Retail Traders Still Missing: Can They Push Bitcoin’s Price to New ATH Soon?

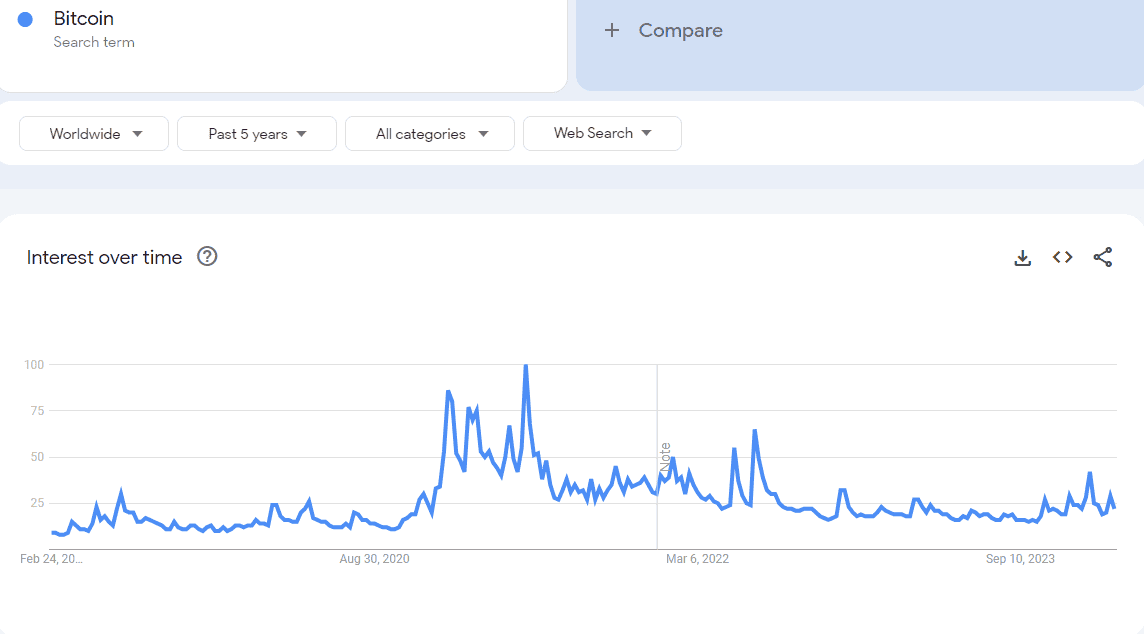

Google search data suggests that retail investors are still absent from the Bitcoin landscape.

Bitcoin’s price has been on the run for the past several months, having surged from under $20,000 to over $50,000 since June 2023.

While that was mainly driven by the anticipation and the subsequent approval of nearly a dozen spot Bitcoin ETFs in the States, it seems retail traders are still not present, which begs the question of whether their arrival could propel another price surge for the asset in the next few months.

How Did We Get Here?

Data from Google Trends shows the typical behavior of retail investors, as they tend to search more for investment options that are very hot. This leads to them entering the market in question in what has been termed as FOMO (fear of missing out).

The cryptocurrency market is perhaps best known for such sentiment changes as it tends to get overheated really quickly when the demand from such investors skyrockets. In turn, this leads to growing prices before the inevitable correction and the market cooling off.

The last such cycle was in 2021, when prices were booming, and the retail crowd was all around. Laser-eyes appeared on Twitter with promises of $100,000 per BTC in the next few months. That didn’t happen; BTC slumped in value, and retail investors disappeared.

Bitcoin started to recover in June 2023 when BlackRock filed to launch its own spot BTC ETF. Given the company’s mind-blowing success rate with ETFs, institutions started to pay more attention to Bitcoin, and the overall anticipation changed from “The SEC will never allow a spot BTC ETF” to “ It’s a matter of when not if .”

That change led to growing hype and, subsequently, rising prices, and BTC soared from under $20,000 in June 2023 to over $40,000 in early January. Then came the actual approvals of 11 spot BTC ETFs, the inevitable sell-the-news moment , before the cryptocurrency went back on the offensive and soared past $50,000 for the first time in more than two years on the actual demand for those financial products.

But one thing still seems to be missing.

Where Is the Retail?

With large investors and institutions seemingly going after Bitcoin with large purchases, reports frequently emerge that smaller holders (sharks and shrimps) have been disposing of their BTC stash. Google Trends data shows something similar, as the worldwide queries for Bitcoin are far from the 2017 boom, the 2021 bull run, and even the 2022 industry crashes.

Aside from a brief spike around the ETF approvals in mid-January, the searches have barely surpassed the 2019 bear market and the 2020 Covid-induced correction.

This only goes to show that retail investors have not really arrived, even though BTC’s price has more than doubled since last June. However, the upcoming halving could change all of that, given Bitcoin’s price performance after each of the previous ones.

As such, it would be interesting to follow if the retail crowd could be behind another run that will result in a new all-time high for Bitcoin in the next few months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (September 11)

Cboe to debut bitcoin and ether Continuous futures in November

Cboe Futures Exchange aims to introduce long-dated crypto contracts under US regulatory oversight

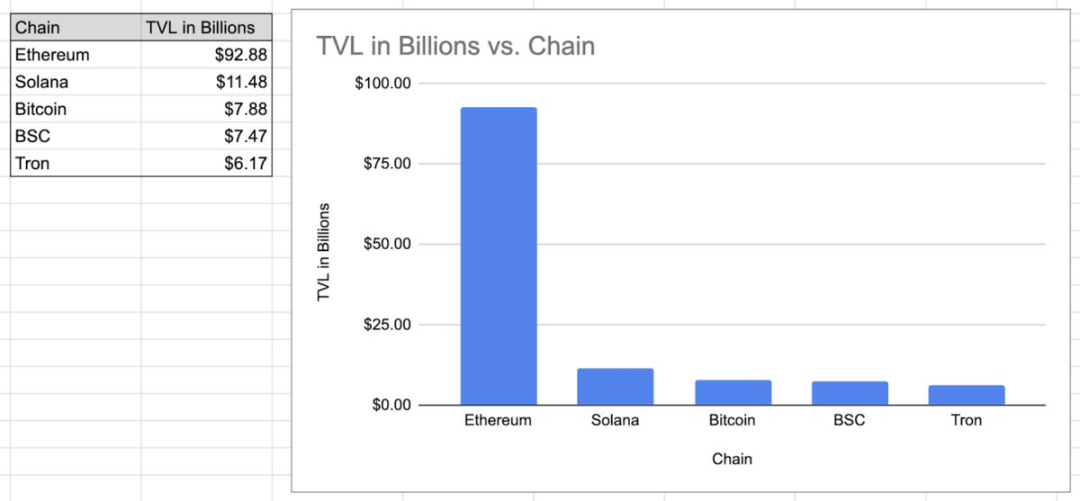

The Internet is building a native financial system, and the key to success or failure still lies in user experience.

Infrastructure provision is possible, but user experience wins everything.

Why are perpetual contracts inevitably part of general-purpose blockchains?

The future trend is that perpetual contracts (and all "killer applications") will make leading general-purpose blockchains even more powerful.