Bitcoin ( BTC ) hit price discovery again before the March 13 Wall Street open as bulls beat out sell-side liquidity.

BTC price roars back after snap wick to $69,000

Data from Cointelegraph markets Pro and TradingView captured new all-time highs of $73,679 on Bitstamp.

BTC price strength had taken a breather the day prior, consolidating around the $72,000 mark and even seeing a snap $4,000 dip before abruptly heading higher.

In so doing, the market set up a repeat performance from the start of the week, where resistance kept upside moves in check — at least for a while.

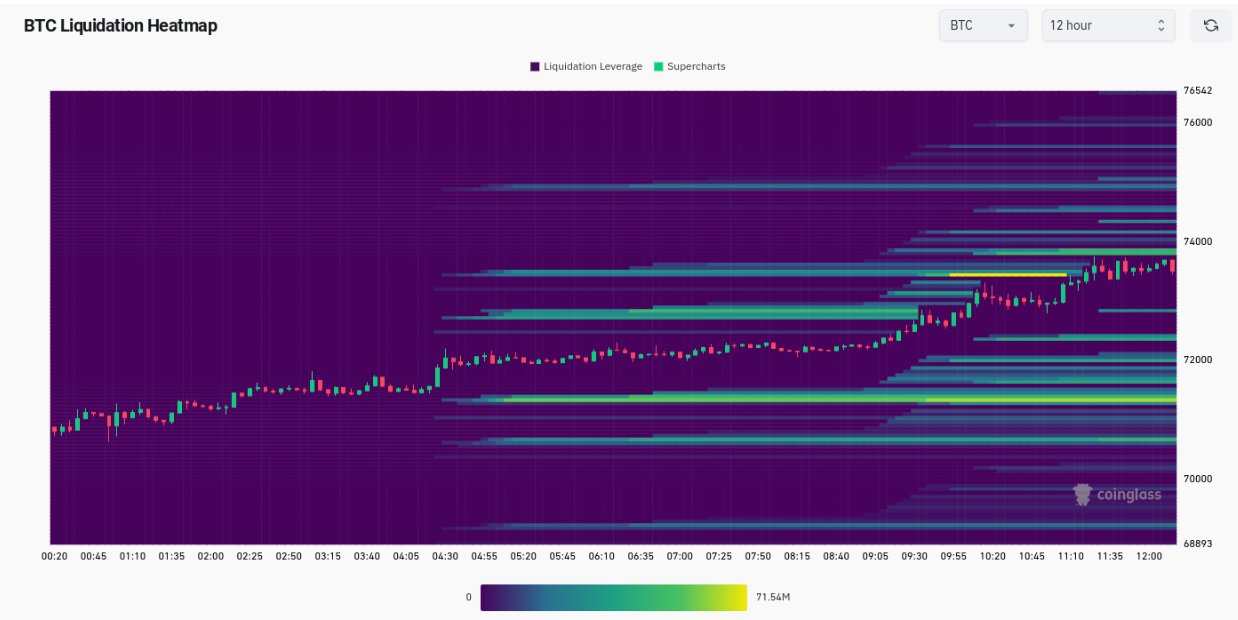

On the day, it was $73,800 fulfilling that role, per data from monitoring resource CoinGlass .

Beyond that, little friction stood in the way of price discovery toward $80,000, evidenced by a lack of liquidation levels.

“Bitcoin wiped out overleveraged longs, retested the 2021 cycle high then bounced back to $72,000,” popular trader Jelle summarized on X (formerly Twitter), adding that the landscape was now “looking good” for upside continuation.

