The U.S. SEC may approve an Ethereum spot ETF in May 2024

According to CryptoPotato, lawyer Scott Johnsson stated that the U.S. Securities and Exchange Commission (SEC) may approve an Ethereum (ETH) spot ETF in May 2024. If not following this timeline, Johnsson estimates approval could be achieved by mid-2025. In the article, Johnsson emphasized the initial steps taken by the SEC towards a Bitcoin spot ETF. He noted that progress was rapid from the preliminary comments on ETF registration statements issued on September 29, 2023, to revisions of the S-1 form about two weeks later. The approval process is expected to be completed within 90 days before the initially set deadline of January 10th. As the deadline for an Ethereum spot ETF approaches on May 23rd, Johnsson believes there might be a similar acceleration in progress. However, he cautiously mentioned that SEC could change its strategy and not follow Bitcoin's timeline, including delaying S-1 review phase until after approving under 19b-4 rule.

Meanwhile, Bloomberg's ETF analyst James Seyffart believes that SEC does not need as much time for approval. Seyffart pointed out that although Ethereum and Bitcoin are different, the regulatory path paved by the latter has facilitated for former's approval process. Johnsson agrees with this view stating that this time around Ethereum's approval process might be faster hence why SEC is currently silent.

Furthermore, he acknowledged that despite hoping for SEC to issue comments before advancing under 19b-4 approval stage; this step is uncertain at present.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South African fast food chain WIMPY now supports Bitcoin payments at 450 locations

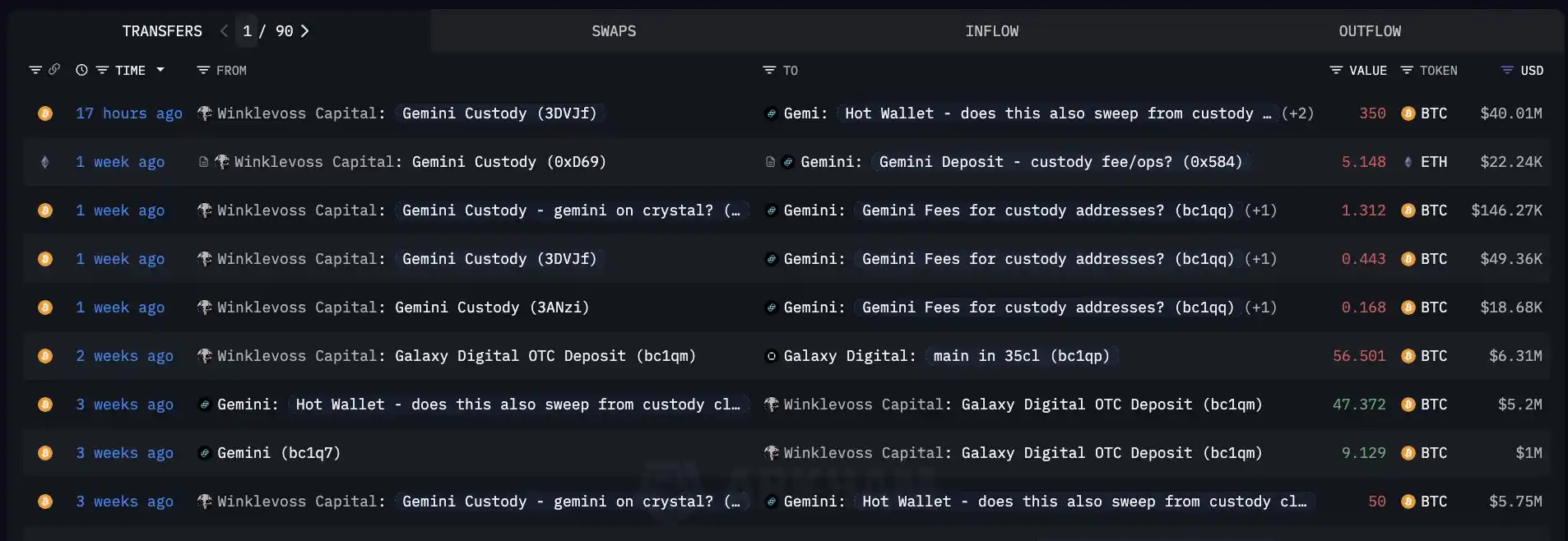

Before the exchange's listing, Winklevoss Capital transferred 350 BTC from the exchange's Custody address.

Bitcoin Core releases v30.0rc1 version, now open for testing

MoonPay launches MoonTags feature, allowing users to send and receive cryptocurrencies via personalized identifiers.