Grayscale Report: Ethereum Price Surge Driven by Anticipated Dencun Upgrade

A new report from Grayscale Investments, a digital asset management firm, highlights that the recent price surge of Ethereum is attributed to market expectations surrounding the upcoming Dencun upgrade. The upgrade, scheduled for March 13, 2024, is expected to enhance Ethereum's scalability, making it more competitive, particularly in comparison to faster blockchains like Solana. The report also mentions optimistic prospects for Ethereum, including factors such as net deflationary supply and network revenue generation, as well as the potential to capture more smart contract applications.

Grayscale Investments is also seeking approval from the U.S. Securities and Exchange Commission (SEC) to convert its Ethereum Trust into a spot Ethereum ETF. The recent approval of spot Bitcoin ETFs by the SEC in the past few months has increased market optimism, leading to similar expectations for Ethereum financial instruments. Overall, the report emphasizes the significance of the upcoming Ethereum upgrade and the potential impact it may have on the cryptocurrency market performance and the competitiveness of the smart contract ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South African fast food chain WIMPY now supports Bitcoin payments at 450 locations

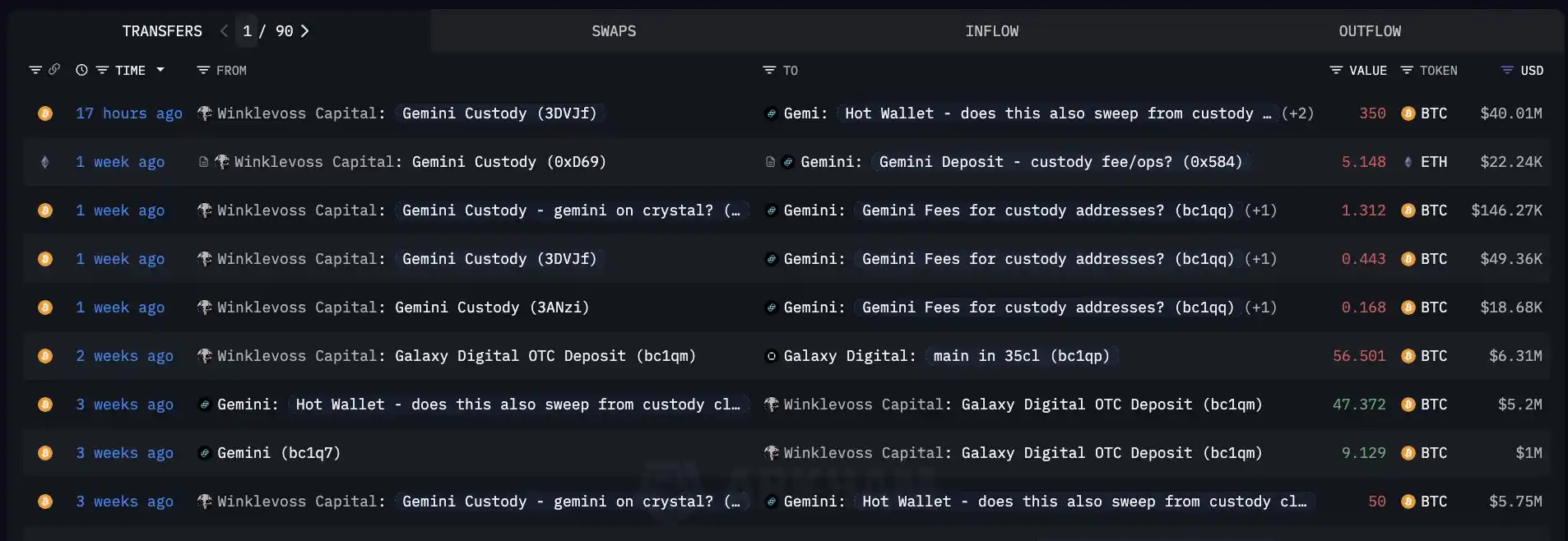

Before the exchange's listing, Winklevoss Capital transferred 350 BTC from the exchange's Custody address.

Bitcoin Core releases v30.0rc1 version, now open for testing

MoonPay launches MoonTags feature, allowing users to send and receive cryptocurrencies via personalized identifiers.