performance of the United States’ new spot Bitcoin exchange-traded funds (ETFs), inflows to which were going some way to counteract the GBTC exits.

Others blamed not GBTC operator Grayscale but forced liquidations, as well as offloading by defunct exchange FTX which prior to its own demise had considerable GBTC holdings .

“Recall selling $GBTC for BTC, does NOT push bitcoin price down; selling for USD and keeping it in USD does,” Adam Back, CEO of Bitcoin technology firm Blockstream, explained .

“People doing USD selling are forced liquidations, bankrutpcy sales like FTX. so i'm not sure if there's much USD net-selling left post FTX $1bil bankruptcy sale.”

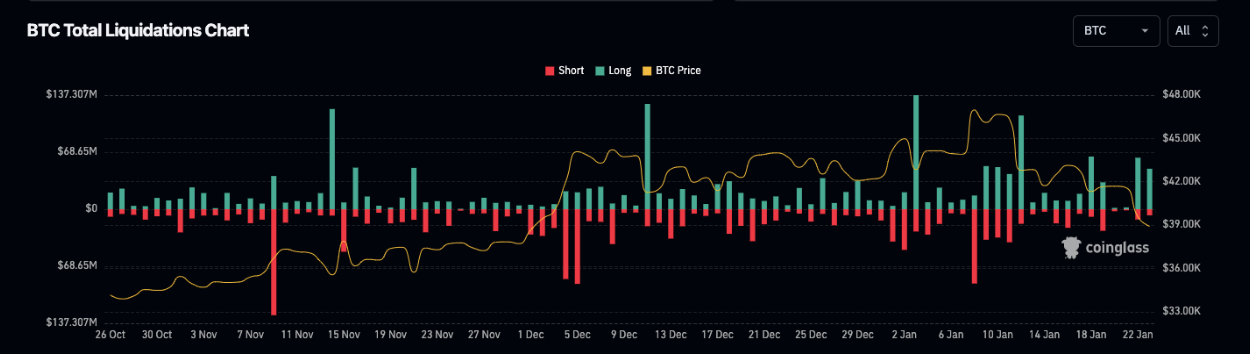

On the topic of spot liquidations, BTC longs faced another day of pain.

Total longs wiped out during the two days through Jan. 23 stood at $110 million at the time of writing, according to the latest data from statistics resource CoinGlass .

Optimists thus chose to take a longer-term view, arguing that current downside sources would not be able to keep up pressure on the market indefinitely.

We’re progressing now towards the celebration of the sell the news, but still not there yet.

— Cold Blooded Shiller (@ColdBloodShill) January 22, 2024

Noticeable shift in psychology today, bears celebrating, bulls angry at bears celebrating.

I’m still just relaxing and waiting for lower prices, as I have been for a while. https://t.co/RU4IJ3oyCk

Eric Balchunas, a dedicated ETF analyst at Bloomberg Intelligence, meanwhile saw reason to celebrate Bitcoin’s 2023 performance.

In the past 12 months, BTC/USD had offered 75% returns — vastly outperforming popular investments such as stocks.

“How spoiled can you be that you living in angst right now? You will be in permanent state of misery if you don't get perspective,” he wrote in part of X comments.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

Is the biggest on-chain bull market about to break out? Are you ready?

The article believes that the crypto sector is experiencing the largest on-chain bull market in history. Bitcoin remains bullish in the long term, but its short-term risk-reward ratio is not high. There is a surge in demand for stablecoins, and regulatory policies will become a key catalyst. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Solana CME futures open interest hits new high of $1.5B after launch of first US Solana staking ETF

JPMorgan expects September Fed rate cut despite CPI risks and warns of S&P 500 volatility

Ripple Expands Crypto Custody Partnership with BBVA in Spain

Quick Take Summary is AI generated, newsroom reviewed. Ripple and BBVA extend their partnership, offering digital asset custody services in Spain. The service supports compliance with Europe’s MiCA regulation. BBVA responds to growing customer demand for secure crypto solutions.References Ripple Official X Post Ripple Press Release