Tangible will fulfill the redemption of USDR stablecoin, holders can receive 90% of DAI and 10% of governance tokens

Cointime2024/02/22 00:20

The USDR stablecoin, backed by Tangible's real estate, has lost its peg to the dollar. However, CEO Jag Singh stated that holders should be able to pay 90 cents in DAI and 10 cents in Tangible's governance token. In October last year, the real estate-backed stablecoin USDR collapsed, threatening millions of dollars in losses for holders.

However, asset issuer Tangible did not abandon the unpegged stablecoin. Instead, Tangible is nearing redemption of the stablecoin which will allow holders to receive 90 cents in DAI and the final 10 cents in their own governance token. Last October, USDR's promise was to provide value through its UK real estate holdings for additional returns for holders. Holders who want out can also exchange their USDR for DAI stablecoins - another component it supports. However, a rush on DAI holdings of USDR caused a shortage of liquidity during redemption.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Alibaba launches more efficient Qwen3-Next AI model

金色财经•2025/09/11 22:32

BlackRock plans to tokenize its funds that hold real-world assets and stocks

Chaincatcher•2025/09/11 22:24

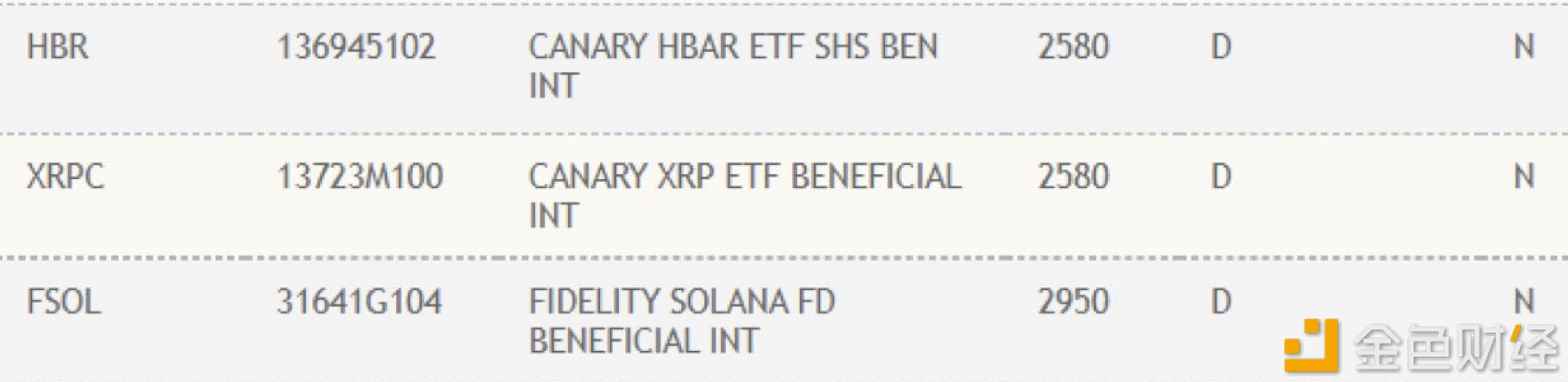

The US DTCC has now listed FSOL, HBR, and XRPC.

金色财经•2025/09/11 22:15

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$115,263.3

+1.27%

Ethereum

ETH

$4,453.17

+2.59%

XRP

XRP

$3.03

+1.62%

Tether USDt

USDT

$1

-0.02%

BNB

BNB

$900.75

+0.78%

Solana

SOL

$228.09

+1.96%

USDC

USDC

$0.9997

-0.03%

Dogecoin

DOGE

$0.2554

+4.72%

TRON

TRX

$0.3461

+2.14%

Cardano

ADA

$0.8906

+0.60%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now