Spot bitcoin ETF volume spike maybe due to high-frequency trading, CoinShares says

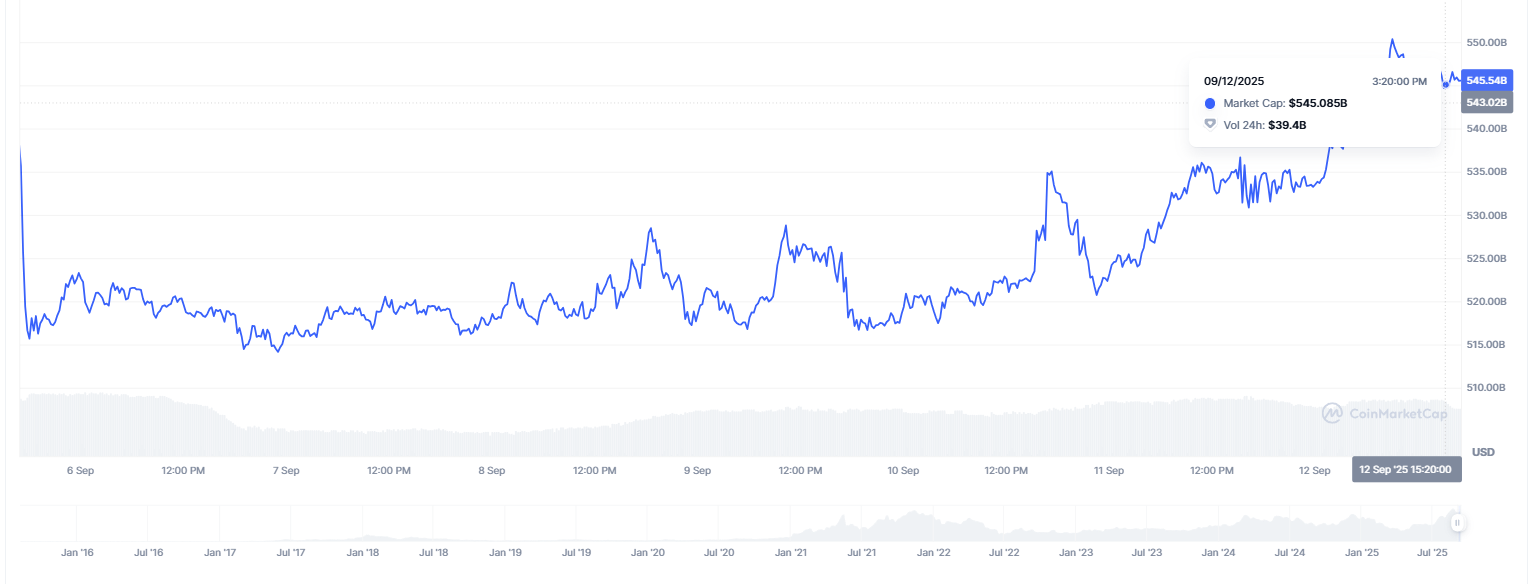

CoinShares said that the massive spike in daily trading volume for VanEck’s spot bitcoin ETF could have been a result of high-frequency trading.In total, since they began trading last month, spot bitcoin ETFs have reported nearly $52 billion in cumulative trading volume while registering net inflows of $5.8 billion.

VanEck's ETF, ticker HODL, which scored $25.5 million in trading volume on its launch day last month, had been consistently reporting daily trading volumes of less than $10 million previous to the $400-million spike on Feb. 20. For all of last week, HODL netted positive inflows of $17 million, according to CoinShares.

So what drove the hundreds of millions of dollars in trading volume if the ETF added just $17 million for the entire week?

"We have noticed a few of the ETFs have experienced this in Europe too. We suspect there are some quant funds executing high-frequency intraday trades," CoinShares's Head of Research James Butterfill told The Block, adding that "some ETFs get used for high frequency trades, but it is typically futures that are used."

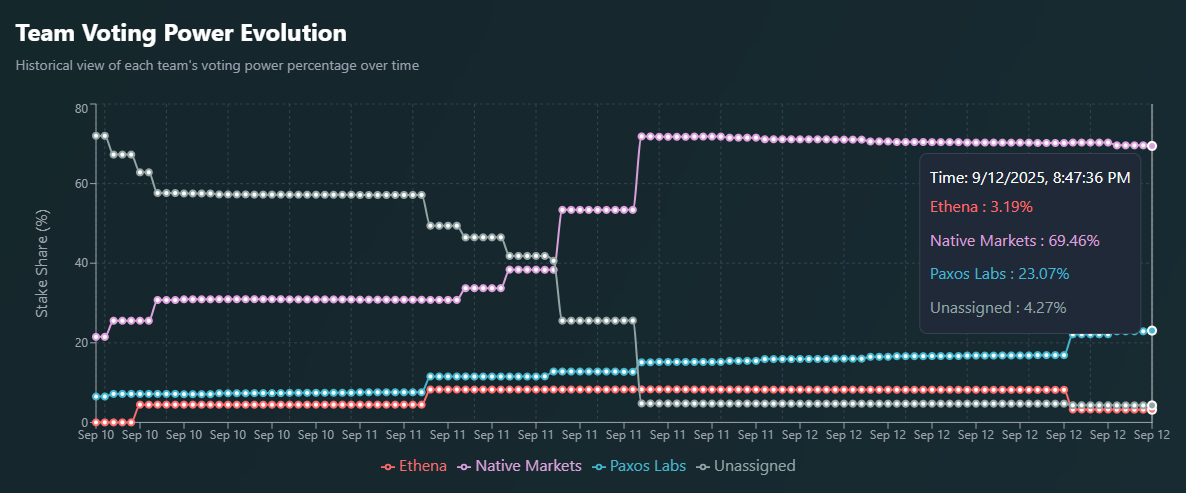

VanEck's spot bitcoin ETF trading volume. Image: The Block Research.

Hard to know 'who or why someone buys an ETF'

In high-frequency trading, investment banks, hedge funds and institutional investors use computers — employing algorithms — to execute an extremely high number of trades at lightning-fast speeds.

VanEck did not immediately respond to a request for comment. But last week the investment manager's Head of Product Management Ed Lopez told The Block: "Because ETFs trade on the secondary market, it can be challenging to know who or why someone buys an ETF."

In total, spot bitcoin ETFs have reported nearly $52 billion in cumulative trading volume since they began trading last month, according to Yahoo Finance data compiled by The Block. Overall, the products have taken in a net of $5.8 billion since launch, according to CoinShares.

VanEck's HODL spot bitcoin ETF was not the only one of the new instruments to experience erratic trading last week. WisdomTree's product, ticker BTCW, also saw a precipitous climb in daily activity on Feb. 20 when it jumped to $223 million in daily trading volume. The exchange-traded fund's previous high was $33.1 million on Feb. 1, according to Yahoo Finance data compiled by The Block.

" HOLD and BTCW volume back to normal today," Bloomberg Senior ETF Analyst Eric Balchunas posted to X on Feb. 21. "It was just one crazy day to remember and now it's over, gives credence to the 'algo testing' theory or some kind of arbing bt ETFs/exchanges vs some kind of retail buying frenzy."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid may become an airdrop hub, with USDH one of the main mechanisms to farm points

Bitdeer Bitcoin Mining: Impressive 375 BTC Mined in August

Ethereum (ETH) to $25,000 in 2026: Key Reasons Why It Can Happen

Dogecoin price forecast after the DOJE ETF launch delay: analysis points to $3