3 crisp charts to celebrate a legendary month of bitcoin ETFs

Billions of dollars have piled into spot bitcoin ETFs in their first month and there’s little sign of slowing down

First-day buyers of spot bitcoin ETFs have been left holding the bag over the last month. But no longer.

Anyone who bought and held shares in any of the spot bitcoin ETFs before today would be in the green.

Bitcoin spiked to $48,000 as the ETFs opened trade on Jan. 11 — two year highs — before retracting more than 20% over the following two weeks.

Now, on the first day of their second month of trade, bitcoin ( BTC ) threatens to blast past $50,000 and is up 13% year to date .

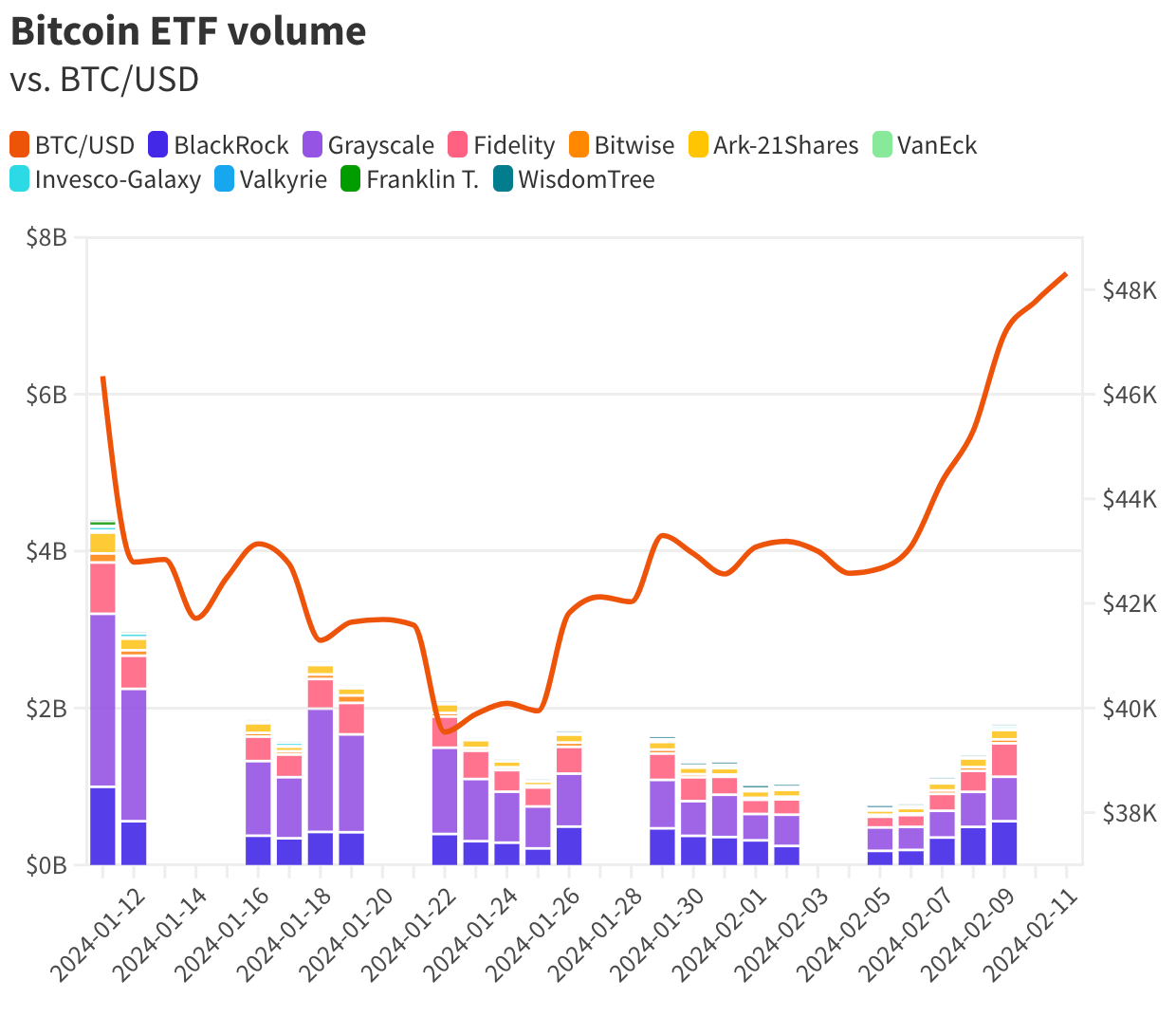

That’s one way to buy the dipThe 10 physically-backed bitcoin funds altogether saw almost $36 billion in trade in their first month, according to market data compiled by Blockworks.

Grayscale’s bitcoin trust ( GBTC ) made up more than half of those volumes, perhaps boosted by the closure of its nagging NAV discount presenting a final arbitrage opportunity.

BlackRock and Fidelity’s offerings followed with $8.31 billion and $6.53 billion, respectively.

Volumes only tell us roughly how popular shares are among traders, who may only be interested in capitalizing on bitcoin’s trademark volatility rather than holding the ETFs long-term.

