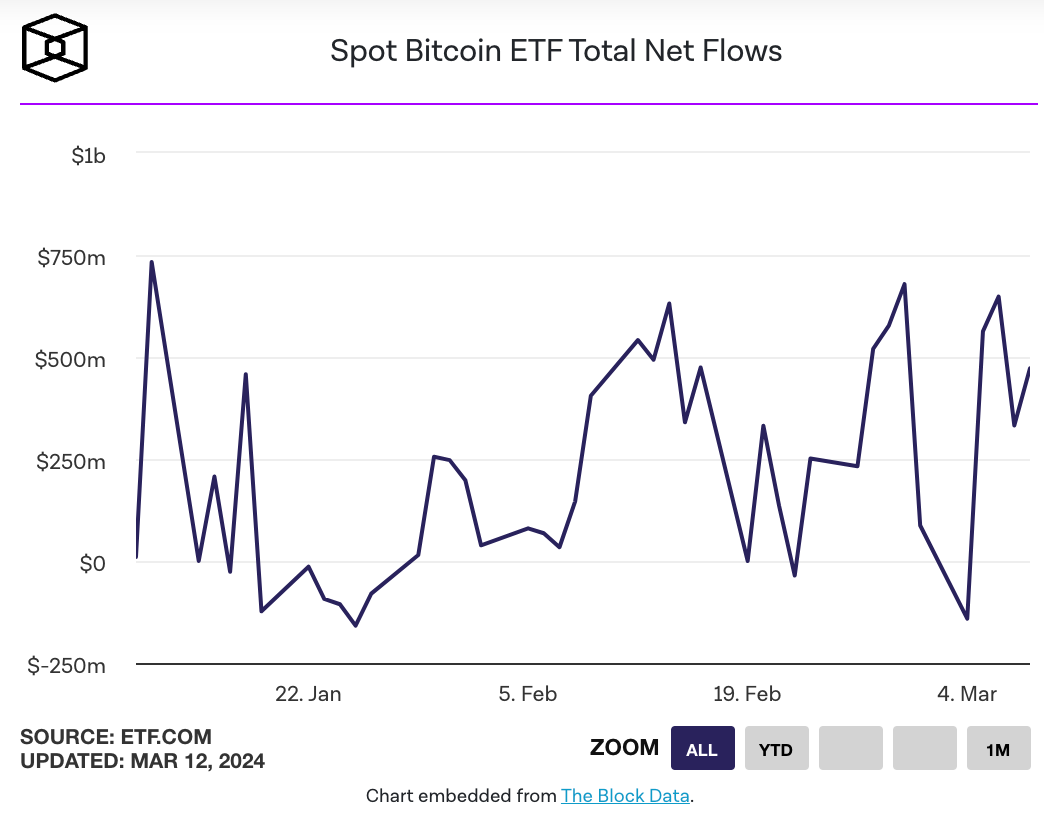

Spot bitcoin ETF inflows net record $1 billion in a single day

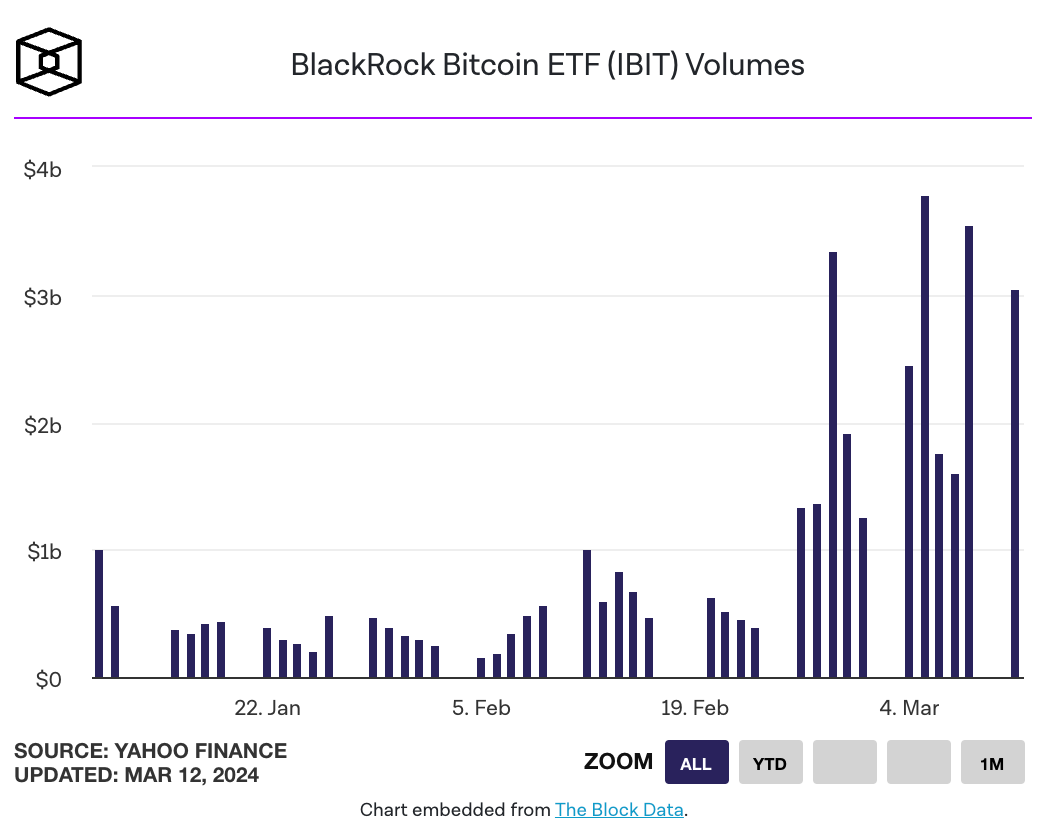

On March 12, net bitcoin ETF inflows hit over $1 billion.Blackrock’s IBIT product saw a record $849 million inflow.

On March 12, net bitcoin ETF inflows hit over $1 billion, according to data from BitMEX Research. At the same time, Blackrock's IBIT product saw a record $849 million inflow.

In bitcoin terms, it was a record 14,706 BTC +1.12% inflow.

Total net bitcoin ETF inflows since Jan. 11, 2024 reached $4.1 billion.

As of yesterday, spot bitcoin ETFs now hold upward of 90% of the daily trading volume market share for ETFs offering bitcoin exposure — an all-time high. Bitcoin futures ETFs, meanwhile, now claim just 10% of the market share.

“To see more than $1 billion of net inflows, a new record, more than a month since launch is nothing short of impressive for any ETF," noted The Block's VP of Research, George Calle.

“The U.S. spot Bitcoin ETFs have been widely successful well beyond even the most optimistic expectations,” GSR Research Analyst Brian Rudick told The Block yesterday. “Their $10 billion-plus of inflows in just two months is approaching what most thought they would do in the first year, and there are arguments for why inflows may increase from here, like greater issuer sales efforts, their addition to wealth manager product offerings, and normalizing GBTC outflows.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyst: XRP Is Repeating a Pattern I’ve Only Seen Once Before

Stunning Prediction: Bitcoin All-Time High Inevitable for 2025 as 4-Year Cycle Shatters

Zerion wallet feed launches early access today: Is a token launch imminent?