Three Chinese state-owned fund companies plan to launch Bitcoin and Ethereum spot ETFs

According to ChainCatcher, three Chinese fund companies, namely Harvest Fund Management, Huaxia Fund Management, and Bosera Asset Management, plan to launch Bitcoin and Ethereum spot ETFs. They are expected to become the world's first batch of Ethereum spot ETFs. It is anticipated that the China Securities Regulatory Commission (CSRC) will approve the first batch of virtual currency ETFs in one go by the end of April, similar to when the U.S. Securities and Exchange Commission (SEC) approved 11 Bitcoin spot ETFs in January this year.

In response to inquiries from CSRC, they stated that investment products approved by them will be made public on their website. If an applied ETF product roughly meets CSRC's requirements, a conditional authorization letter will be issued; however, various conditions must still be met including payment of relevant fees, submission of documents, and obtaining approval for listing from The Stock Exchange of Hong Kong Limited (0388). It is expected that the relevant fund companies will submit applications to The Stock Exchange of Hong Kong Limited.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

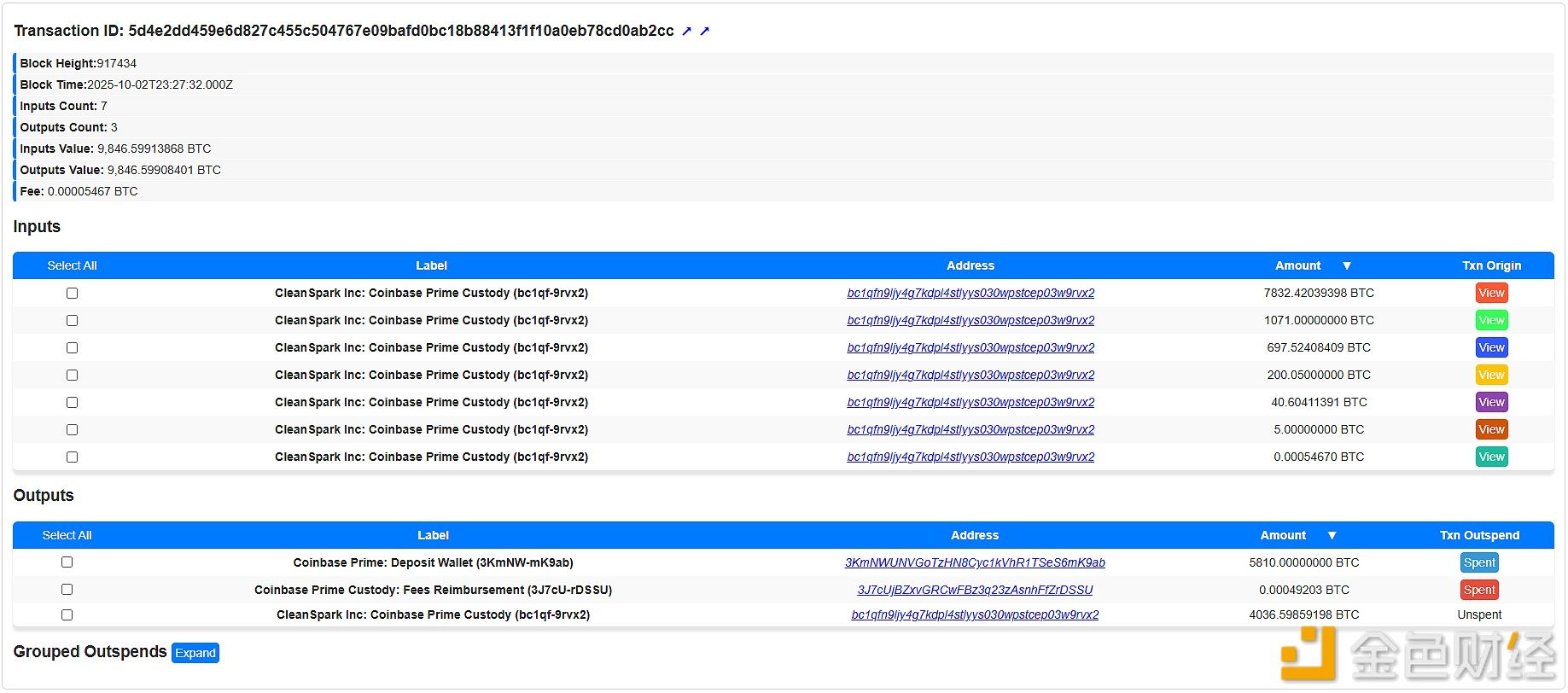

Data: CleanSpark transferred 5,810 BTC to an exchange 9 hours ago

CleanSpark transfers 5,810 BTC to an exchange, worth approximately $700 million