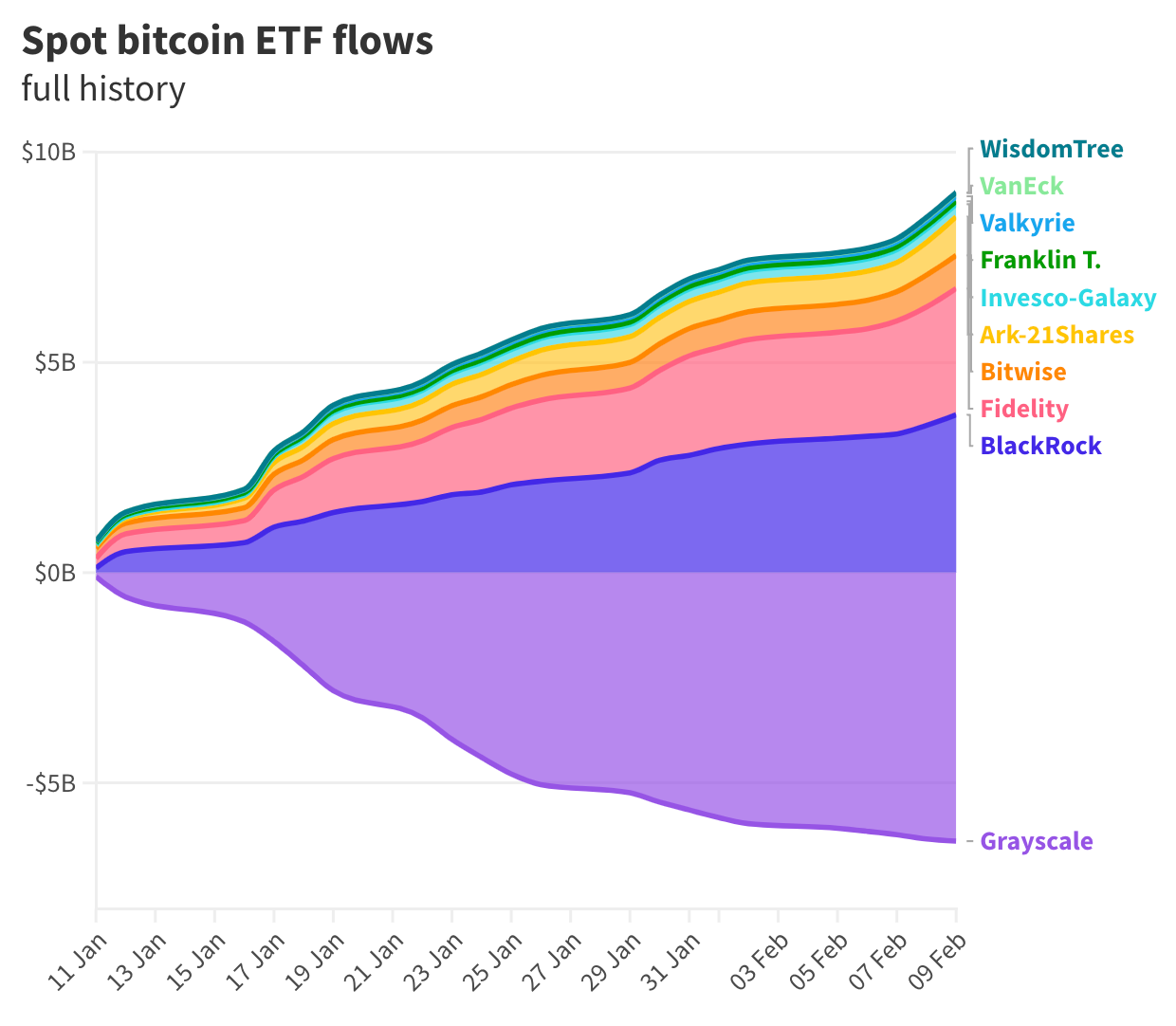

The dollar value of funds flowing in and out of each ETF is a better indicator of investor sentiment.

- Not counting GBTC, investors piled more than $9 billion into US-listed spot ETFs in their first month.

- GBTC shareholders pulled $6.38 billion from the former closed-ended fund over that time.

- Spot ETFs overall have seen net inflows of $2.63 billion to date.

BlackRock and Fidelity’s products are some of the most popular in ETF history , while GBTC outflows have largely been attributed to its high management fee relative to its rivals, 1.5% compared to 0.25% from BlackRock and Fidelity.

BlackRock and Fidelity so far lead the pack for inflows, having respectively pulled in $3.75 billion and $3.5 billion.

