LPL Financial plans to complete the evaluation of Bitcoin spot ETF within three months

According to Bloomberg, LPL Financial, the largest independent investment advisory service platform in the United States, is currently reviewing recently approved Bitcoin spot ETFs. The platform manages trillions of dollars in funds. LPL stated that it needs three months to evaluate the new spot ETFs. Rob Pettman, Head of Wealth Management Solutions at LPL Financial, said, "We just want to see how they perform in the market. After a three-month evaluation period, the platform will decide which funds they want to offer or if they need more time to assess the ETFs."

Currently, financial advisors using LPL can purchase Grayscale's GBTC for their clients because this trust fund was available on the LPL platform before its conversion into an ETF. Nine other funds, including BlackRock's IBIT and Fidelity's FBTC, are undergoing evaluation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South African fast food chain WIMPY now supports Bitcoin payments at 450 locations

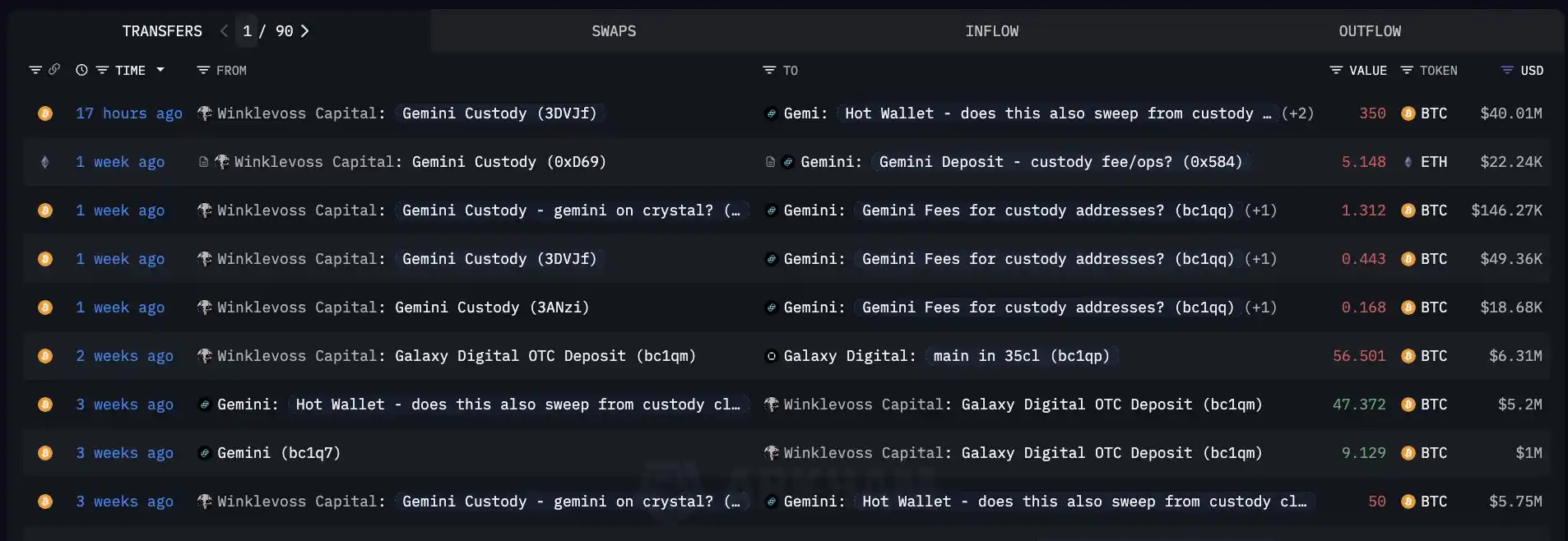

Before the exchange's listing, Winklevoss Capital transferred 350 BTC from the exchange's Custody address.

Bitcoin Core releases v30.0rc1 version, now open for testing

MoonPay launches MoonTags feature, allowing users to send and receive cryptocurrencies via personalized identifiers.