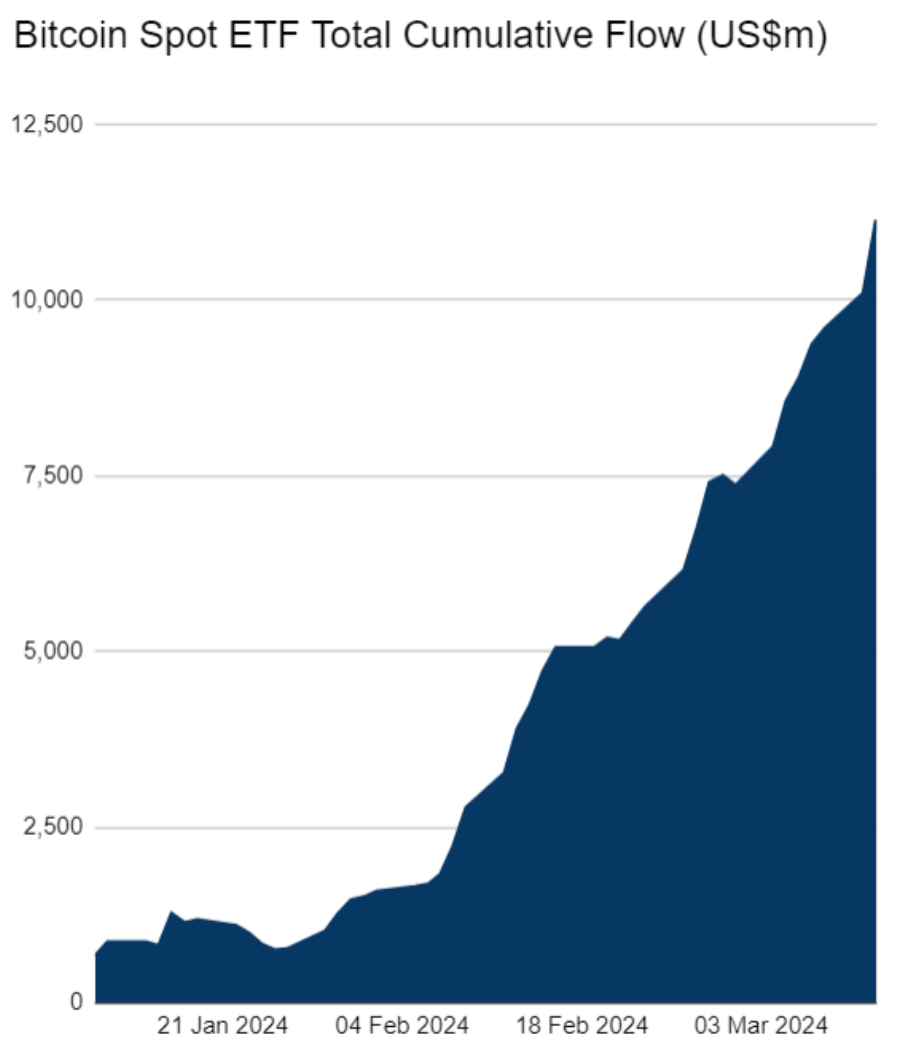

Spot Bitcoin ETFs set record daily inflows

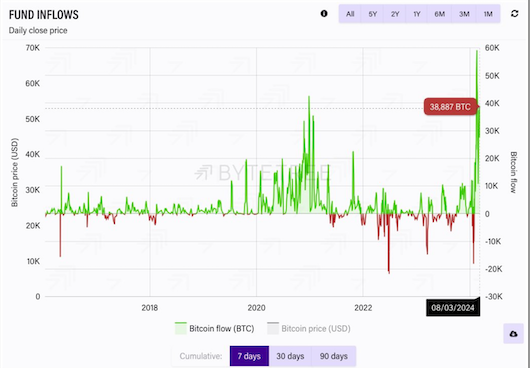

Financial commentator Tedtalksmacro noted the increasing wave of institutional money inflows.

These now dwarfed anything seen previously, even accounting for the United States’ new spot Bitcoin exchange-traded funds (ETFs).

“Fund inflows like we have never seen before. It makes 2020 look small... price will continue to catch up over the coming months,” he told X followers.

“The steady grind to 100k is underway. Historically, when these flows peak, theres 2-3 months to GTFO of the market.”