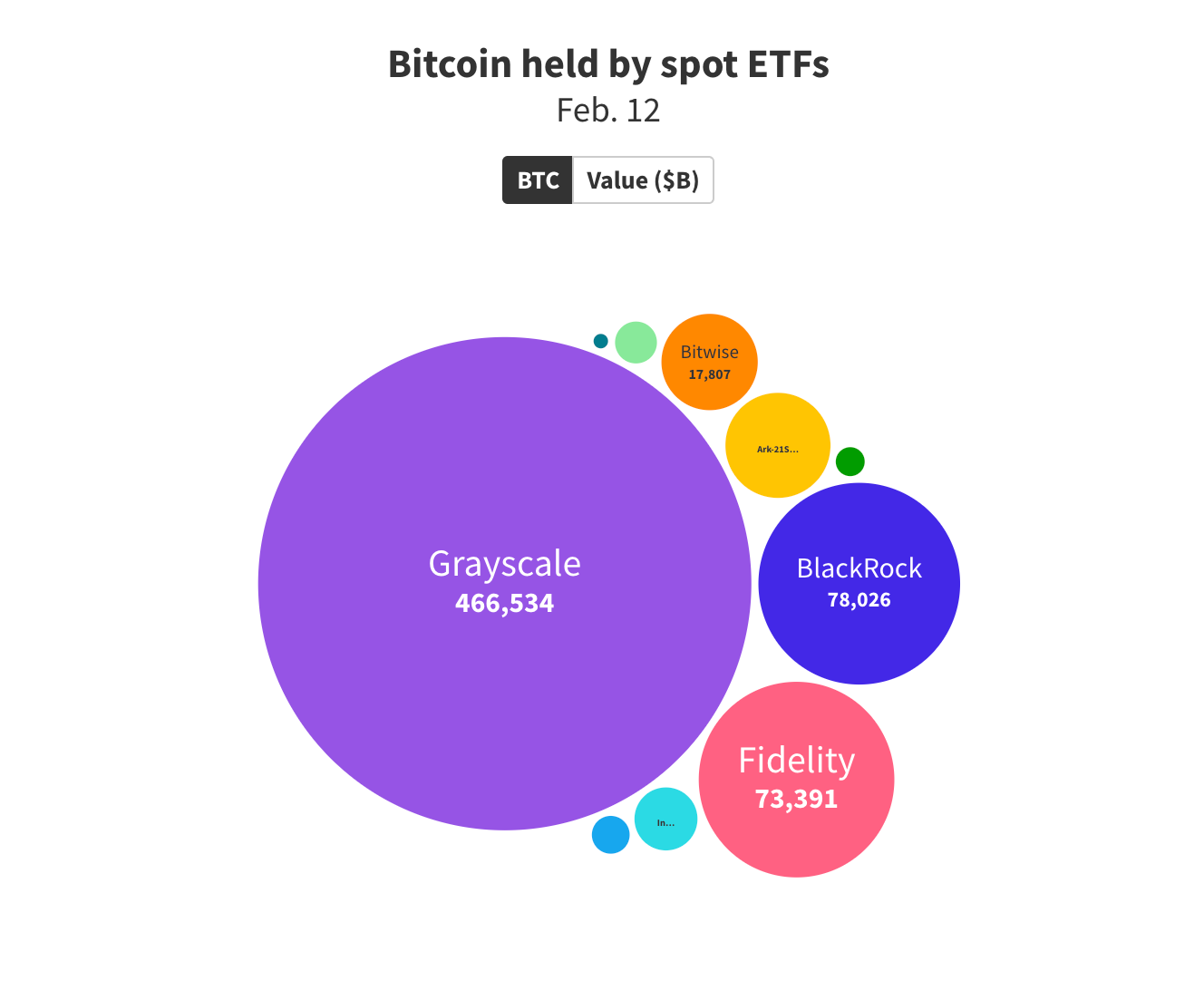

Altogether (and excluding GBTC), the spot ETFs held 206,155 BTC ($10.25 billion) as of Monday morning, per CoinGlass.

Grayscale had nearly a decade of first mover advantageThose funds manage about 1% of bitcoin’s circulating supply, slightly more than MicroStrategy .

GBTC meanwhile still holds more than 466,000 BTC ($23.2 billion) — more than double all the other US spot ETFs combined.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unveiling Solana's "Invisible Whale": How Proprietary AMMs Are Reshaping On-Chain Trading

The rapid rise of proprietary AMMs on Solana is no coincidence; rather, it is a logical and even inevitable evolution as the DeFi market pursues ultimate capital efficiency.

XRP Reenters Global Top 100 With Market Cap Near HDFC

Quick Take Summary is AI generated, newsroom reviewed. XRP has entered the Top 100 Global Assets at $181.8B XRP trades at $3.05 showing strong annual growth and volume activity XRP has surpassed companies like Adobe, Pfizer, and Shopify in valuation ETF filings and Ripple’s U.S. banking license could boost XRP adoption Japan’s banks and RippleNet partners highlight growing global use of XRPReferences $XRP reenters the top 100 global assets by market cap.

Solana Treasury Fund, operated by Sharps Technology, and Pudgy Penguins have announced a strategic partnership

Through this partnership, Pudgy Penguins' top-tier IP will be combined with STSS's institutional-grade Solana vault, creating a brand-new interactive opportunity for retail and institutional users.

Magma Finance Officially Launches ALMM: Sui's First Adaptive & Dynamic DEX, Pioneering a New Liquidity Management Paradigm

Magma Finance today officially announced the launch of its innovative product ALMM (Adaptive Liquidity Market Maker), becoming the first Adaptive & Dynamic DEX product on the Sui blockchain. As an improved version of DLMM, ALMM significantly enhances liquidity efficiency and trading experience through discrete price bins and a dynamic fee mechanism, marking a major upgrade to the Sui ecosystem's DeFi infrastructure.