After the US stock market opens tonight, the net inflow of Bitcoin spot ETF custodial address will be approximately 1912 BTC

According to a report from Golden Finance, as monitored by on-chain analyst Yu Jin, after two days of strong capital inflows on 3/12-3/13 (with a net inflow of $1.728 billion), the influx of funds significantly slowed down last night (3/14). Apart from BlackRock (IBIT) still having around $350 million in fund inflows, the total fund inflow for the other several ETFs was only $44.29 million. On 3/14, ten BTC spot ETFs had a net inflow of $132.51 million, corresponding to an estimated net inflow of about 1,912 BTC into ETF custody addresses after the U.S. stock market opens tonight (3/15): Outflow: Grayscale (GBTC) saw an outflow of approximately 3,711 BTC (corresponding to a fund outflow of $2.5715 billion on 3/14); Inflow: The remaining nine ETFs had an inflow of around 5,623 BTC (corresponding to a fund inflow of $3.8966 billion on 3/14). The main player is BlackRock (IBIT), with an influx of 4,984 BTC ($34.537 billion). Currently, the ten BTC spot ETFs collectively hold a total amount of Bitcoin: 832,028 BTC ($57.66 billion).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

EU may propose 19th round of sanctions against Russia as early as Friday

BBH View: Risk sentiment remains positive but limited after the Fed's neutral rate cut

Trump Signs the "Technology Prosperity Agreement," Designates "ANTIFA" as a Terrorist Organization

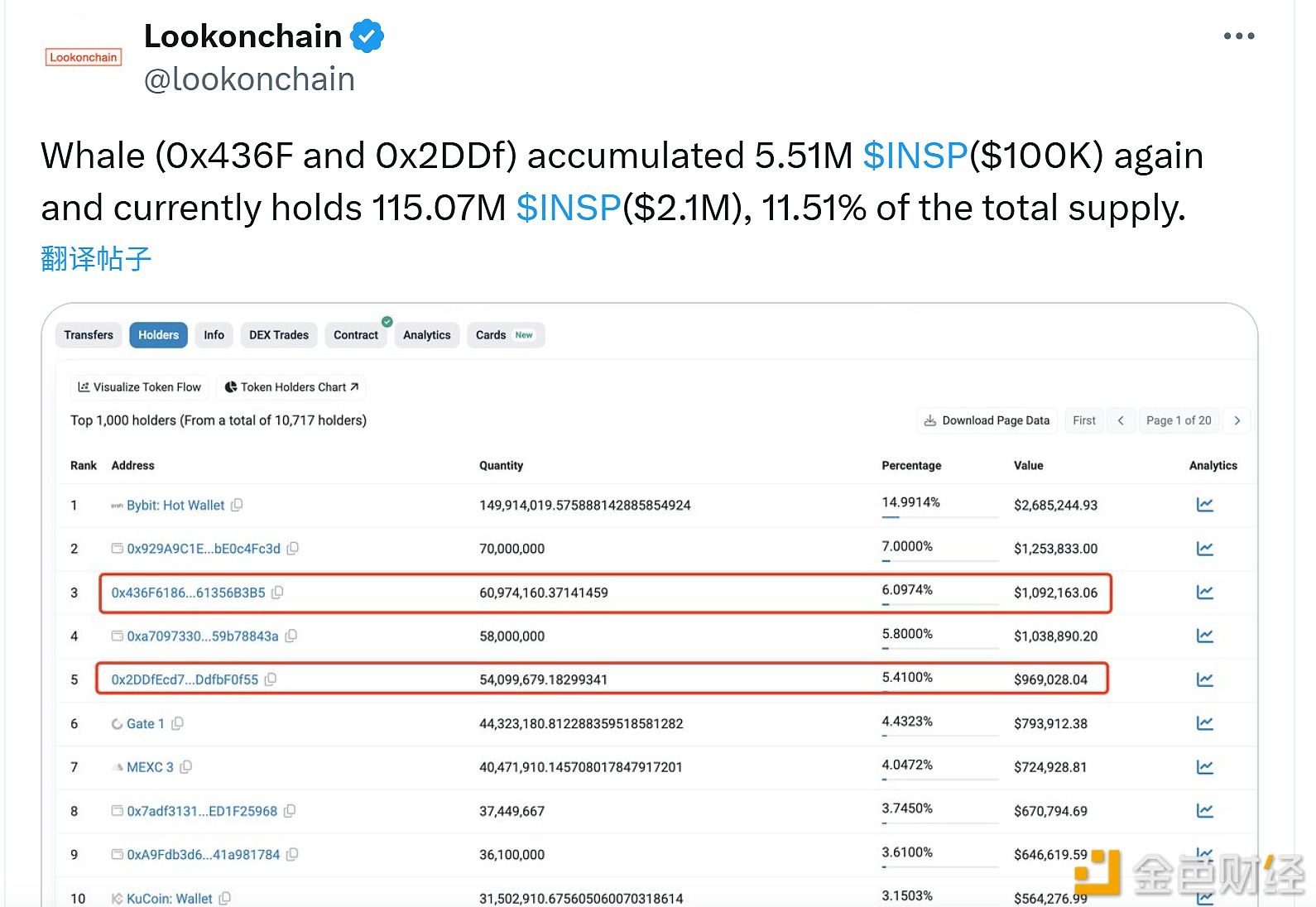

A certain whale address has accumulated an additional 5.51 million INSP tokens.