Bitcoin ( BTC ) is splitting hodler sentiment near all-time highs as coins migrate to larger players.

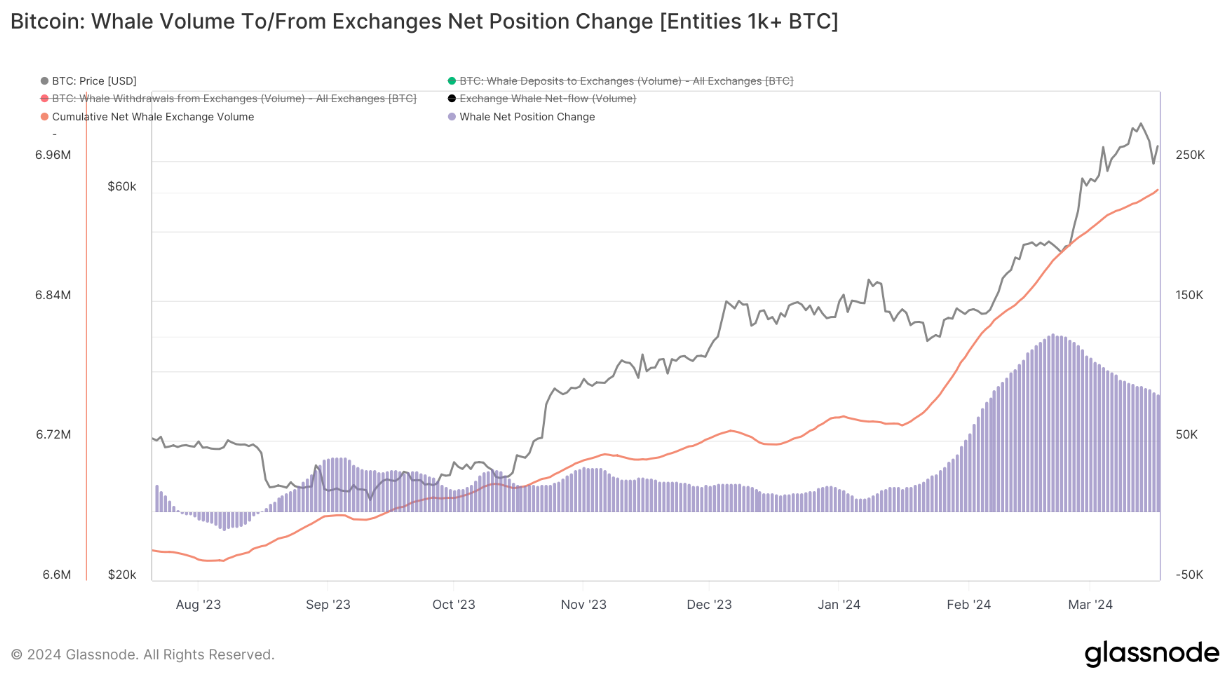

Data from on-chain analytics firm Glassnode shows that Bitcoin whales are “furiously accumulating” BTC at current prices.

