February 5th futures market data: Are L2s Bleeding Ethereum Dry?

Bitget2024/02/05 04:00

By:Bitget

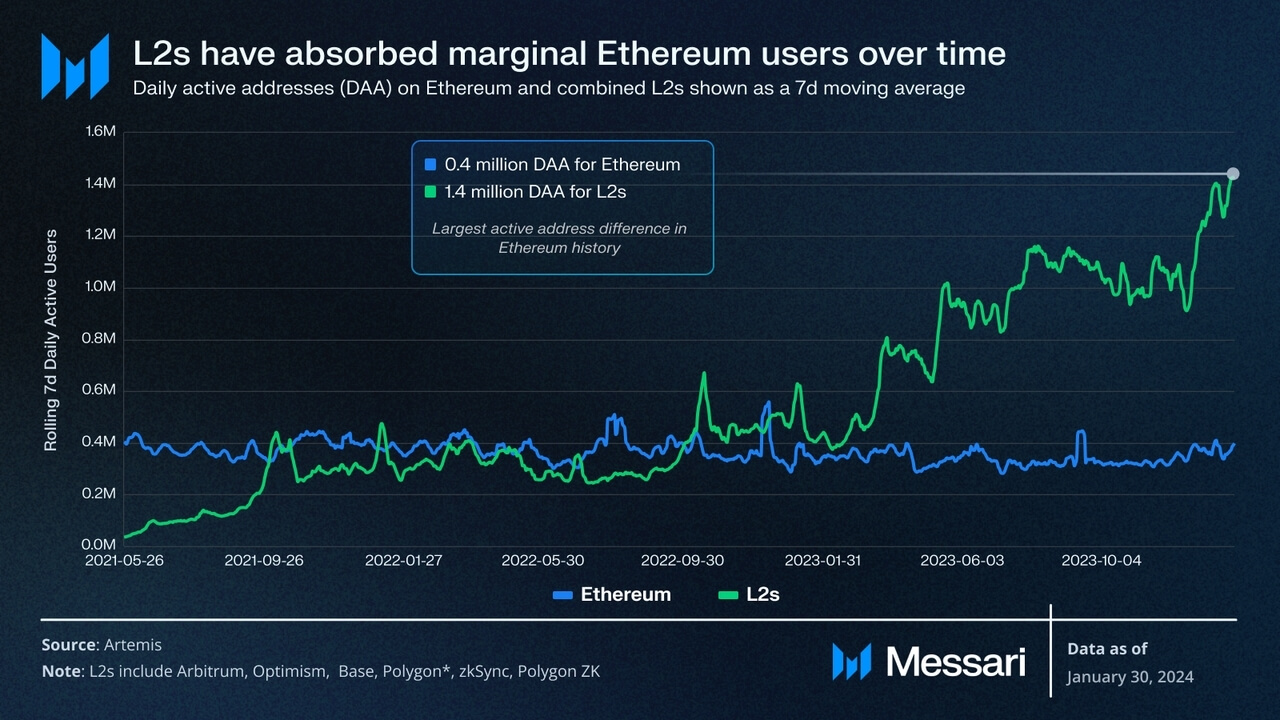

The prevailing narratives surrounding

Ethereum, such as its identity as the world computer or digital oil, are losing popularity due to technical challenges, competition, and a need for intellectual honesty. Ethereum's ambition to be a global computer has waned, and its dominance in finance has declined. Although the shift to rollups has advantages, it has constrained Ethereum's ability to handle large volumes. By highlighting its strong value capture and positioning it as the future security asset for various chains, Ethereum can address scalability issues while maintaining security and value. As Layer-3 solutions emerge, users are increasingly opting for alternative gas tokens instead of ETH, challenging its role as the primary gas token. The proposed EIP-4844, aimed at drastically reducing transaction costs on Layer-2s, further diminishes the USD-denominated demand for ETH as gas. Even without factoring in the anticipated cost reduction, the annualized demand for ETH as a gas token on Layer-2s amounts to around $420 million, constituting roughly 17% of annual fees on Layer-1 and a mere 0.15% of the current

market cap ($280 billion). As usage shifts to Layer-2s and transaction costs decrease, the demand for ETH as a gas token decreases in USD terms, particularly relative to market capitalization.

Source: Messari

Futures Market Updates

Over the past 24 hours, the futures market went through a series of liquidations on long positions after a dip. Major cryptocurrencies such as BTC and ETH still dominate the market. Investors are balanced between their long contracts and short contracts.

Bitcoin Futures Updates

Total BTC Open Interest: $17.49B (+0.97%) BTC Volume (24H): $21.43B (+44.98%) BTC Liquidations (24H): $13.14M (Long)/$3.09M (Short) Long/Short Ratio: 49.17%/50.83% Funding Rate: 0.0096%

Ether Futures Updates

Total ETH Open Interest: $7.59B (+0.89%) ETH Volume (24H): $9.97B (+31.16%) ETH Liquidations (24H): $8.55M (Long)/$2.64M (Short) Long/Short Ratio: 48.95%/51.05% Funding Rate: 0.0059% ---

Top 3 OI Surges

NMR: $33.21M (+106.28%) FLR: $3.74M (+72.76%) RON: $22.79M (+59.42%)

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Shiba Inu Holds $0.00001288 Support as $0.00001319 Resistance Limits Upside

Cryptonewsland•2025/09/11 22:12

Dogwifhat Trades at $0.88 as Price Holds $0.8771 Support While $0.9019 Resistance Caps Upside

Cryptonewsland•2025/09/11 22:12

Bitcoin ETF Inflows Hit $741M, Highest in 2 Months

Bitcoin ETFs saw $741M in inflows yesterday, marking the biggest surge in two months amid rising market optimism.Bullish Signals Amid Market VolatilityBitcoin ETFs Gaining Investor Trust

Coinomedia•2025/09/11 22:09

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$115,067.91

+0.81%

Ethereum

ETH

$4,518.97

+1.84%

XRP

XRP

$3.05

+1.33%

Tether USDt

USDT

$1

-0.01%

Solana

SOL

$237.74

+6.64%

BNB

BNB

$904.97

+0.84%

USDC

USDC

$0.9997

-0.01%

Dogecoin

DOGE

$0.2597

+4.03%

TRON

TRX

$0.3487

+0.92%

Cardano

ADA

$0.8961

+1.03%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now