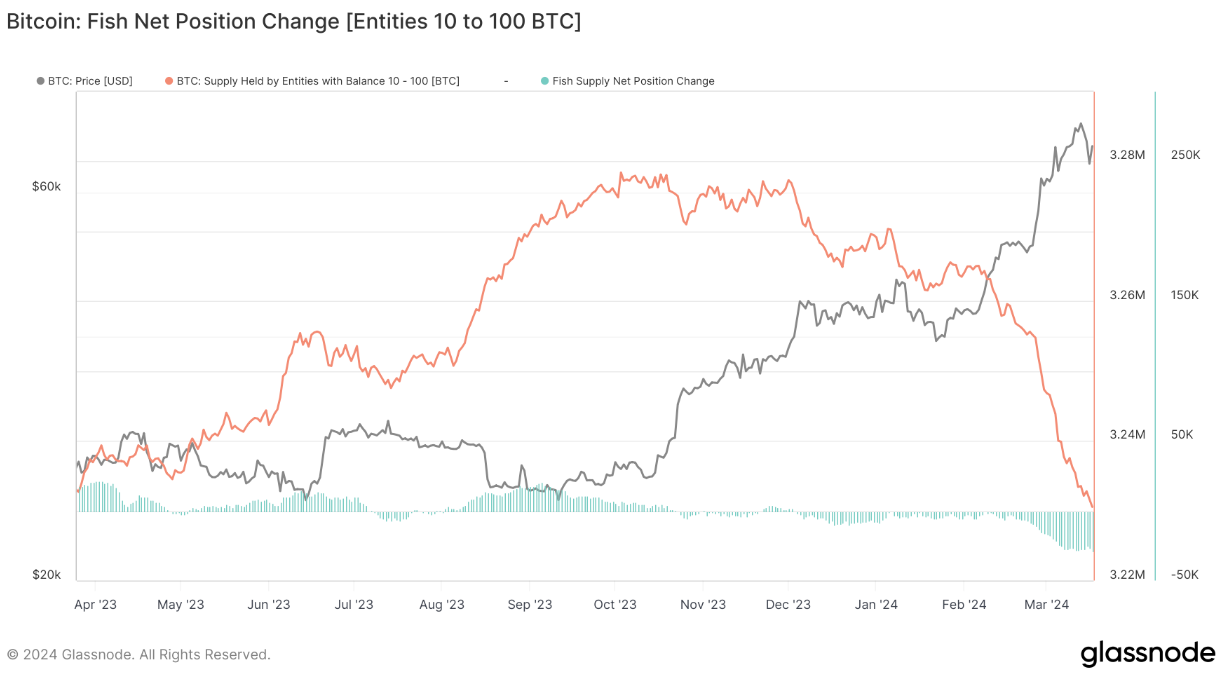

Big fish snap up unwanted BTC

Bitcoin investors have vastly different impressions of the current bull market, and the latest on-chain data confirms it.

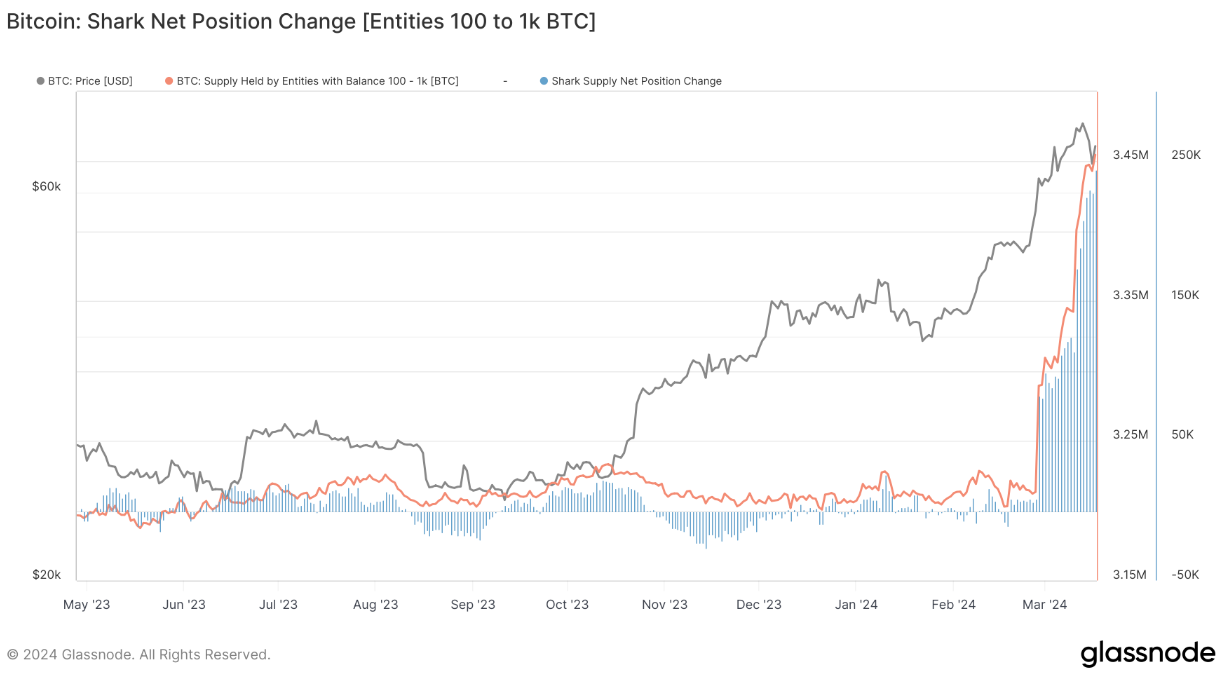

Glassnode’s coverage of the net position change for various BTC hodler cohorts draws a clear distinction between larger and smaller allocations.

The figures were uploaded to X (formerly Twitter) by popular commentator account Bitcoin Munger this week.

“What you observe in nature is much like what you observe in markets,” he argued in the post.

Glassnode shows that both Bitcoin “whales” (entities holding between 1,000 BTC or more) and “sharks” (entities holding between 100 BTC and 1,000 BTC) are fighting to accumulate coins.

Based on flows between whale wallets and exchanges, whales held around 84,000 BTC more than 30 days prior as of March 17.

Sharks, the data for whom is not focused on exchanges, began majorly boosting to their exposure at the end of February. As of March 17, their 30-day net position change was 244, 000 BTC.

Both classes strongly contrast with Bitcoin “fish” — those with between 10 BTC and 100 BTC. These have seen distribution of assets throughout this month.

For Bitcoin Munger, the conclusion is clear.

“Smart money is buying, while dumb money sells,” he wrote.

“We are going much higher.”

"This time is different"

As Cointelegraph continues to report , Bitcoin is currently in flux as old all-time highs refuse to be flipped to support without a fight.

While institutional inflows continue, price discovery has only existed for a brief period this month.

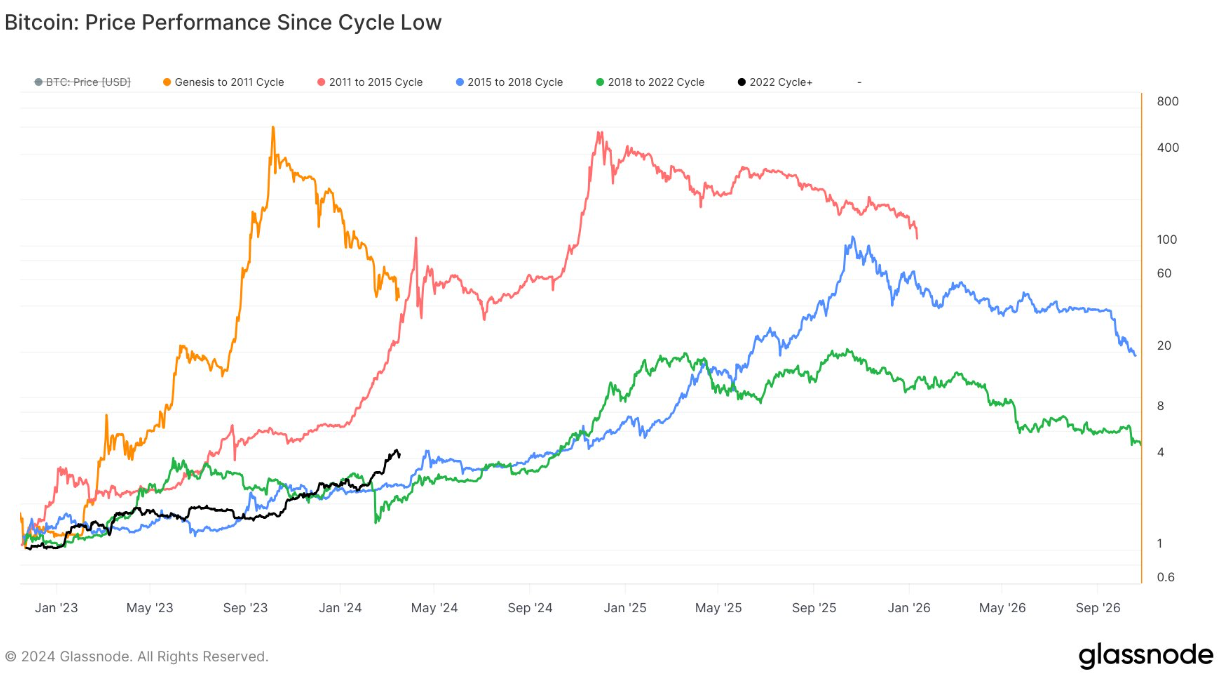

Comparing the current price cycle to history, however, Bitcoin Munger was unfazed.

“Relative to historical cycles, the fun hasn't even started yet,” he argued .

“The regret of past cycles was generally selling too late. The regret of this cycle will be selling too soon. This time is different.”